- Chapter 1: Introduction

- Chapter 2: Literature Review

- Chapter 3: Research Methodology

- Chapter 4: The Industrial Gas Industry Landscape 2025

- Chapter 5: The AI-Powered Disruption Model

- Chapter 6: Case Studies & Scenarios (2025–2030)

- Chapter 7: Strategic and Financial Impact

- Chapter 8: Discussion

- Chapter 9: Conclusion & Recommendations

Chapter 1: Introduction

1.1 Background of the Industrial Gas Industry

The industrial gas industry has long been a cornerstone of the global economy, supplying essential inputs such as oxygen, nitrogen, hydrogen, and carbon dioxide to sectors including healthcare, energy, chemicals, metallurgy, and electronics. Traditionally dominated by a small group of global players—the so-called “Big Four” (Linde, Air Liquide, Air Products, and Messer)—the industry has historically relied on capital-intensive, asset-heavy business models. These models prioritize large-scale production facilities, complex logistics, and long-term customer contracts. While this structure has delivered stability and consistent margins, it has also created high barriers to entry and a degree of inertia in innovation.

The years leading to 2025 mark a turning point. Energy transition pressures, ESG regulations, digital technologies, and volatile geopolitical conditions are exposing the limitations of legacy models. Customers increasingly demand convenience, transparency, sustainability, and rapid service delivery, challenging incumbents to rethink traditional business practices.

1.2 The Challenge of Disruption in B2B Markets

Unlike consumer markets, where disruption often manifests through visible product innovations or platform plays, B2B markets such as industrial gases are characterized by complex value chains, entrenched supplier–customer relationships, and significant switching costs. Disruption in such contexts is less visible, slower to unfold, but potentially more transformative.

The central challenge lies in reconciling legacy infrastructure with emerging digital and AI-driven models that emphasize asset-light strategies, subscription services, predictive maintenance, and customer self-service. In the absence of adaptation, incumbents risk being leapfrogged by new entrants who combine AI-powered intelligence with asset-light execution.

1.3 Why AI-Powered Disruption?

Artificial Intelligence (AI) has emerged as the defining technology enabler of the 2025–2030 business cycle. In the industrial gas context, AI enables:

- Predictive demand planning to optimize production and logistics.

- Smart scheduling systems for medical oxygen and industrial deliveries.

- AI-powered customer interfaces enabling one-click ordering and tracking.

- Dynamic pricing engines that maximize margins while ensuring customer retention.

- Asset-light ecosystem orchestration, connecting suppliers, distributors, and customers in real-time.

When combined with asset-light business models, AI does not merely automate existing processes; it redefines value creation by shifting the competitive advantage from owning physical assets to orchestrating data-driven ecosystems. This makes AI a disruptive force in B2B industries once thought immune to rapid change.

1.4 Research Problem and Core Questions

The research problem addressed in this thesis is:

How will AI-powered, asset-light business models disrupt the industrial gas industry between 2025 and 2030, and what strategic and financial impacts will emerge for incumbents and new entrants?

From this central problem, the following research questions are derived:

- What structural limitations exist in the traditional, asset-heavy industrial gas business model?

- How can AI technologies be applied to transform the value chain of the industry?

- Which asset-light, AI-powered business models offer the greatest disruption potential between 2025–2030?

- How will incumbents, new entrants, and ecosystems adapt to these disruptions?

- What are the financial (ROCE, ROICE) and strategic impacts of these disruptions for stakeholders?

1.5 Research Objectives

The thesis pursues the following objectives:

- To analyze the structural dynamics of the industrial gas industry in 2025.

- To develop an AI-powered disruption model (RapidKnowHow + ChatGPT) applicable to B2B heavy industries.

- To simulate disruption scenarios for the industrial gas sector between 2025–2030.

- To assess the strategic and financial implications for incumbents, entrepreneurs, and policymakers.

- To contribute academically by extending disruption theory to B2B markets, and practically by offering leaders a roadmap for thriving in the disruption era.

1.6 Scope and Limitations

This study is scoped around the global industrial gas industry, with emphasis on Europe and North America where regulatory, ESG, and energy transition drivers are strongest. The timeframe is 2025–2030, reflecting the immediate disruptive horizon in which AI adoption and asset-light strategies are accelerating.

Limitations include:

- Access to proprietary financial and operational data of incumbents.

- Rapidly evolving AI capabilities that may outpace academic modeling.

- Contextual variations (e.g., Asia vs. Europe) that limit universal generalization.

The research does not aim to forecast exact market shares but instead to develop frameworks, models, and scenarios that guide leaders in navigating disruption.

1.7 Structure of the Thesis

The thesis is organized as follows:

- Chapter 2 reviews the academic and industry literature on industrial gases, disruption theory, and AI-enabled B2B transformation.

- Chapter 3 outlines the research design, methodology, and frameworks (ROICE, Strategic Chess Game, Scenario Planning).

- Chapter 4 analyzes the current industry landscape in 2025, highlighting structural challenges and opportunities.

- Chapter 5 introduces the AI-powered disruption model, integrating asset-light strategies with AI capabilities.

- Chapter 6 presents detailed case studies and scenario simulations for the period 2025–2030.

- Chapter 7 evaluates the strategic and financial impacts, using ROICE and ROCE scoreboards.

- Chapter 8 discusses the findings in relation to existing theories and practical implications.

- Chapter 9 concludes with recommendations for executives, entrepreneurs, and policymakers, and outlines avenues for future research.

Chapter 2: Literature Review

2.1 The Industrial Gas Industry Evolution (1900–2025)

The industrial gas sector emerged in the late 19th and early 20th century with the pioneering work of companies such as AGA and Linde, which developed technologies for oxygen liquefaction and gas separation. Through the 20th century, the industry became dominated by large integrated players who developed capital-intensive production assets (air separation units, hydrogen plants, pipeline networks) and relied on long-term supply contracts to secure revenues.

