RapidKnowHow creates new AI-Driven FREE CASH-FLOW Opportunities in 2026

Top 20 Rapid Free-Cash-Flow Opportunities for AI-Orchestrator Leaders

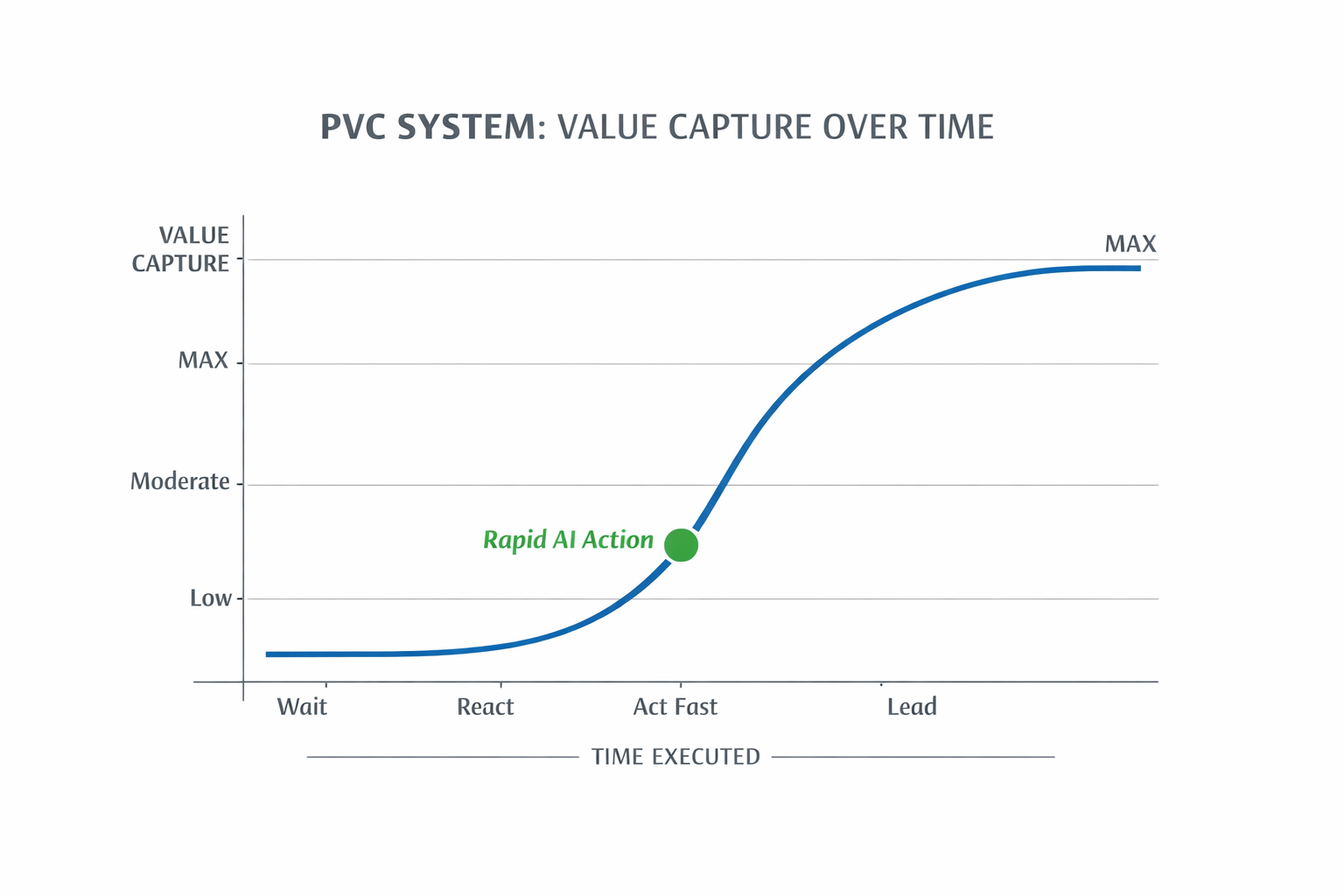

A) PVC SYSTEM — EXECUTIVE LOGIC

Definition

PVC = A decision framework that identifies opportunities where:

Speed × AI Leverage × Market Friction = Immediate Cash-Flow Gain

PVC Formula

PVC Score = (Time Advantage × Margin Expansion × AI Automation Level) ÷ Complexity

High PVC Score = act immediately.

B) THE TOP 20 PVC OPPORTUNITIES (Ranked by Cash-Flow Velocity)

TIER 1 — ACT NOW (0–90 DAYS PAYBACK)

- AI Sales Automation for B2B high-ticket deals

- Contract renegotiation using AI price benchmarking

- Inventory liquidation via AI demand repricing

- Supplier consolidation optimization

- AI invoice auditing (recover overpayments)

- Pricing optimization engine deployment

- Subscription conversion of one-time services

- Eliminating manual reporting tasks

- Cash collection acceleration system

- Workforce productivity AI copilots

TIER 2 — FAST SCALE (3–9 MONTH PAYBACK)

- Asset-Light outsourcing of non-core operations

- Predictive maintenance replacing reactive repair

- Dynamic procurement bidding platform

- AI-optimized marketing spend allocation

- Data monetization from existing customer base

- Process cycle-time compression projects

TIER 3 — STRATEGIC LEAP (9–18 MONTH PAYBACK)

- Platformizing your core product as BaaS

- Licensing proprietary know-how

- AI-driven new market entry simulation

- Digital twin of operations for decision testing

C) PVC DECISION MATRIX FOR LEADERS

Use this 4-Quadrant Execution Filter

| Priority | Criteria | Action |

|---|---|---|

| Immediate | High cash + low complexity | Execute now |

| Fast Track | High cash + medium complexity | Assign AI-SWOT team |

| Strategic | High cash + high complexity | Pilot first |

| Ignore | Low cash | Discard |

D) HOW AI-ORCHESTRATOR LEADERS CAPTURE PVC FIRST

Traditional leaders wait for certainty.

AI-Orchestrator leaders act on probability.

They operate with 5 execution rules:

- Decide before competitors see opportunity

- Automate before hiring

- Monetize before optimizing

- Capture cash before scaling

- Scale before competitors copy

E) EXECUTIVE SIGNALS THAT A PVC OPPORTUNITY EXISTS

If you see any of these — act immediately:

- Manual processes still exist

- Pricing unchanged for 12+ months

- Data unused

- Teams overloaded

- Customer waiting time >24h

- Supplier dependency >40%

- Reports created manually

These are hidden cash-flow leaks.

F) PVC PLAYBOOK — 48-HOUR ACTION SPRINT

Day 1 — Scan

- Identify 10 friction points

- Score PVC for each

Day 2 — Capture

- Select top 3

- Assign owner

- Automate or renegotiate

Day 7 — Cash Impact Review

- Measure delta

- Scale winners

G) STRATEGIC INSIGHT FOR 2026

The fastest companies will not be the biggest —

they will be the fastest at capturing value.- Josef David

AI doesn’t create value.

Speed does.

AI only multiplies speed.

H) FINAL CEO TAKEAWAY

The PVC Rule

If an opportunity increases cash-flow within 90 days, it is not optional.

It is a leadership obligation.- Josef David