Problem:

The industrial gases sector is a critical component of the global economy, powering a wide range of industries from healthcare to manufacturing. However, since 2020, our company has been grappling with a significant decline in profit and cash flow.

This downturn has been driven by a combination of factors including increased competition, fluctuating market conditions, and operational inefficiencies. The impact on our bottom line has been substantial and if left unaddressed, could potentially jeopardise the long-term sustainability of our business.

Impact:

The implications of this downward trend are far-reaching. Not only does it affect our ability to invest in new technologies and expand our operations, but it also impacts our capacity to attract and retain top talent. Furthermore, it undermines our competitive position in the market and could potentially erode customer confidence in our brand. The longer this situation persists, the more difficult it will be for us to recover and regain our footing in the industry.

Solution:

To turn our business around, we need to implement a comprehensive strategy that addresses the root causes of our declining profit and cash flow. This strategy should encompass several key areas:

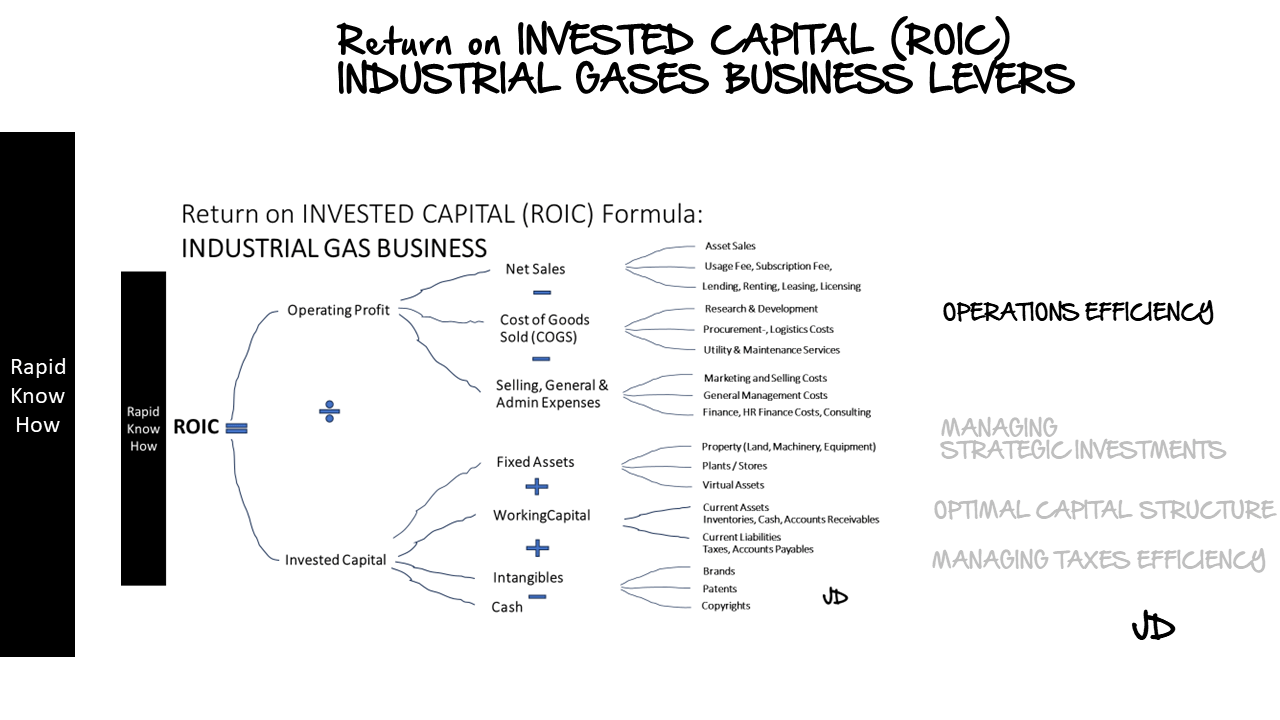

1. Operational Efficiency: We need to conduct a thorough review of our operations to identify areas where we can improve efficiency and reduce costs. This could involve streamlining processes, investing in automation technologies, or retraining staff.

2. Market Diversification: To mitigate the risk of market fluctuations, we should consider diversifying into new markets or sectors. This could involve expanding into emerging markets or developing new products or services that cater to different customer segments.

3. Competitive Positioning: We need to strengthen our competitive position by investing in research and development, enhancing product quality, and improving customer service. By doing so, we can differentiate ourselves from competitors and create a unique value proposition for customers.

4. Financial Management: We need to improve our financial management practices to ensure that we are maximising profitability and cash flow. This could involve implementing stricter budget controls, improving cash flow forecasting, or renegotiating supplier contracts.

5. Talent Management: We need to attract and retain top talent to drive innovation and growth. This could involve enhancing our employee value proposition, investing in training and development, or implementing performance-based incentives.

By implementing these measures, we can not only reverse the current downward trend but also position our company for future growth and success. It will require a concerted effort from all levels of the organisation, but with the right strategy and execution, we can turn our business around and restore profitability and cash flow.