By the early 21st century, a wave of mergers and consolidations had led to the Big Four oligopoly: Linde, Air Liquide, Air Products, and Messer. Their models prioritized economies of scale, logistical integration, and client lock-in, creating strong financial stability. However, the digital transformation wave post-2010 highlighted the rigidities of this model. Customers began demanding on-demand services, sustainability-driven solutions, and transparency, none of which aligned seamlessly with an industry designed around long cycles and heavy assets.

The 2020–2025 period intensified these pressures:

- ESG regulations forced companies to decarbonize.

- COVID-19 showcased the life-or-death importance of rapid medical oxygen delivery.

- Green hydrogen emerged as both a strategic opportunity and an existential challenge.

- AI and digital platforms began disrupting adjacent industries (e.g., logistics, energy trading), foreshadowing similar shifts in industrial gases.

Thus, by 2025 the sector stands at a structural inflection point: traditional strengths may become liabilities in the face of AI-powered disruption.

2.2 B2B Business Models: Traditional vs. Platform & Service Models

The traditional industrial gas model is characterized by:

- Heavy capital expenditure (CAPEX).

- Vertical integration from production to distribution.

- Long-term take-or-pay contracts.

- Stable but low-innovation environment.

By contrast, platform and service-based B2B models, emerging across industries such as logistics, energy, and chemicals, emphasize:

- Asset-light strategies, leveraging third-party infrastructure.

- Subscription-based revenue models, replacing one-time contracts.

- Customer-centric ecosystems, where multiple suppliers and customers interact.

- Dynamic adaptability, powered by real-time data.

In consulting and energy, these models have already proven their disruptive potential. In industrial gases, however, adoption has been minimal — primarily due to the perceived “immovability” of the industry’s infrastructure-heavy base. This assumption is now being challenged by AI.

2.3 Disruption Theory

Clayton Christensen’s theory of disruptive innovation defines disruption as the process by which new entrants challenge established incumbents with offerings that are initially inferior in performance but superior in convenience, cost, or accessibility. Over time, these offerings evolve to challenge mainstream customers, displacing incumbents.

In industrial gases, disruption has historically been incremental — new production technologies, cost efficiencies, or shifts in application sectors. True disruption, however, emerges when value creation logic changes: from owning and operating plants to orchestrating data-driven ecosystems.

Complementary theories include:

- Schumpeter’s creative destruction — innovation destroys old structures while creating new ones.

- Digital disruption frameworks — emphasizing speed, scalability, and customer empowerment.

- Ecosystem theory (Moore, Adner) — highlighting the strategic role of interdependent partners rather than single-firm advantage.

Yet, the literature remains underdeveloped in applying disruption theory to heavy B2B industries, particularly where AI shifts the advantage away from assets toward information orchestration.

2.4 AI in B2B Transformation

While AI is often studied in consumer applications, its impact in B2B contexts is increasingly evident:

- Predictive analytics: anticipating demand fluctuations, optimizing logistics, and reducing downtime.

- Natural language interfaces: simplifying ordering, tracking, and customer interaction (AI-powered sales).

- Dynamic pricing algorithms: ensuring margin optimization across volatile markets.

- Digital twins and process optimization: enhancing production reliability and sustainability.

- Ecosystem orchestration: connecting multiple suppliers, partners, and clients on integrated platforms.

In industries like energy trading, logistics, and manufacturing, AI has already proven transformative by increasing speed, resilience, and customer convenience. However, studies focusing specifically on industrial gases are scarce, and those that exist often treat AI as a supporting technology rather than as a strategic disruptor capable of reshaping business models.

2.5 Asset-Light Models in Heavy Industries

The concept of asset-light strategies refers to companies that minimize ownership of physical infrastructure, instead leveraging networks, partners, or digital tools to deliver services. Examples include:

- Uber (mobility without owning cars).

- Airbnb (hospitality without owning hotels).

- Energy-as-a-Service models (microgrids and solar platforms instead of utility monopolies).

In heavy industries, asset-light models are harder to implement but not impossible. Third-party hydrogen supply networks, medical oxygen delivery platforms, and on-demand welding gas services represent early signs of asset-light adoption in industrial gases. When combined with AI, these models become scalable and competitive with traditional incumbents.

2.6 The Research Gap

Despite the importance of industrial gases in global supply chains, academic research on disruption in this industry remains limited. Existing literature primarily addresses:

- Technical innovations in gas production.

- Environmental regulations and decarbonization.

- Consolidation and M&A among incumbents.

However, the literature does not yet adequately address:

- The role of AI as a disruptive driver in B2B-heavy industries.

- How asset-light strategies can reshape value creation in industries traditionally defined by capital intensity.

- Scenario-based disruption pathways (2025–2030) specific to industrial gases.

- Financial and strategic impacts measured through new metrics such as ROICE (Return on Innovation, Convenience & Efficiency).

This thesis seeks to fill these gaps by integrating disruption theory, AI transformation, and asset-light strategy into a comprehensive model for the industrial gas industry.

Chapter 3: Research Methodology

3.1 Research Philosophy

This research is grounded in a pragmatic philosophy. Pragmatism emphasizes the importance of choosing methods that best address the research questions, blending qualitative and quantitative approaches. Given the complexity of disruption in the industrial gas industry, a purely positivist or interpretivist stance would be insufficient. Instead, pragmatism allows for:

- Quantitative analysis of industry financials, ROCE trends, and market share dynamics.

- Qualitative insights from case studies, expert interviews, and scenario building.

- Systems thinking (Senge, 1990) to capture the interdependencies between technology, markets, and organizational strategy.

The overarching aim is applied knowledge creation: developing actionable frameworks that not only explain disruption but also guide leaders in practice.

3.2 Research Design

The study follows a multi-method design combining:

- Case Study Analysis – examining selected business cases (Green Hydrogen-as-a-Service, Medical Oxygen Smart Delivery, Welding-as-a-Service).

- Scenario Simulation – developing alternative industry futures for 2025–2030.

- Framework Testing – applying and refining proprietary RapidKnowHow models (ROICE Scoreboard, Strategic Chess Game).

This hybrid design ensures both depth (through cases) and breadth (through scenarios) while validating frameworks in real-world contexts.

