The Strategic Breakpoint for the Global Automotive Industry 2025–2030

RapidKnowHow + ChatGPT | Mobility Evolution Series

1. INTRODUCTION — TWO MODELS, TWO FUTURES

For 100 years, the automotive industry has optimized car production, distribution, and sales.

The business was simple:

- Build cars

- Sell cars

- Keep workshops busy

- Repeat every 3–6 years

But between 2025–2030, this model is collapsing under the weight of:

- Electrification

- Digitalization

- AI personalization

- Subscription economy

- Declining ownership

- Predictive maintenance

- Mobility platforms replacing car buyers

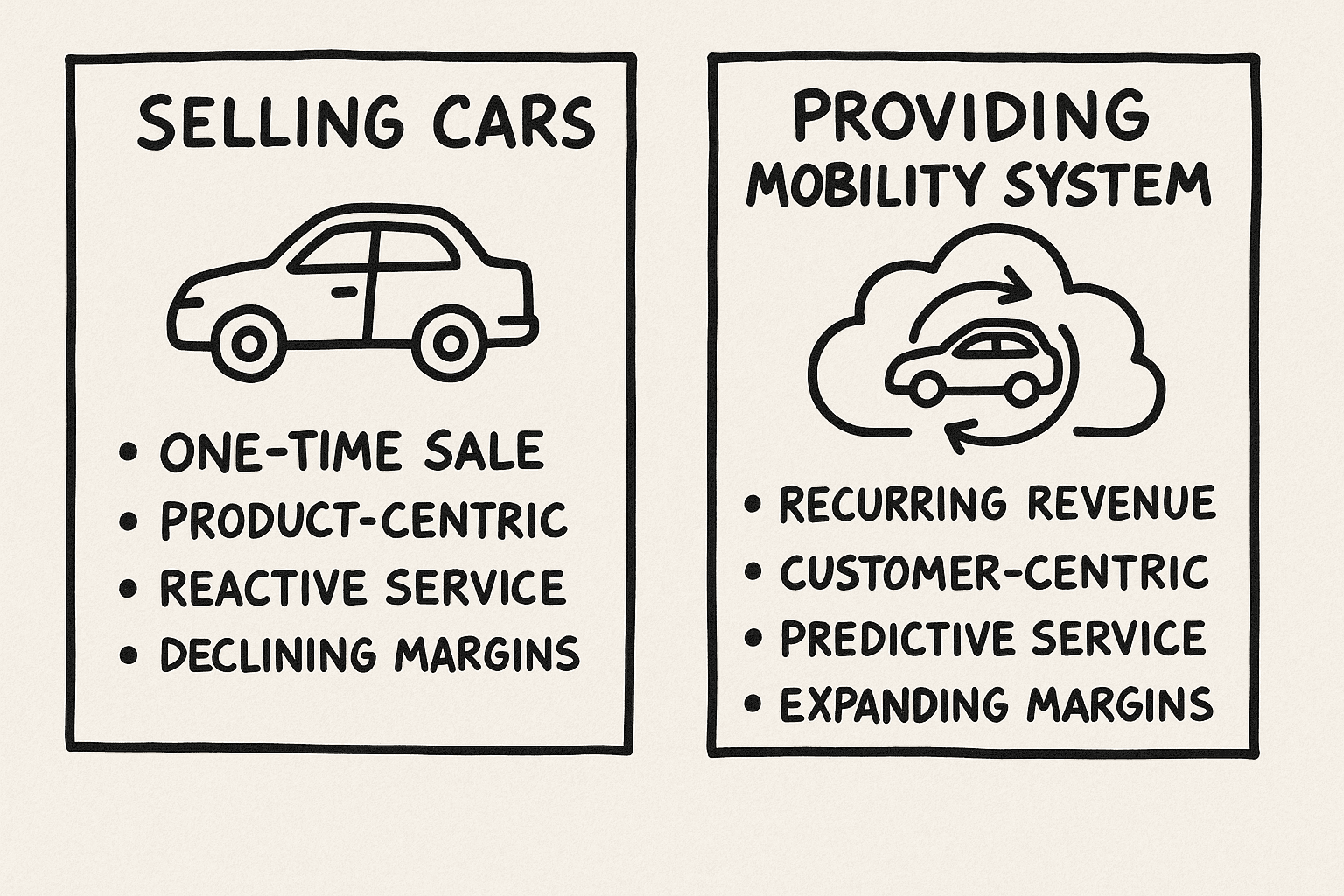

The choice for manufacturers, dealers, and mobility providers is clear:

👉 Continue selling cars (old model)

or

👉 Provide a Mobility System (future model)

This Power Report explains the shift.

