Thriving from Capital to Knowledge Mindset 2026

Industrial Gas Perspective

A) THE STRATEGIC SHIFT 2026

For decades, industrial capital markets rewarded:

• Asset growth

• EBITDA expansion

• Dividend stability

• ROCE optimization

This is the classic Shareholder Value Model.

But 2026 reality changes the architecture:

Energy volatility

Hydrogen capital risk

AI infrastructure demand

Regulatory acceleration

Supply chain fragility

The equation evolves from:

Maximize short-term capital return

to

Maximize long-term system resilience and cash-flow durability.

That is the shift toward Stakeholder Value.

But here is the critical insight:

Stakeholder value does not dilute shareholder value.

It stabilizes and compounds it.

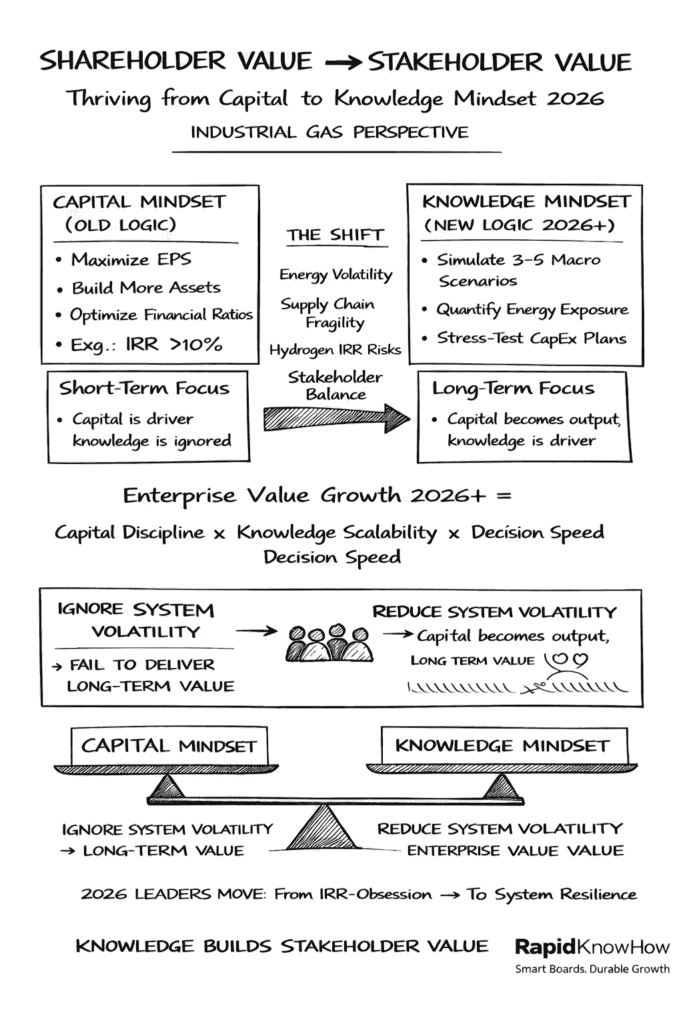

B) CAPITAL MINDSET VS KNOWLEDGE MINDSET

1️⃣ CAPITAL MINDSET (OLD LOGIC)

• Build more assets

• Expand footprint

• Lock in long-term contracts

• Optimize financial ratios

Capital is treated as growth engine.

Risk:

Capital misallocation becomes structural.

2️⃣ KNOWLEDGE MINDSET (NEW LOGIC 2026+)

• Use AI to stress-test CapEx

• Simulate 3–5 macro scenarios

• Quantify energy exposure

• Model hydrogen IRR under subsidy shifts

• Re-rank portfolio quarterly

Capital becomes the output.

Knowledge becomes the driver.

C) SHAREHOLDER VALUE 1.0

Metric Focus:

• EPS

• EBITDA

• ROCE

• Dividends

Limitation:

Ignores systemic fragility.

D) STAKEHOLDER VALUE 2.0 (AI-Orchestrated)

Stakeholders include:

• Customers

• Employees

• Energy suppliers

• Regulators

• Capital markets

• Society

But here’s the deeper logic:

If you reduce system volatility →

you reduce capital risk →

you increase valuation multiple.