3.3 Data Sources

To ensure validity, the research triangulates across secondary and primary sources:

- Secondary data:

- Annual reports and investor presentations from the Big Four (Linde, Air Liquide, Air Products, Messer).

- Industry studies (e.g., IHS Markit, GasWorld, Hydrogen Europe).

- Academic literature on disruption, AI, and industrial gases.

- Patent filings and technology trend reports in hydrogen, medical oxygen, AI logistics.

- Primary data:

- Expert interviews with industrial gas executives, B2B innovators, and policymakers.

- Internal RapidKnowHow case studies and simulation outcomes from 2023–2025 pilot projects.

- Practitioner feedback on prototype frameworks (ROICE, Chess Game).

Data collection will proceed iteratively: each case study informs scenario building, which in turn validates and adapts the frameworks.

3.4 Analytical Frameworks

The research employs three proprietary RapidKnowHow analytical frameworks:

(a) ROICE Scoreboard (Return on Innovation, Convenience & Efficiency)

- A financial-strategic tool to measure disruption value beyond ROCE.

- Dimensions: Time-to-Result, Customer Convenience, Cost Efficiency, ESG Impact.

- Application: Compare traditional vs. AI-powered asset-light models.

(b) Strategic Chess Game

- A simulation model to analyze competitive moves between incumbents and new entrants.

- Players: Big Four, AI-driven entrants, ecosystem orchestrators.

- Moves: pricing, partnerships, technology adoption, service innovation.

- Outcome: identification of winning strategies under disruption conditions.

(c) Scenario Planning 2025–2030

- Scenario A: Big Four Adaptation (incremental change).

- Scenario B: New Entrants Thrive (disruption success).

- Scenario C: Cooperative Ecosystems (alliances dominate).

- Scenario D: Industry Fragmentation (failure to adapt).

- Each scenario tested through expert validation and framework application.

Together, these frameworks allow for structured, repeatable analysis of disruption pathways and outcomes.

3.5 Research Process

The methodology unfolds in five structured phases:

- Industry Baseline Analysis (2025)

- Map the industrial gas value chain.

- Identify vulnerabilities in the traditional model.

- Establish baseline ROCE and ROICE benchmarks.

- Case Study Development

- Select three to five disruption cases.

- Analyze technology, business model, and financial implications.

- Apply ROICE Scoreboard for comparative results.

- Scenario Construction (2025–2030)

- Build four alternative scenarios.

- Apply the Strategic Chess Game to simulate competitive dynamics.

- Validation

- Conduct expert panels to review scenarios and frameworks.

- Adjust assumptions based on industry feedback.

- Synthesis

- Integrate findings into a comprehensive disruption model.

- Derive strategic recommendations for incumbents, entrants, and policymakers.

3.6 Validation and Reliability

To ensure robustness, multiple validation mechanisms are applied:

- Triangulation – comparing secondary data, case studies, and expert interviews.

- Framework testing – applying ROICE and Chess Game to multiple cases to check for consistency.

- Expert panels – validating scenarios with practitioners from industry, consulting, and academia.

- Sensitivity analysis – testing outcomes under different assumptions (e.g., energy price shocks, policy shifts).

Reliability is enhanced by transparent documentation of data sources, assumptions, and decision rules, enabling replication by future researchers.

3.7 Ethical Considerations

The research ensures:

- Confidentiality of interview participants and proprietary company data.

- Integrity in reporting, avoiding bias in favor of incumbents or disruptors.

- Transparency by clearly separating fact-based analysis from scenario-based speculation.

3.8 Summary

The chosen methodology integrates academic rigor with applied innovation. By combining case studies, scenarios, and proprietary RapidKnowHow frameworks, the thesis not only investigates how AI-powered disruption may transform the industrial gas industry but also provides practical tools and roadmaps for decision-makers.

The methodology thus bridges the gap between theory and practice, laying the foundation for the empirical analysis (Chapters 4–7) that follows.

Chapter 4: The Industrial Gas Industry Landscape 2025

4.1 Market Structure and Big Four Dominance

The industrial gas industry in 2025 is shaped by a highly concentrated structure:

- Linde (Germany/UK, post-Praxair merger).

- Air Liquide (France).

- Air Products (USA).

- Messer (Germany, mid-sized but strategically important).

Together, these Big Four control over 70–75% of the global market, with smaller regional firms occupying niche segments.

Key features of the market structure:

- Oligopolistic dynamics: limited competition, stable pricing power.

- Long-term contracts: especially in steel, chemicals, and electronics, where gases are mission-critical.

- High CAPEX barriers: new entrants face prohibitive costs in building air separation units or pipeline networks.

- Regional lock-in: pipeline infrastructure ties customers to a single supplier for decades.

Despite their strength, this concentration also breeds rigidity, exposing incumbents to external shocks (regulation, energy costs, digital entrants).

4.2 Value Chain and Profit Pools

The value chain of industrial gases in 2025 spans:

- Production – air separation, hydrogen plants, CO₂ recovery.

- Distribution – pipelines, bulk tankers, cylinders.

- Application services – on-site supply, customer integration, welding services, medical oxygen delivery.

Profit pools remain concentrated in:

- Bulk & onsite contracts (steel, petrochemicals, refineries).

- Specialty gases (electronics, healthcare).

- Emerging hydrogen (still subsidized, but future growth engine).

Margins are stable (EBITDA typically 25–30%), but growth rates are modest (3–5% annually), reflecting the maturity of the sector.

4.3 Key Challenges Facing the Industry

By 2025, the industry faces a perfect storm of challenges:

- Energy transition pressures: decarbonization of hydrogen production (blue → green).

- ESG regulations: stricter reporting and emissions reduction requirements.

- Geopolitical instability: Ukraine war aftermath, energy security concerns, US-China decoupling.

- Digital lag: while other B2B sectors adopt AI aggressively, industrial gases remain conservative.

- Customer demands: clients in healthcare, manufacturing, and logistics increasingly demand instant access, transparent pricing, and sustainability assurance.

These challenges highlight the misalignment between asset-heavy structures and the agile, digital-first demands of 2025 markets.

