SIGNAL → What changed? What matters now?

1️⃣ Energy Cost Volatility (Europe)

Signal:

• Natural gas and electricity prices show renewed volatility

• Electrolysis-based hydrogen remains cost-sensitive

• Customers renegotiate supply contracts

Impact:

→ Margin pressure on merchant gases

→ Pass-through speed becomes critical

→ Contract structure determines survival

2️⃣ AI-Driven Manufacturing Acceleration

Signal:

• Semiconductor & battery production ramping

• AI-driven fabs require ultra-high purity gases

• On-site supply demand increasing

Impact:

→ Premium gas demand rising

→ Reliability > price

→ Asset-light modular supply gaining advantage

3️⃣ Competitive Pressure from Majors

Signal:

• Major players expanding hydrogen & electronics footprint

• Long-term lock-in contracts

• Regional consolidation ongoing

Players involved:

• Linde plc

• Air Liquide

• Air Products

Impact:

→ Mid-size players squeezed

→ Niche specialization becomes mandatory

B) PRIORITIZE → Eisenhower Logic (Week 8)

🔴 ACT NOW (Urgent + Important)

- Energy Pass-Through Execution

- Apply your Industrial Gas Pass-Through Formula

- Renegotiate merchant contracts within 14 days

- Protect Electronics & Pharma Accounts

- Guarantee uptime

- Offer AI-based consumption optimization

🟠 IMPORTANT (Strategic Build)

- Deploy AI-Orchestrator Pricing Dashboard

- Real-time margin heatmap

- Segment-based elasticity model

- Hydrogen Optionality Model

- Avoid CapEx-heavy bets

- Structure joint venture or modular pilot

C) ACT → What exactly to do in Week 8

Move 1: Margin Firewall Sprint (5 Days)

• Audit 30 largest energy-sensitive contracts

• Identify negative contribution margin accounts

• Trigger immediate repricing

Move 2: AI Sales War-Room

• Predict demand spike in electronics

• Lock supply reliability before competitors

Move 3: Asset-Light Hydrogen Strategy

• No mega-plant commitment

• Pilot 1 modular electrolyzer with co-investor

D) CAPTURE → Convert action into Free Cash-Flow

Measure 4 KPIs this week:

- Pass-through recovery rate (%)

- Margin delta vs Week 6

- Contract upgrade ratio

- Energy exposure index shift

Target Outcome Week 8:

+2–3% margin stabilization

Cash-flow risk reduced

Electronics backlog secured

E) REINFORCE → Make it Structural

- Institutionalize Weekly AI-Orchestrator Loop

- Embed Pass-Through Auto Trigger

- Build Exposure Dashboard for Board

Strategic Insight

This loop is not operational management.

It is Strategic Cash-Flow Defense + Optionality Creation.

The Industrial Gas sector in 2026 is no longer:

“Production & Distribution”

It is:

Energy Arbitrage + Reliability Monetization + AI-Pricing Intelligence – Josef David

STRATEGIC COLLABORATION MODEL

RapidKnowHow + Industrial Gas Leader

Applying the AI-Orchestrator Leader System (2026–2030)

A) WHY THIS COLLABORATION – THE STRATEGIC GAP

Industrial Gas Leaders (e.g. Linde plc, Air Liquide, Air Products) are facing:

- Energy volatility

- AI infrastructure demand explosion

- Decarbonization pressure (Hydrogen, CCUS)

- Margin compression in merchant segments

- Capital intensity + long asset cycles

- Talent gap in digital orchestration

Core Problem 2026:

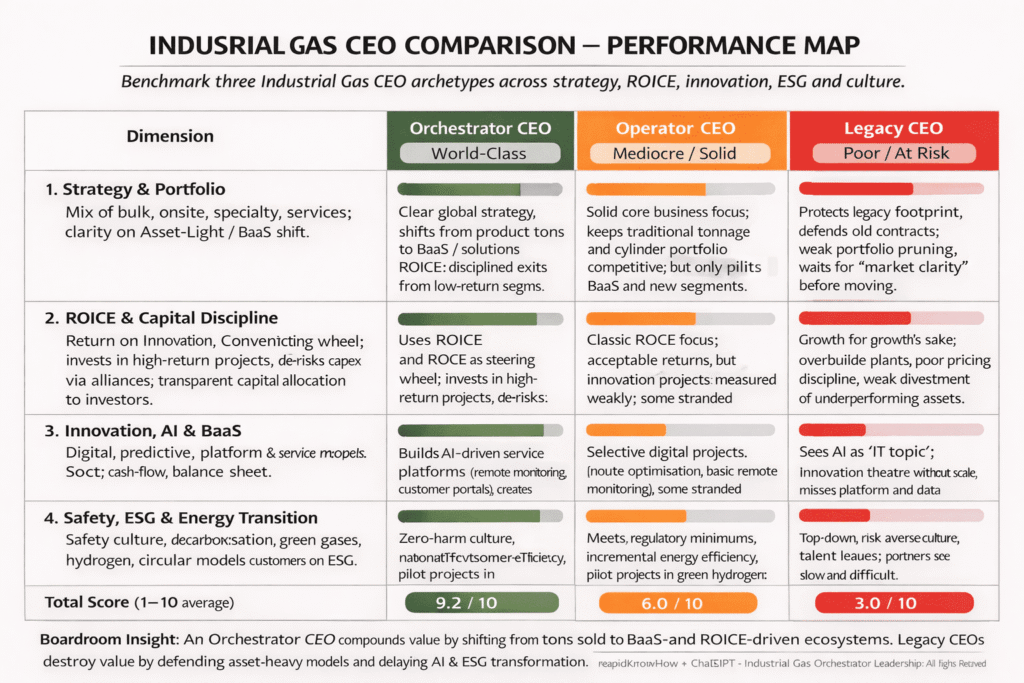

Traditional leadership = operational excellence.

2026+ Leadership = system orchestration.

This is where RapidKnowHow + AI-Orchestrator Leader becomes the differentiator.

B) THE COLLABORATION ARCHITECTURE

1️⃣ STRUCTURE: 3-LAYER MODEL

Layer 1 – Signal Intelligence

Layer 2 – Strategic Orchestration

Layer 3 – Value Capture & Compounding

LAYER 1 — SIGNAL INTELLIGENCE ENGINE

Purpose:

Turn weak signals into structured executive insight.

Components:

- Industrial Gas Exposure Index

- Pass-Through Formula Engine

- AI Demand Acceleration Radar

- GeoMove Risk Overlay

- Free Cash-Flow Sensitivity Map

Output:

- Weekly CEO Snapshot (10 min)

- Board Heatmap (Stephen Few style)

- ACT NOW Flashpoints

LAYER 2 — AI-ORCHESTRATOR LEADERSHIP SYSTEM

Operating Logic:

Instead of siloed optimization:

Production | Energy | Sales | Supply | CapEx | Digital

→ Orchestrated via AI Decision Loops:

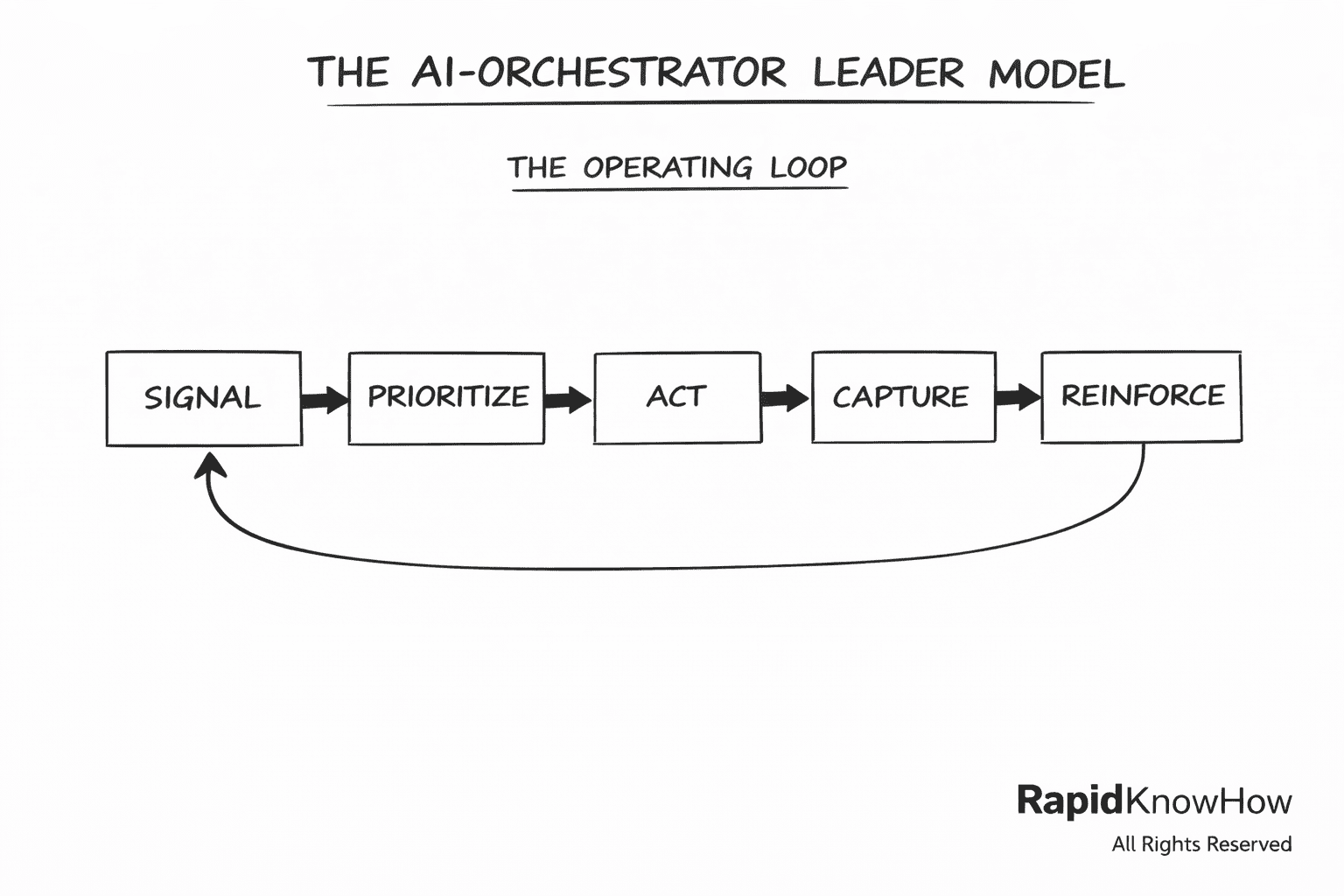

Signal → Prioritize → Act → Capture → Reinforce

Core Capabilities:

- Decision Speed Compression (Weeks → Days → Hours)

- Cash-Flow Sensitivity Control

- Strategic CapEx Prioritization

- AI Infrastructure Positioning

- Hydrogen ROI Reality Testing

LAYER 3 — VALUE CAPTURE ENGINE

This is where RapidKnowHow’s differentiation becomes monetizable.

Focus:

- Free Cash-Flow Delta %

- ROICE (Return on Innovation, Convenience & Efficiency)

- Risk-Adjusted Growth

- Compounded Capital Allocation Discipline

Output:

- PVC Rapid Response System

- 90-Day Free Cash-Flow Sprint

- AI-Driven Margin Expansion

- Compounding Wealth Model (Industrial Gas Leader Level)

C) COLLABORATION FORMATS

OPTION 1 — STRATEGIC ADVISORY RETAINER

RapidKnowHow becomes:

External AI-Orchestrator Strategic Partner

Scope:

- Weekly Executive Signal Brief

- Monthly Strategic Calibration

- Quarterly Capital Allocation Session

- Board AI Orchestration Workshop

Fee Structure (Industrial Gas Tier):

€8k–25k/month depending on scope

OPTION 2 — 90-DAY AI ORCHESTRATOR SPRINT

Objective:

Deliver measurable FCF improvement within 90 days.

Deliverables:

- Exposure Index Deployment

- Pricing Pass-Through Recalibration

- Portfolio Stress Test

- CapEx Re-ranking

- AI Efficiency Implementation Map

Success Metric:

≥ 2–5% Free Cash-Flow Delta identified or captured.

Fee:

Hybrid model:

Base + Success Fee (1–3% of value captured)

OPTION 3 — JOINT THOUGHT LEADERSHIP

Publish:

- Industrial Gas Exposure Index 2026

- AI-Orchestrator Leadership Whitepaper

- CEO Roundtable Vienna / DACH

- Closed Executive Workshops

This builds:

Authority

Inbound Leads

Licensees

Strategic Positioning

D) STRATEGIC DIFFERENTIATION

Nobody currently offers:

- AI-Orchestrator Leadership specifically for Industrial Gases

- Integrated Signal → Cash-Flow orchestration

- Industrial Gas specific ROICE model

- Exposure Index + Decision Speed Compression

Consulting firms optimize slides.

RapidKnowHow orchestrate systems.