Industrial Gas Sector | Q1 + Q2 2026

AI-Orchestrator Intelligence Brief

Clean. Sector-level. Executive-grade.

A) MACRO SIGNAL LAYER (Q1–Q2 2026)

1️⃣ Energy Cost Regime: Structurally Volatile

• Renewed electricity & gas fluctuation

• Margin sensitivity high in merchant segment

• On-site long-term contracts more resilient

Board implication: Pass-through speed determines cash-flow stability.

2️⃣ Electronics & AI Infrastructure Demand: Structural Upswing

• Semiconductor expansion cycle

• Battery & data center ecosystem growth

• Ultra-high purity gases gaining pricing power

Board implication: Reliability premium > price competition.

3️⃣ Hydrogen & Decarbonization: Optionality Phase

• Subsidy uncertainty across EU

• Large CapEx projects under scrutiny

• Modular pilots favored over mega-scale

Board implication: Preserve strategic flexibility.

B) SECTOR EXPOSURE DASHBOARD (Directional Assessment)

Energy Exposure Risk: HIGH

Electronics Growth Momentum: STRONG

Healthcare Demand Stability: STABLE

Hydrogen ROI Visibility: LOW

Competitive Consolidation: INCREASING

C) CASH-FLOW & ROICE IMPACT (Q1–Q2)

Margin Dynamics

• Merchant gases: under pressure

• On-site contracts: resilient

• Electronics segment: expanding contribution margin

Free Cash-Flow Drivers

- Energy pass-through discipline

- Contract repricing velocity

- Asset-light expansion vs heavy CapEx

ROICE Outlook (Directional)

If AI-Orchestrator discipline applied weekly:

→ Stabilization in Q1

→ Margin expansion in Q2

→ ROICE uplift potential 2–4%

Without orchestration:

→ Margin erosion

→ Cash-flow volatility

→ CapEx misallocation risk

D) STRATEGIC PRIORITIES FOR LEADERS (Q1–Q2 2026)

1️⃣ Install Margin Firewall

• Weekly exposure review

• Automatic repricing triggers

2️⃣ Monetize Reliability

• Premium service tier for electronics

• Uptime as monetizable KPI

3️⃣ Hydrogen = Structured Optionality

• Avoid irreversible mega commitments

• Joint-venture modular pilots

4️⃣ AI-Orchestrator Pricing Layer

• Real-time segment margin heatmap

• Predictive elasticity model

E) BOARD-LEVEL KEY QUESTION

Is your organization:

A) Reacting to energy volatility?

or

B) Actively arbitraging it?

This determines valuation multiple trajectory in 2026–2027.

F) STRATEGIC CONCLUSION

The Industrial Gas Sector in 2026 is no longer defined by:

Production Capacity.

It is defined by:

Energy Intelligence

Reliability Monetization

Capital Discipline

AI-Driven Pricing Control

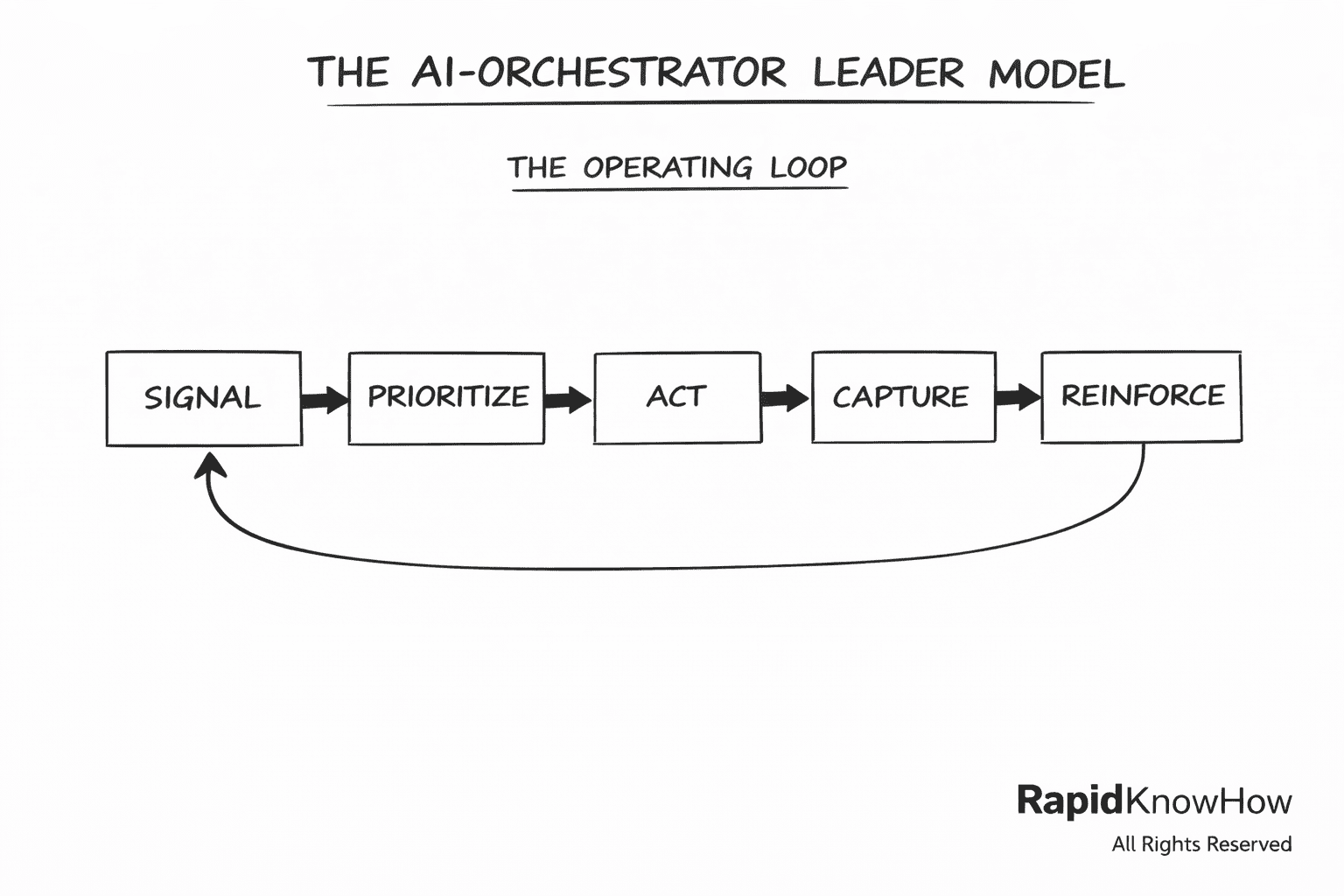

Boards that institutionalize the AI-Orchestrator Loop

convert volatility into structured cash-flow advantage.