Stakeholder stability = Shareholder compounding.

E) INDUSTRIAL GAS EXAMPLE

Companies like

Linde plc

and

Air Liquide

are increasingly valued for:

• Stability

• Long-term contracts

• Pricing power

• Risk discipline

Why?

Because markets reward resilience.

F) THE NEW ENTERPRISE VALUE FORMULA

Enterprise Value Growth 2026+ =

Capital Discipline × Knowledge Scalability × Stakeholder Stability × Decision Speed

Where:

Stakeholder Stability =

Energy resilience + regulatory alignment + customer reliability + workforce competence.

G) WHY KNOWLEDGE CREATES STAKEHOLDER VALUE

Knowledge enables:

1️⃣ Predictive pricing → protects customers and margins

2️⃣ Energy stress testing → reduces volatility

3️⃣ CapEx simulation → protects shareholders

4️⃣ Hydrogen realism → protects capital

5️⃣ AI account prioritization → strengthens key clients

This is not soft governance.

This is hard cash-flow engineering.

H) THE 2026 BOARD QUESTION

Instead of asking:

“What is the IRR?”

Boards must ask:

• What is the system volatility impact?

• What is the exposure index shift?

• What stakeholder risk does this reduce?

• How does knowledge reduce capital intensity?

I) THE STRATEGIC CONCLUSION

2026 is not about abandoning shareholder value.

It is about upgrading it.

From:

Capital-heavy, asset-driven growth

To:

Knowledge-driven, system-stabilized compounding.