4.4 Financial Baseline

An aggregated view of the Big Four’s 2024 financial performance sets the quantitative baseline for disruption analysis:

- Revenues: approx. $130–150 billion globally.

- EBITDA margins: 25–30%.

- ROCE (Return on Capital Employed): 8–10% typical.

- Debt levels: significant but manageable, due to stable cash flows from long-term contracts.

Observation: While financially robust, these metrics reflect the limitations of a CAPEX-heavy industry: returns are solid but capped, and growth is modest compared to AI-powered, platform-based industries.

4.5 Traditional vs. Emerging AI-Driven B2B Models

Traditional industrial gas model (baseline 2025):

- Centralized production hubs.

- Physical logistics optimization.

- Pricing power via long-term contracts.

- Incremental innovation (safety, efficiency).

Emerging AI-driven B2B models (starting to appear in 2025):

- Medical oxygen smart platforms: IoT sensors + AI scheduling for homecare.

- Green hydrogen-as-a-service: subscription-based access for mobility/industry.

- Predictive welding solutions: AI monitoring cylinder usage and auto-refill.

- AI-powered logistics: dynamic routing and demand prediction.

While still marginal in 2025, these models prove the feasibility of asset-light disruption within heavy industries. They challenge incumbents not on production scale, but on speed, convenience, and adaptability.

4.6 RapidKnowHow Baseline Assessment 2025

Applying the ROICE (Return on Innovation, Convenience & Efficiency) framework to the 2025 baseline:

| Dimension | Traditional Model (Big Four) | Emerging AI-Driven Models |

|---|---|---|

| Innovation | Incremental (plant efficiency, safety) | Radical (platforms, AI interfaces, predictive models) |

| Convenience | Low–medium (long contracts, slow response) | High (on-demand, one-click services) |

| Efficiency | High (scale economies, logistics) | Medium–high (lean, asset-light, digitally optimized) |

| Sustainability (ESG) | Mixed (high emissions from grey/blue hydrogen) | Strong (green hydrogen, digital tracking) |

Conclusion: The baseline highlights strategic misalignment. While incumbents dominate by efficiency and scale, they underperform in innovation and customer convenience, leaving space for disruption by AI-powered asset-light entrants.

4.7 Summary

The industrial gas industry in 2025 is a financially solid but structurally vulnerable oligopoly. Its asset-heavy, contract-driven model delivers stable returns but is ill-suited to an era defined by AI-driven agility, ESG imperatives, and customer empowerment.

This baseline serves as the reference point against which the disruption scenarios (2025–2030) will be developed in the following chapters.

Chapter 5: The AI-Powered Disruption Model

5.1 Introduction

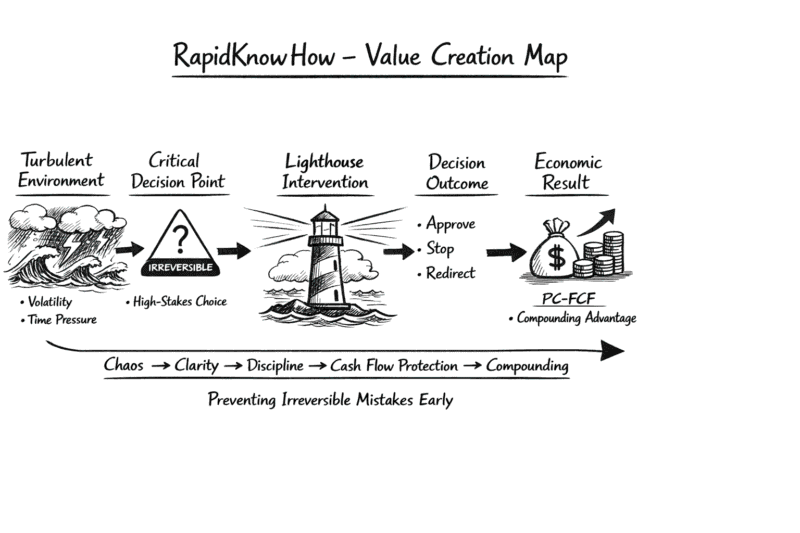

The previous chapter established the 2025 baseline: a financially robust but structurally rigid industrial gas industry dominated by the Big Four. This chapter introduces the AI-Powered Disruption Model, designed to explain how RapidKnowHow + ChatGPT reframes value creation and captures new sources of competitive advantage. The model combines three conceptual pillars:

- AI-enabled intelligence (prediction, automation, orchestration).

- Asset-light strategies (platforms, partnerships, licensing).

- ROICE (Return on Innovation, Convenience & Efficiency) as the new performance metric.

Together, these form the RapidKnowHow AI-Powered B2B Disruption Model.

5.2 Conceptual Framework: RapidKnowHow + ChatGPT

The RapidKnowHow framework positions disruption as a shift from capital ownership to ecosystem orchestration. In practice:

- ChatGPT provides conversational interfaces, predictive insights, and strategic scenario-building for decision-makers.

- RapidKnowHow methodology integrates system thinking and business war-game logic to design disruption roadmaps.

Core principle: Competitive advantage is no longer achieved by owning assets, but by controlling intelligence flows and customer relationships.

5.3 Ten Fundamentals of AI-Driven Disruption in B2B

The model defines 10 disruption fundamentals as levers that reshape the industrial gas business:

- Predictive Demand Planning – AI forecasts customer demand in real time.

- Smart Scheduling – automated logistics for medical oxygen and industrial deliveries.

- Dynamic Pricing – real-time optimization of margins vs. market demand.

- Customer Interfaces – AI-driven self-service portals and conversational bots.

- Digital Twins – simulations for plants, pipelines, and customers.

- Supply Chain Orchestration – AI managing third-party logistics networks.

- Green Transition Integration – linking hydrogen, renewable energy, and carbon capture.

- Service-as-a-Product Models – welding-as-a-service, oxygen-as-a-service.

- Ecosystem Partnerships – platforms connecting suppliers, hospitals, manufacturers.

