Why wealth is not luck – but a leadership decision

Most people work their entire lives for income

—and later wonder why their wealth does not carry them.

The reason is simple:

👉 Cashflow, assets, and life stage are rarely aligned by strategy.

This Power Post provides a clear thinking and decision framework for building sustainable wealth over 40–50 years—independent of market cycles, inflation, or political promises.

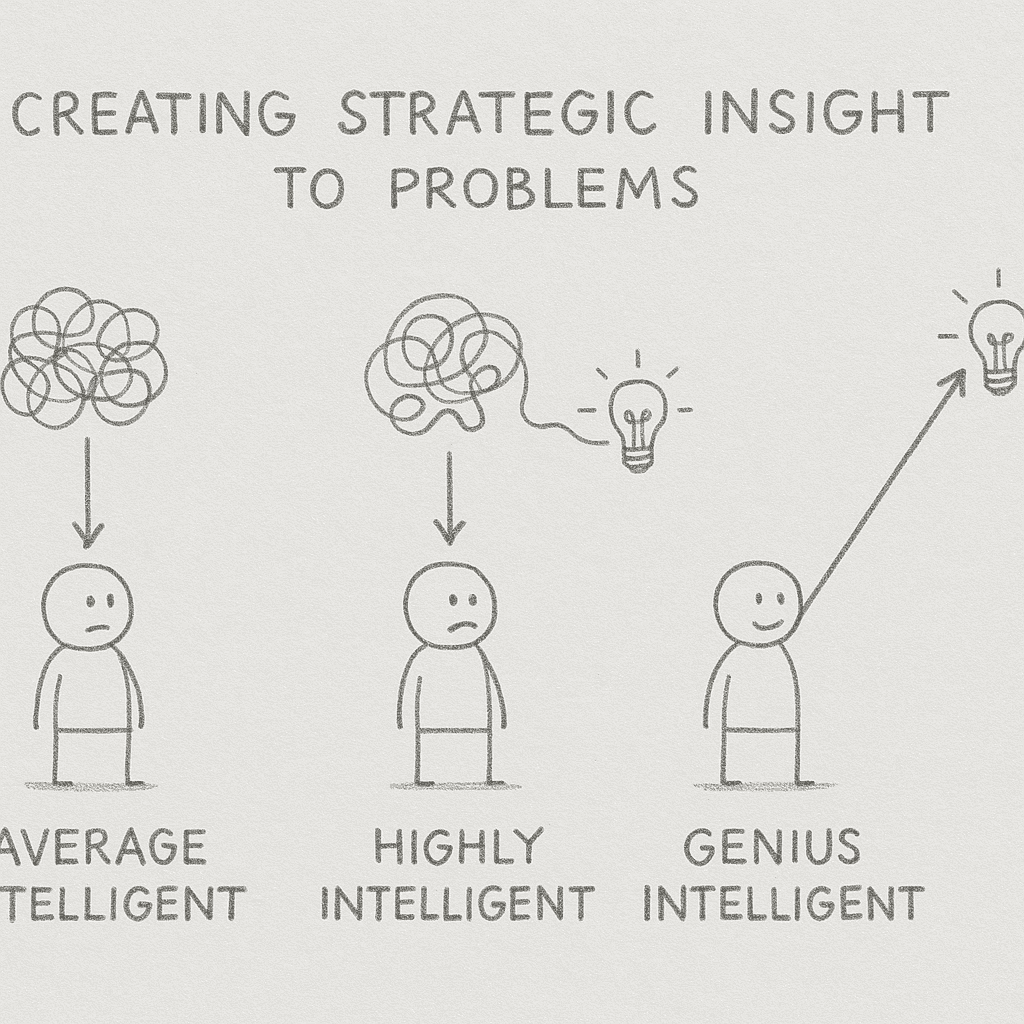

The core insight

Cashflow finances your life.

Wealth stabilizes your life.

Strategy determines whether both work together.

The core problem with traditional “wealth strategies”

❌ Focus on valuations instead of payment streams

❌ Same strategy for every life phase

❌ Dependence on job, pension, or the state

❌ No transition from work → systems → structure

👉 The result: high effort, low resilience.

The 4-Phase Lifetime Model

Phase 1 – FOUNDATION

Learn · Earn · Build Cashflow

Objective:

Income > living costs

Strategic focus

- Skills as capital

- Active cashflow

- Reinvestment discipline

Costly mistakes

- Lifestyle inflation

- Debt without earning logic

Rule: Invest in skills before status.

Phase 2 – SCALE

Decouple income from time

Objective:

System-generated cashflow

Strategic focus

- Systems instead of hours

- Recurring income

- Multiple income streams

Mistakes

- Permanent self-employment

- Growth without control

Rule: Replace working hours with systems.

Phase 3 – STABILIZE

Predictability beats growth

Objective:

Stable, inflation-resistant cashflow

Strategic focus

- Asset-based cashflow

- Risk reduction

- Liquidity reserves

Mistakes

- Yield chasing

- Concentration risk

Rule: Security matters more than maximization.

Phase 4 – LEGACY

Transfer value – not chaos

Objective:

Continuity and dignity

Strategic focus

- Structure and governance

- IP and license income

- Clear succession

Mistakes

- No structure

- Emotional decisions

Rule: Structure beats good intentions.

Five timeless principles (always valid)

- Cashflow > valuation

- Reinvestment is mandatory

- Risk must decline with age

- Liquidity equals decision freedom

- Systems outlast individuals

The strategic target state

A sustainable lifetime portfolio is:

- income-producing

- inflation-resilient

- crisis-resistant

- scalable

- transferable

Wealth is not an event.

Wealth is a well-run system.

30-second self-check

- Which phase are you really in?

- Is your current strategy aligned with that phase?

- What is the one decision you are postponing?

Conclusion

Sustainable cashflow and wealth strategies are not financial products.

They are life architecture.

Those who think in systems early

live freely later

—and pass on substance instead of chance. – Josef David