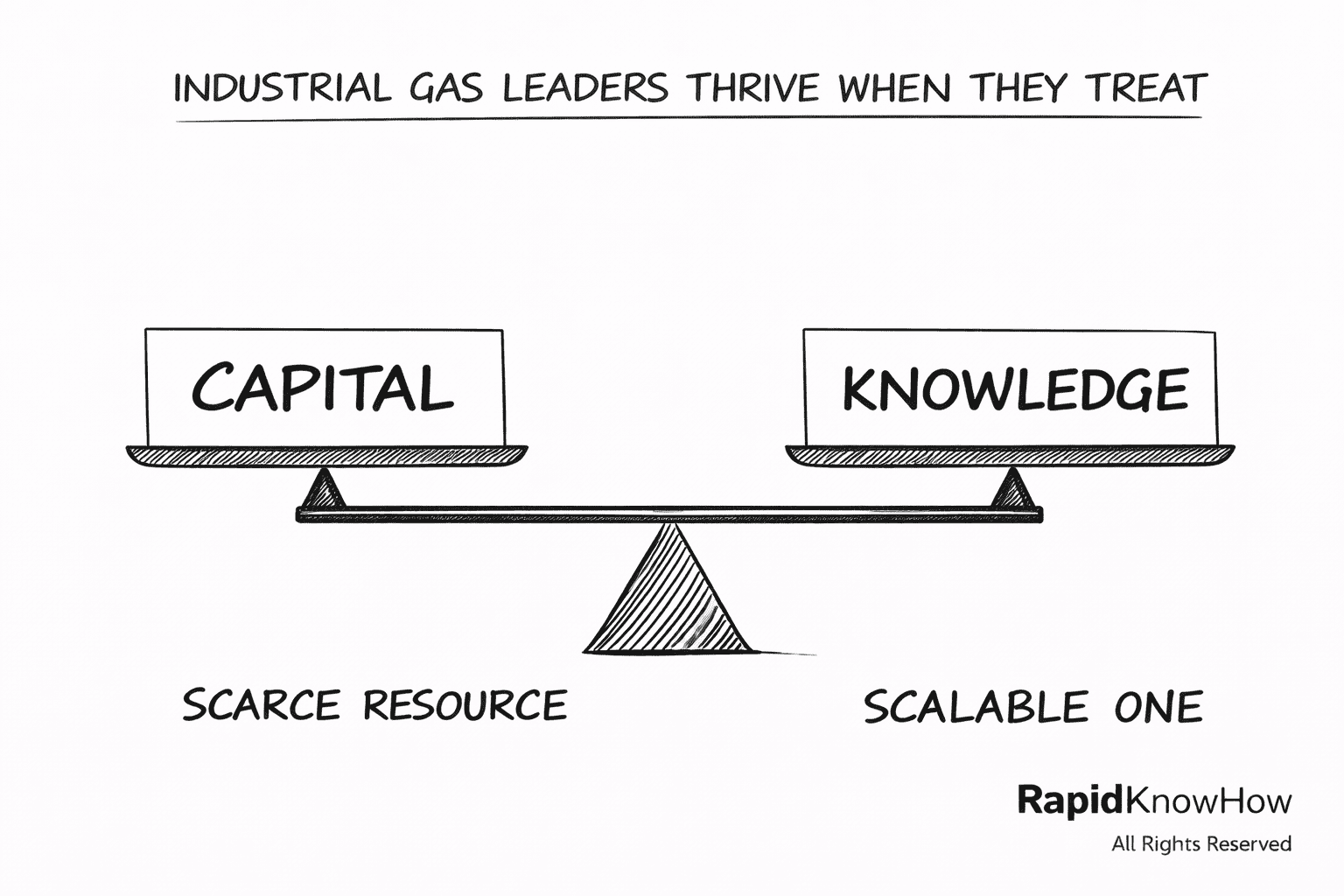

Industrial Gas leaders will thrive when they:

Treat capital as scarce

Treat knowledge as scalable

Treat stakeholders as risk buffers

Treat AI as orchestration engine

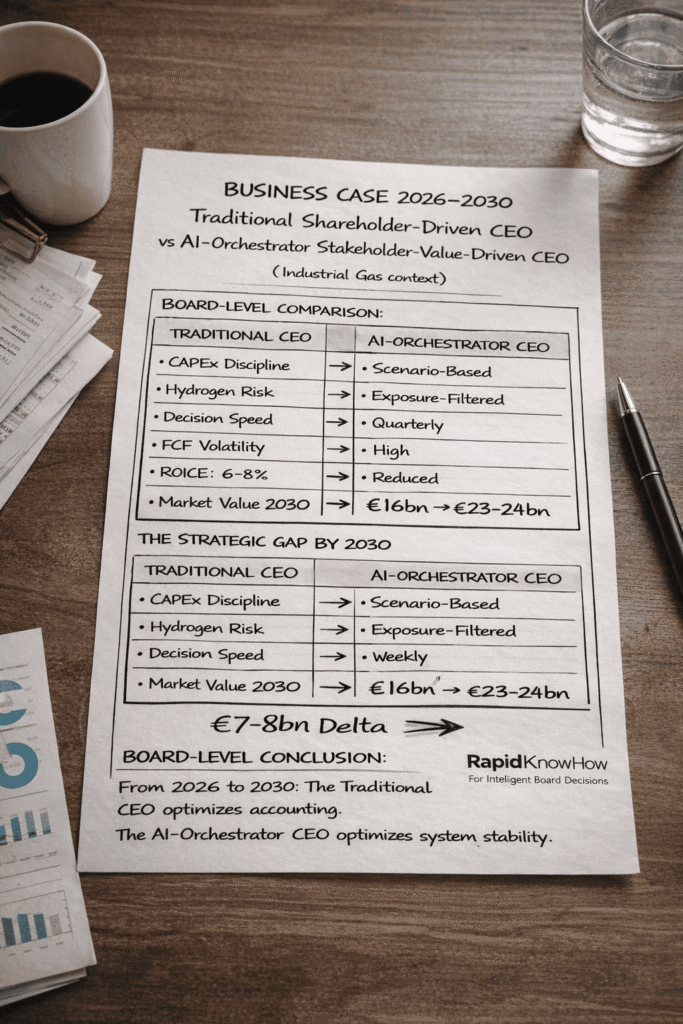

BUSINESS CASE 2026–2030

Traditional Shareholder-Driven CEO

vs

AI-Orchestrator Stakeholder-Value-Thriven CEO

(Industrial Gas context)

A) STRATEGIC ARCHETYPES

1️⃣ Traditional Shareholder-Driven CEO

Primary Focus:

- EPS growth

- EBITDA expansion

- IRR thresholds (>10–12%)

- Asset scale

Behavior Pattern:

- CapEx-led growth

- Hydrogen announcements

- Quarterly guidance protection

- Financial ratio optimization

Blind Spot:

- System volatility

- Energy shock exposure

- Portfolio rigidity

- Slow decision loops

2️⃣ AI-Orchestrator Stakeholder-Value CEO

Primary Focus:

- Free Cash Flow durability

- Exposure compression

- Capital discipline

- Knowledge scalability

- System resilience

Behavior Pattern:

- Signal → Simulate → Stress-Test → Allocate

- CapEx re-ranking quarterly

- Pricing compression within days

- AI-driven exposure index

Core Principle:

Capital is scarce.