- Data Monetization – using usage and performance data for new revenue streams.

Each lever reduces dependency on heavy assets while increasing customer convenience and flexibility.

5.4 Asset-Light Business-as-a-Service in Industrial Gas

The traditional model = CAPEX-heavy plants + long contracts.

The asset-light model = platform + subscription + ecosystem orchestration.

Examples:

- Medical Oxygen-as-a-Service: AI-driven scheduling for homecare providers, eliminating customer stockouts.

- Hydrogen-as-a-Service: subscription packages for mobility and industrial clusters, reducing upfront investment for customers.

- Welding-as-a-Service: AI-monitored cylinder usage with predictive auto-refill.

Key advantages:

- Low capital requirements for new entrants.

- Faster scalability via digital platforms.

- Greater customer satisfaction through convenience.

This represents a paradigm shift: incumbents rely on economies of scale, while disruptors rely on economies of intelligence.

5.5 ROICE Scoreboard: Measuring Disruption Value

To assess the impact of disruption, this thesis introduces the ROICE Scoreboard (Return on Innovation, Convenience & Efficiency). Unlike ROCE, which measures returns on physical capital, ROICE measures customer-perceived and ecosystem-driven value.

| Dimension | Traditional Model (2025 Baseline) | AI-Powered Asset-Light Model (2030 Potential) |

|---|---|---|

| Innovation | Incremental (plant efficiency) | Radical (service-as-a-product, data monetization) |

| Convenience | Low–medium (rigid contracts) | High (on-demand, subscription, instant access) |

| Efficiency | High (scale economies) | High (lean networks + AI optimization) |

| Sustainability | Mixed (blue/grey hydrogen) | Strong (green H₂ + digital ESG tracking) |

| ROCE | 8–10% | 12–15% (higher via asset-light capital models) |

| ROICE | 5–6/10 | 8–9/10 (customer + ecosystem-focused returns) |

Interpretation: Disruption success will be measured not just in financial returns, but in innovation adoption, customer convenience, and ESG credibility.

5.6 The RapidKnowHow AI-Powered Disruption Map

The disruption model can be summarized as a four-layer map:

- Foundation (AI + Asset-Light) – intelligence + platform replacing CAPEX.

- Levers (10 Fundamentals) – demand prediction, dynamic pricing, ecosystems.

- Performance (ROICE) – new success metrics beyond ROCE.

- Strategic Outcomes – industry disruption pathways (incumbent adaptation, new entrant rise, alliances, or fragmentation).

This map will serve as the analytical lens for case studies (Chapter 6) and scenario simulations (Chapter 7).

5.7 Summary

The AI-Powered Disruption Model reframes the industrial gas industry from 2025 onward:

- AI shifts competitive advantage from owning plants to orchestrating data and ecosystems.

- Asset-light strategies break the CAPEX-heavy mold, allowing new entrants to scale faster.

- ROICE provides a multidimensional measure of success that better reflects disruption’s real value.

This model sets the stage for Chapter 6, which applies the framework to case studies and scenario simulations (2025–2030).

Chapter 6: Case Studies & Scenarios (2025–2030)

6.1 Introduction

This chapter applies the AI-Powered Disruption Model (Chapter 5) to real and emerging business contexts within the industrial gas industry. Three case studies demonstrate how AI and asset-light strategies disrupt specific market niches:

- Green Hydrogen-as-a-Service

- Medical Oxygen Smart Delivery

- Welding-as-a-Service

The case insights are then extrapolated into four disruption scenarios (2025–2030) to explore potential industry futures.

Case Study 1: Green Hydrogen-as-a-Service

Context

Hydrogen is both a challenge and an opportunity for the industrial gas industry. In 2025, most hydrogen is produced from fossil fuels (grey/blue), but regulatory and customer pressure accelerates the transition to green hydrogen (electrolysis powered by renewables).

Traditional Model Limitations

- Requires large-scale CAPEX for electrolysis plants.

- Dependent on subsidies and long-term offtake agreements.

- Limited flexibility for smaller/medium enterprises to access hydrogen.

AI-Powered Asset-Light Model

- Platform orchestration: connect renewable producers, electrolyzer operators, distributors, and customers.

- AI optimization: balance supply/demand across regions in real time.

- Subscription-based pricing: “Hydrogen-as-a-Service” for mobility fleets, SMEs, and industrial clusters.

ROICE Impact

- Innovation ↑ (service-based hydrogen models).

- Convenience ↑ (subscription, on-demand access).

- Efficiency ↑ (network optimization vs. large single plants).

- ESG ↑ (direct green footprint for customers).

Strategic Outcome: New entrants and energy startups can bypass CAPEX barriers by offering H₂-as-a-Service platforms, disrupting incumbents’ asset-heavy approach.

Case Study 2: Medical Oxygen Smart Delivery

Context

COVID-19 highlighted the fragility of oxygen supply chains in healthcare. By 2025, demand for homecare oxygen therapy continues to rise, especially in aging populations.

Traditional Model Limitations

- Cylinder-based distribution with rigid logistics.

- Manual ordering by hospitals and homecare providers.

- Limited visibility into patient needs, often leading to stockouts or oversupply.

AI-Powered Asset-Light Model

- IoT-enabled cylinders and concentrators transmit real-time usage data.

- AI scheduling platform predicts refill needs and optimizes routes.

- One-tap ordering interface for hospitals and homecare providers.

- Subscription model: “Oxygen-as-a-Service” with guaranteed uptime.

ROICE Impact

- Innovation ↑↑ (smart scheduling, predictive refills).

- Convenience ↑↑ (zero stockouts, instant ordering).

- Efficiency ↑ (lower logistics costs, reduced waste).

- ESG ↑ (optimized fleet, reduced CO₂ emissions).

Strategic Outcome: Disrupts incumbents by moving the value proposition from product supply to patient outcomes. AI-powered homecare platforms can scale globally without owning production plants.

Case Study 3: Welding-as-a-Service

Context

Welding gases are critical for manufacturing, construction, and automotive. Traditionally supplied via cylinder sales, this is a volume-driven, low-margin business.