2. THE OLD MODEL: SELLING CARS (LINEAR, FRAGMENTED, LABOUR-HEAVY)

2.1 Customer Relationship

- One-time interaction

- Manual lead handling

- Limited personalization

- Customer retention < 30%

- Communication: reactive

2.2 Revenue Structure

- One-time margin from sale

- Aftersales margin (declining in EV era)

- Finance/Leasing commissions

- Used car trading

Volatile, not recurring.

2.3 Operations

- Dealer-centric

- Slow processes

- Manual CRM + scheduling

- High inventory cost

- High marketing cost per sale

2.4 The Strategic Limitations

- Zero recurring revenue

- Zero predictive insights

- Zero personalization

- EVs kill service revenue

- High fixed cost

- Scale depends on labour, not intelligence

This is why the old model is dying.

3. THE NEW MODEL: PROVIDING A MOBILITY SYSTEM (AI-DRIVEN, RECURRING, PREDICTIVE)

A Mobility System does not focus on selling cars.

It delivers predictive, personalized customer mobility powered by AI:

- Predictive maintenance

- Personalized journeys

- On-demand mobility bundles

- Digital financing + insurance

- OTA updates

- Subscription + pay-per-use models

- AI-driven loyalty cycles

3.1 Customer Relationship

- Continuous

- Predictive

- Personalized

- Proactive

- AI-driven

Retention rises from 30% → 70%.

3.2 Revenue Structure

Multiple recurring streams:

- Mobility subscriptions

- Predictive maintenance plans

- AI-personalized insurance

- OTA software upgrades

- Dynamic service bundles

- EV + charging optimization plans

- Fleet-as-a-Service

Stable, scalable, high-margin recurring value.

3.3 Operations

- AI CRM (24/7)

- AI routing for service

- Subscription billing

- Predictive alerts

- Automated customer journeys

- Digital-first interactions

3.4 The Strategic Advantages

- Higher LTV

- Higher ROICE

- Lower cost-to-serve

- Self-optimizing system

- Lower dependence on labour

- Faster scaling

This is the path to 2030 Automotive Leadership.

4. SIDE-BY-SIDE STRATEGIC COMPARISON

| Category | Selling Cars (Old) | Providing Mobility System (New) |

|---|---|---|

| Business Type | Product | System |

| Revenue | One-time | Recurring |

| Customer Lifecycle | 3–6 years | 12 months recurring |

| Personalization | Low | High (AI-driven) |

| Service Model | Reactive | Predictive |

| Profit Margin | Declining | High & growing |

| Scaling | Labour-based | Data-driven |

| Retention | 20–30% | 60–80% |

| LTV | 3–7K | 12–25K |

| ROICE | 40–50 | 85–95 |

5. THE BLUE OCEAN SHIFT

The shift from selling cars to providing mobility is a Blue Ocean Strategy because:

- You change the business model

- You increase value while lowering cost

- You escape competition

- You build recurring income

- You create a self-learning platform

- You dominate customer lifetime value

Competitors still selling hardware are stuck in a red ocean:

- shrinking margins

- price pressure

- low differentiation

- slow cycles

Mobility providers operate in a blue ocean:

- no direct competition

- high differentiation

- high lock-in

- expanding margins

This is the strategic frontier of Automotive 2030.

6. THE TRANSFORMATION SYSTEM (5R)

Using the RapidKnowHow + ChatGPT 5R Formula:

R1 — Reveal: Bottlenecks

R2 — Redesign: Predictive Mobility Blueprint

R3 — Replace: Legacy tasks with AI

R4 — Replicate: Mobility AI Value Engine

R5 — Revenue: Subscriptions, licensing, ecosystems

This framework transforms any car business into:

- a mobility platform

- an AI personalization engine

- a customer value multiplier

- a recurring revenue system

7. FINANCIAL IMPACT – THE LTV & ROICE SHIFT

LTV (5 years)

- Selling Cars: 3–7K

- Mobility System: 12–25K

ROICE (Innovation, Convenience, Efficiency)

- Selling Cars: 40–50

- Mobility System: 85–95

Margin

- Selling Cars: 5–10%

- Mobility System: 25–40%

Customer Retention

- Selling Cars: <30%

- Mobility System: >70%

The economic shift is massive.

8. CONCLUSION — THE FUTURE IS SYSTEMS, NOT SALES

The automotive markets of Europe, the US, and Asia are entering a transition from:

Car Ownership → Mobility Intelligence

and

One-Time Sales → Predictive, Recurring Systems

OEMs, dealers, mobility providers, and entrepreneurs who shift now will dominate the next decade.

Not because they sell more cars.

But because they deliver continuous mobility value.

This is the new Blue Ocean.