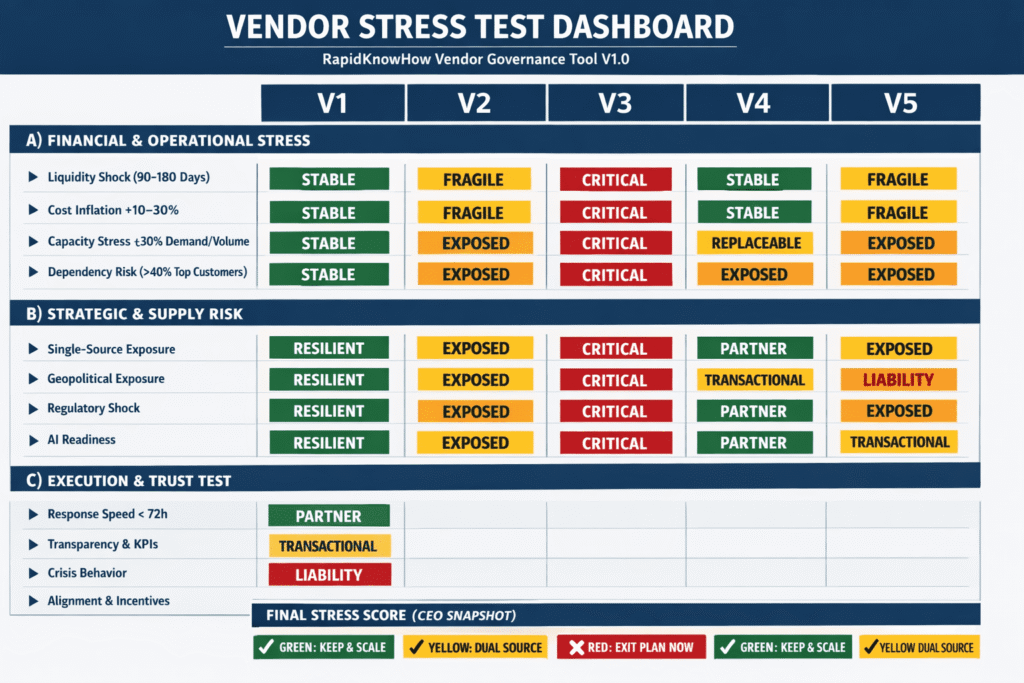

A) FINANCIAL & OPERATIONAL STRESS

- Liquidity shock: Can the vendor survive 90–180 days with delayed payments?

- Cost inflation: +10–30% input costs — margins still positive?

- Capacity stress: Sudden +30% demand or −30% volume — delivery intact?

- Dependency risk: % revenue tied to top 1–3 customers (red flag >40%).

Verdict: Stable / Fragile / Critical

B) STRATEGIC & SUPPLY RISK

- Single-source exposure: Any critical component with no backup?

- Geopolitical exposure: China, Russia, Middle East, Red Sea, Ukraine links?

- Regulatory shock: ESG, sanctions, data, labor — compliance ready?

- AI readiness: Manual processes vs. automated, forecast-driven ops.

Verdict: Resilient / Exposed / Replaceable

C) EXECUTION & TRUST TEST

- Response speed: Decision → action cycle <72h?

- Transparency: Real-time KPIs or excuses?

- Crisis behavior: Past failures — owned or hidden?

- Alignment: Incentives aligned with your outcomes or just their margin?

Verdict: Partner / Transactional / Liability

🔴 FINAL STRESS SCORE (CEO SNAPSHOT)

- GREEN: Keep & scale

- YELLOW: Dual-source + renegotiate

- RED: Exit plan now