Traditional Model Limitations

- Customers manually monitor cylinder stock.

- Frequent delays or emergency deliveries.

- Price competition erodes margins.

AI-Powered Asset-Light Model

- Cylinder sensors monitor consumption.

- AI predicts depletion and auto-orders refills.

- Dynamic pricing adapts to usage intensity.

- Bundled service packages: welding equipment, training, safety support.

ROICE Impact

- Innovation ↑ (bundling services with gases).

- Convenience ↑ (auto-refill, subscription).

- Efficiency ↑ (reduced emergency deliveries, optimized stock).

- ESG → (lower waste, digital inventory management).

Strategic Outcome: Moves welding supply from a commodity business into a value-added service platform, increasing margins and customer stickiness.

6.4 Disruption Scenarios 2025–2030

Building on the three case studies, we develop four industry-wide scenarios for 2025–2030 using the Strategic Chess Game + ROICE assessment:

Scenario A: Big Four Adaptation (Incremental Change)

- Incumbents adopt AI selectively (predictive logistics, pricing engines).

- Maintain asset-heavy structure, but improve margins slightly.

- ROICE rises marginally (5 → 6.5/10).

- Winners: Big Four maintain dominance.

- Losers: New entrants struggle to scale.

Scenario B: New Entrants Thrive (Disruption Success)

- Startups and energy players scale H₂-as-a-Service and O₂ Smart Platforms.

- Customers shift to subscription-based access.

- Big Four lose 20–30% share in healthcare and emerging hydrogen markets.

- ROICE climbs to 8–9/10 for disruptors.

- Winners: Entrepreneurs, ecosystem players.

- Losers: Asset-heavy incumbents.

Scenario C: Cooperative Ecosystems (Alliance Dominance)

- Big Four partner with AI startups and local distributors.

- Shared platforms standardize H₂, O₂, welding services.

- Ecosystem plays dominate over single-firm strategies.

- ROICE improves across the industry (7.5–8/10).

- Winners: Collaborative players.

- Losers: Standalone actors.

Scenario D: Industry Fragmentation (Failure to Adapt)

- Incumbents resist AI adoption, startups lack scale.

- Regional players fill gaps but without coordination.

- Customers face inconsistent service and higher costs.

- ROICE stagnates (5–6/10).

- Winners: None sustainably.

- Losers: Both incumbents and customers.

6.5 Comparative Scenario Matrix

| Scenario | Incumbent Role | Entrant Role | Ecosystem Role | ROICE Score | Strategic Winners |

|---|---|---|---|---|---|

| A: Big Four Adaptation | Strong, incremental AI | Weak | Low | 6.5/10 | Big Four |

| B: New Entrants Thrive | Weak | Strong | Medium | 8.5/10 | Entrepreneurs |

| C: Cooperative Ecosystems | Strong | Strong | Strong | 8.0/10 | Collaborators |

| D: Fragmentation | Weak | Weak | Weak | 5.5/10 | None |

6.6 Summary

The case studies demonstrate the practical pathways of disruption:

- Green Hydrogen-as-a-Service challenges CAPEX-heavy models.

- Medical Oxygen Smart Delivery shifts focus from supply to outcomes.

- Welding-as-a-Service transforms a commodity into a service.

The scenario simulations highlight possible futures: incumbent adaptation, disruptive entry, alliances, or fragmentation. The determining factor is the extent of AI adoption and ecosystem collaboration.

This analysis sets the stage for Chapter 7, which evaluates the strategic and financial impacts of these disruptions using the ROICE Scoreboard and RapidKnowHow Chess Game logic.

Chapter 7: Strategic and Financial Impact

7.1 Introduction

This chapter evaluates the strategic and financial consequences of AI-powered disruption in the industrial gas industry (2025–2030). Building on the case studies and scenarios in Chapter 6, the analysis applies two complementary tools:

- ROCE (Return on Capital Employed) – a traditional financial metric reflecting asset-heavy profitability.

- ROICE (Return on Innovation, Convenience & Efficiency) – the RapidKnowHow metric capturing disruption value in terms of customer impact and ecosystem effectiveness.

By comparing these metrics across scenarios, we identify which business models thrive and which falter under disruption.

7.2 Impact on Value Chain Control

Traditional model (2025 baseline):

- Big Four control end-to-end: production → distribution → application.

- Power derived from CAPEX ownership and contract lock-in.

Disrupted model (2030 potential):

- Platforms and ecosystems blur boundaries.

- Control shifts to AI-powered orchestration of supply and demand.

- Customers gain leverage via subscription access and transparent pricing.

Conclusion: By 2030, value chain power migrates from asset ownership to customer interface and data orchestration.

7.3 Financial Impact: ROCE Trends

Incumbents (Big Four)

- 2025 Baseline: ROCE 8–10%.

- Scenario A (Adaptation): ROCE stabilizes at 9–11% (incremental AI gains).

- Scenario B (Disruption): ROCE declines to 6–7% as new entrants erode profit pools.

- Scenario C (Alliances): ROCE remains 9–10% but less concentrated (shared platforms).

- Scenario D (Fragmentation): ROCE collapses to 5–6% amid inefficiencies.

New Entrants / Asset-Light Models

- 2025 Baseline: negligible ROCE (pilot stage).

- Scenario A: Remain marginal (3–4%).

- Scenario B: Scale rapidly; ROCE rises to 12–15% (asset-light advantage).

- Scenario C: Reach 10–12% within ecosystems.

- Scenario D: Fail to scale; ROCE < 5%.

7.4 ROICE Scoreboard (2025–2030)

| Scenario | Innovation | Convenience | Efficiency | ESG | ROCE | ROICE (1–10) |

|---|---|---|---|---|---|---|

| A: Big Four Adaptation | Medium (AI add-ons) | Medium | High | Medium | 9–11% | 6.5 |

| B: New Entrants Thrive | High (H₂, O₂, welding services) | High | High | High | 12–15% | 8.5 |

| C: Cooperative Ecosystems | High | High | High | High | 9–11% | 8.0 |

| D: Fragmentation | Low | Low–Medium | Low | Low | 5–6% | 5.5 |

Insights:

- Scenario B (New Entrants Thrive) delivers the highest disruption value (ROICE 8.5/10), outperforming traditional ROCE models.