Knowledge is scalable.

Volatility destroys enterprise value.

B) BASELINE INDUSTRIAL GAS PROFILE (ILLUSTRATIVE)

Revenue: €10bn

EBITDA margin: 25%

EBITDA: €2.5bn

CapEx: 15% of revenue = €1.5bn

FCF baseline: €1.0bn

Market Multiple: 15× FCF

Market Value: €15bn

C) 2026–2030 SCENARIO COMPARISON

1️⃣ CAPITAL ALLOCATION DISCIPLINE

Traditional CEO

- Hydrogen CapEx accelerated

- Political pressure-driven projects

- IRR assumptions optimistic

- CapEx remains rigid

Capital misallocation risk:

1% of revenue per year = €100m drag

5-year compounding drag:

≈ €500–600m cumulative

AI-Orchestrator CEO

- Hydrogen stress-tested under 3 macro scenarios

- 15–20% CapEx re-ranked

- Exposure Index gating

- AI demand prioritized

Capital efficiency gain:

1–2% improvement in FCF = €100–200m/year

5-year cumulative gain:

€500m–1bn advantage

2️⃣ FREE CASH FLOW TRAJECTORY (2026–2030)

Traditional CEO

Energy shocks + slower pricing response:

- FCF volatility ±15%

- Average FCF growth 2% CAGR

2026: €1.0bn

2030: ~€1.08bn

AI-Orchestrator CEO

Pricing compression in days, not quarters

Exposure-managed portfolio

Working capital release 2–3%

FCF CAGR 5–7%

2026: €1.0bn

2030: €1.28–1.40bn

Difference by 2030:

+€200–320m annually

3️⃣ ROICE COMPARISON

(Return on Innovation, Convenience & Efficiency)

Traditional CEO

Innovation tied to assets

ROICE: 6–8%

AI-Orchestrator CEO

AI-driven:

- Decision compression

- Capital re-ranking

- Working capital optimization

- Portfolio intelligence

ROICE: 12–18%

This is structural — not cyclical.

D) MARKET VALUE IMPACT 2030

Assume market rewards stability.

Traditional CEO

FCF 2030: €1.08bn

Multiple remains 15×

Market Value ≈ €16.2bn

AI-Orchestrator CEO

FCF 2030: €1.35bn

Volatility reduced

Market rewards predictability

Multiple expands to 17–18×

Market Value ≈ €23–24bn

E) STRATEGIC GAP BY 2030

Market Value Delta:

€7–8bn difference

on same industrial footprint.

This is not ideology.

It is volatility engineering.

F) WHY MULTIPLE EXPANSION OCCURS

Markets reward:

- Predictable FCF

- Capital discipline

- Exposure transparency

- Lower macro sensitivity

- Faster reaction capability

Stakeholder stability → Lower systemic risk

Lower systemic risk → Higher valuation multiple

G) BOARD-LEVEL DECISION MATRIX

| Dimension | Traditional CEO | AI-Orchestrator CEO |

|---|---|---|

| CapEx Discipline | IRR-based | Scenario-gated |

| Hydrogen Risk | Political cycle | Exposure-index filtered |

| Decision Speed | Quarterly | Weekly |

| FCF Volatility | High | Reduced |

| ROICE | Moderate | High |

| Market Multiple | Flat | Expanding |

| 2030 Market Value | €16bn | €23bn+ |

H) CONCLUSION

The traditional shareholder-driven CEO optimizes accounting performance.

The AI-Orchestrator Stakeholder-Value CEO optimizes system stability and capital durability.

From 2026–2030:

The difference is not ideology.

It is compounded FCF × valuation multiple expansion. – Josef David