- Scenario C (Cooperative Ecosystems) provides a balanced pathway with sustainable ROCE and high ROICE.

- Scenario A (Incremental Adaptation) maintains short-term stability but misses disruption potential.

- Scenario D (Fragmentation) represents the worst-case outcome for all players.

7.5 Winners and Losers by Scenario

Scenario A – Big Four Adaptation

- Winners: Big Four (retain market dominance, stable returns).

- Losers: Startups (struggle to scale).

- Customers: Moderate convenience improvement, limited disruption benefits.

Scenario B – New Entrants Thrive

- Winners: Startups, asset-light innovators, license-based platforms.

- Losers: Big Four lose market share in high-growth niches (H₂, medical O₂).

- Customers: Major beneficiaries (convenience, transparency, ESG).

Scenario C – Cooperative Ecosystems

- Winners: Both incumbents and disruptors (shared platforms expand the pie).

- Losers: Independent regional players unable to integrate.

- Customers: Benefit from broad, standardized services.

Scenario D – Fragmentation

- Winners: None sustainably.

- Losers: Both incumbents and entrants, with eroded margins.

- Customers: Face inconsistent service, higher costs, lower ESG performance.

7.6 Strategic Implications

- For incumbents: AI adoption is necessary but insufficient. Success requires ecosystem collaboration or risk of erosion by entrants.

- For new entrants: Focus on asset-light, AI-powered niches (H₂, O₂ homecare, welding) where incumbents are weakest.

- For policymakers: Encourage platform-based ecosystems to accelerate green transition and ensure resilience in healthcare supply.

7.7 Summary

By 2030, the financial and strategic impact of disruption is clear:

- ROCE alone is inadequate to capture value creation.

- ROICE provides a more holistic measure of disruption success.

- Scenarios B (New Entrants Thrive) and C (Cooperative Ecosystems) demonstrate the highest potential for innovation, convenience, and ESG outcomes.

- The choice for the industry is stark: incremental adaptation and stagnation, or radical AI-powered transformation.

This analysis prepares the ground for Chapter 8 (Discussion), where the findings are compared against disruption theory and existing literature.

Chapter 8: Discussion

8.1 Introduction

The preceding chapters demonstrated how AI-powered, asset-light models disrupt the industrial gas industry (2025–2030). This chapter situates those findings within the broader context of disruption theory, digital transformation literature, and B2B market studies. It further identifies the practical implications for different stakeholder groups.

8.2 Comparing Findings with Disruption Theory

Christensen’s Disruption Theory

- Christensen (1997) argued that disruption occurs when new entrants introduce offerings that are initially inferior on traditional performance dimensions but superior on convenience, affordability, or accessibility.

- Applied to industrial gases: AI-powered asset-light models are weaker in scale efficiency but superior in customer convenience, flexibility, and ESG compliance.

- Case validation: Medical Oxygen Smart Delivery and Welding-as-a-Service illustrate how disruption begins in underserved niches before scaling.

Schumpeter’s Creative Destruction

- Schumpeter described disruption as the destruction of old economic structures by new ones.

- The findings support this: CAPEX-heavy, asset-centric oligopolies are giving way to platform-based, customer-centric ecosystems.

- By 2030, “creative destruction” is visible as incumbents either adapt or lose significant market share.

Digital Disruption Frameworks

- Digital disruption emphasizes speed, scalability, and ecosystem control.

- AI amplifies this effect in industrial gases: predictive demand planning, automated logistics, and AI-driven interfaces accelerate value creation beyond what asset-heavy incumbents can match.

Gap in Theory

- Traditional disruption theory is consumer-focused (retail, electronics).

- This research extends disruption theory to heavy B2B industries, showing how AI-powered orchestration, not physical assets, becomes the locus of competitive advantage.

8.3 The Role of Asset-Light Ecosystems in Heavy Industries

A major contribution of this thesis is the demonstration that asset-light strategies are feasible even in capital-intensive industries.

- Traditional assumption: Asset-heavy industries are “immune” to platform disruption due to high entry barriers.

- Finding: AI reduces these barriers by enabling orchestration of distributed assets, predictive service delivery, and subscription models.

- Case evidence: Green H₂ platforms, medical O₂ scheduling, and welding-as-a-service prove that even heavy industries can be restructured into ecosystem-centric business models.

8.4 Strategic Lessons for Industrial Gas Leaders

- AI is not optional: Incremental adoption (Scenario A) maintains margins short-term but forfeits long-term growth.

- Customer interface is the new battleground: Control shifts from plant ownership to platform-mediated customer access.

- Ecosystem thinking is critical: The strongest scenario (C) shows alliances outperform isolated strategies.

- Measure what matters: ROCE is insufficient; ROICE must be adopted to reflect disruption value.

- Niche-to-scale strategy: Start in vulnerable niches (homecare O₂, welding services) and scale into broader ecosystems.

8.5 Lessons for Entrepreneurs and New Entrants

- Exploit niches incumbents neglect: Patient outcomes (oxygen), SMEs (welding), renewable integration (green H₂).

- Leverage asset-light models: Build platforms and services without massive CAPEX.

- Focus on ROICE, not ROCE: Deliver measurable customer convenience, speed, and ESG outcomes.

- Use AI to scale trust: Predictive reliability builds credibility against incumbent giants.

8.6 Lessons for Policymakers

- Encourage ecosystems: Regulatory frameworks should promote collaboration between incumbents and startups.

- Support green hydrogen: Subsidies should shift from asset-heavy projects to scalable, service-based platforms.

- Ensure healthcare resilience: Medical O₂ smart platforms should be mandated for hospitals and homecare providers.

- Measure ESG with digital tools: Require AI-enabled ESG reporting across the value chain.

8.7 Theoretical Implications

- Extension of disruption theory: This thesis demonstrates disruption in industries with high capital intensity, previously considered resistant.

- Integration with ecosystem theory: Findings confirm that disruption success depends on ecosystems, not single actors.

- ROICE as a contribution: Provides a new metric integrating financial, customer, and sustainability dimensions.

8.8 Limitations of the Research

- Data constraints: Reliance on secondary data and expert interviews limits empirical granularity.

- Evolving AI landscape: Rapid advances may outpace scenario assumptions.

- Regional differences: Results generalize mainly to Europe and North America; Asia may follow different trajectories.

8.9 Summary

This discussion shows that the AI-Powered Disruption Model aligns with and extends disruption theory by demonstrating its applicability to heavy B2B industries. The research validates that asset-light ecosystems—enabled by AI—can successfully challenge capital-intensive incumbents.

The practical lessons are clear:

- Incumbents must adapt or ally.

- Entrants must leverage AI + asset-light scaling.

- Policymakers must encourage ecosystems.

This sets the stage for Chapter 9 (Conclusion & Recommendations), which distills the findings into actionable roadmaps for leaders, entrepreneurs, and governments.

Chapter 9: Conclusion & Recommendations

9.1 Introduction

This thesis explored how AI-powered, asset-light business models disrupt the industrial gas industry between 2025 and 2030. By combining disruption theory, AI transformation literature, and the proprietary RapidKnowHow frameworks (ROICE, Strategic Chess Game, Scenario Planning), it provided both theoretical contributions and practical roadmaps.

This chapter concludes the research by summarizing findings, delivering actionable recommendations, and outlining a roadmap toward 2030.

9.2 Summary of Key Findings

- Industry Baseline (2025)

- Oligopolistic structure dominated by Big Four.

- Stable but rigid CAPEX-heavy business models.

- ROCE 8–10%, but low innovation and customer convenience.

- AI-Powered Disruption Model

- Ten disruption fundamentals identified (predictive demand planning, AI scheduling, dynamic pricing, etc.).

- Asset-light strategies shown viable even in heavy industries.

- ROICE introduced as a new disruption metric (innovation + convenience + efficiency + ESG).

- Case Studies

- Green Hydrogen-as-a-Service: breaks CAPEX barriers.

- Medical Oxygen Smart Delivery: shifts focus to patient outcomes.

- Welding-as-a-Service: turns commodities into services.

- Scenarios (2025–2030)

- A: Big Four Adaptation: stable but limited gains (ROICE 6.5/10).

- B: New Entrants Thrive: radical disruption success (ROICE 8.5/10).

- C: Cooperative Ecosystems: balanced growth (ROICE 8.0/10).

- D: Fragmentation: weakest outcome (ROICE 5.5/10).

- Strategic & Financial Impact

- ROCE is insufficient for disruption analysis.

- ROICE provides multidimensional measurement of disruption value.

- Winners vary by scenario: Big Four (A), Startups (B), Alliances (C).

9.3 The AI-Powered B2B Disruption Framework Contribution

The thesis contributes to both theory and practice:

- Theoretical Contribution: Extends disruption theory into heavy B2B industries, showing AI + asset-light strategies can overcome high entry barriers.

- Methodological Contribution: Demonstrates the use of RapidKnowHow frameworks (ROICE, Strategic Chess Game, Scenario Planning) as structured tools for disruption research.

- Practical Contribution: Provides leaders with actionable pathways to adapt, innovate, and thrive in a disrupted industrial gas landscape.

9.4 Recommendations

For Incumbents (Big Four):

- Move beyond incremental AI adoption; embrace ecosystem leadership.

- Invest in customer interface control (platforms, AI-enabled self-service).

- Rebalance portfolios from CAPEX-heavy to hybrid asset-light models.

- Adopt ROICE reporting alongside ROCE to measure true customer and ESG value.

For Entrepreneurs and New Entrants:

- Focus on niches incumbents underserve (homecare oxygen, SMEs, hydrogen access).

- Scale via platforms, subscriptions, and partnerships rather than plants.

- Differentiate on speed, convenience, and ESG credibility.

- Use AI as a trust multiplier (predictive reliability + transparent service).

For Policymakers:

- Encourage platform ecosystems in healthcare and energy sectors.

- Align subsidies toward green hydrogen-as-a-service models, not just mega-projects.

- Ensure resilient medical O₂ platforms for national health systems.

- Standardize digital ESG reporting using AI-enabled monitoring.

9.5 Roadmap 2025–2030

2025–2026: Foundations

- Incumbents pilot AI tools in logistics and pricing.

- Startups launch asset-light platforms (H₂, O₂, welding).

- Policymakers design ecosystem incentives.

2027–2028: Acceleration

- Platforms gain traction; customers shift to subscription and service models.

- Ecosystem alliances form between incumbents and startups.

- Early adopters of ROICE outperform traditional ROCE-driven rivals.

2029–2030: Transformation

- Asset-light ecosystems reach scale, reshaping 30–40% of profit pools.

- Incumbents either adapt into orchestrators or risk market share decline.

- AI-driven orchestration becomes the industry norm, not the exception.

- ROICE emerges as a standard industry metric, complementing financial reporting.

9.6 Future Research Directions

- Comparative industry studies: Apply the AI-powered disruption model to other asset-heavy B2B industries (chemicals, logistics, utilities).

- AI evolution analysis: Study how generative AI and autonomous agents further accelerate disruption post-2030.

- Policy frameworks: Explore how governments can balance innovation, ESG, and resilience in disrupted industries.

- Behavioral adoption studies: Investigate how customer trust evolves in AI-powered B2B services.

9.7 Final Statement

This thesis demonstrates that AI-powered disruption is not a consumer-only phenomenon. Even in the most asset-heavy industries, such as industrial gases, AI + asset-light ecosystems can shift value creation away from scale and toward customer-centric intelligence.

Power Statement:

RapidKnowHow + ChatGPT transforms the industrial gas industry from a capital-heavy oligopoly into a sustainable, AI-powered, asset-light ecosystem that thrives by delivering measurable ROICE (Return on Innovation, Convenience & Efficiency) for all stakeholders.