Defining the Pareto Rule for Investing in Stocks

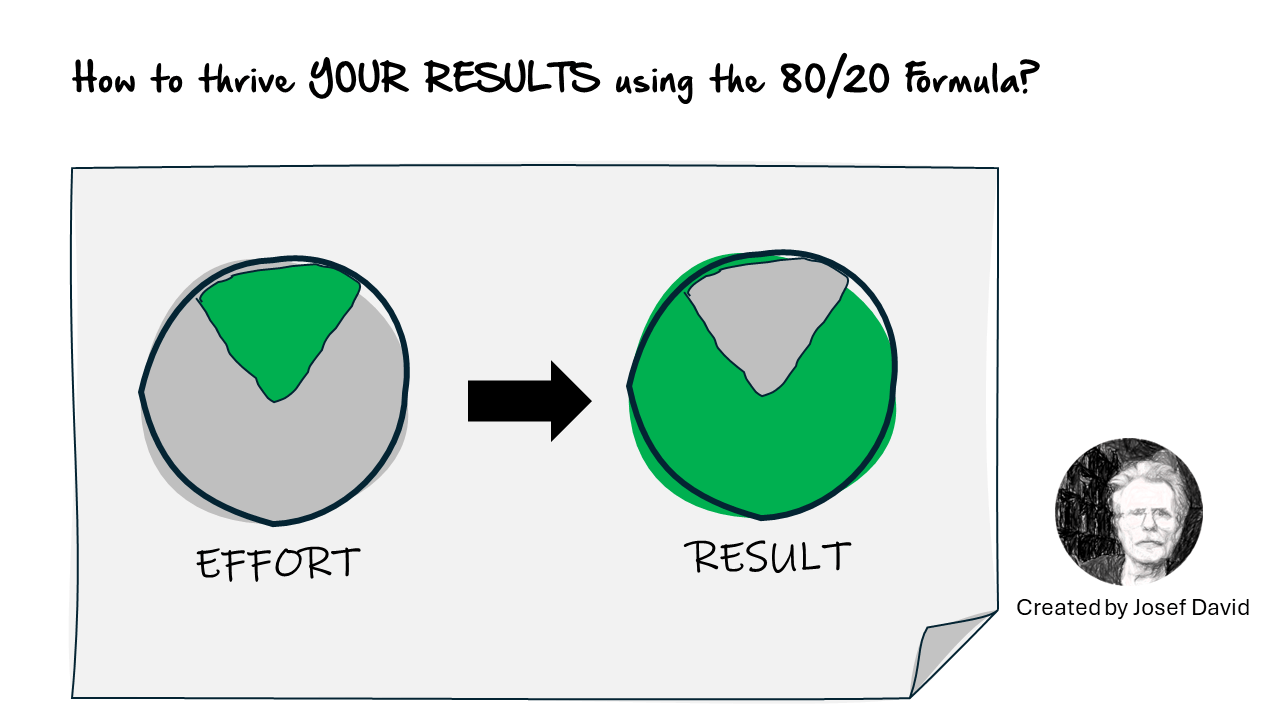

The Pareto Principle, also known as the 80/20 rule, is a concept developed by Italian economist Vilfredo Pareto in the late 19th century. The principle suggests that roughly 80% of effects come from 20% of causes. In the context of investing, this principle can be interpreted to mean that approximately 80% of your investment returns are likely to come from just 20% of your investments.

This principle is not a hard and fast rule, but rather a guideline to help investors focus their efforts and resources on the most productive areas. It’s important to note that the numbers don’t have to add up to exactly 100%, and they don’t always have to be 80/20. The key takeaway is that a small number of inputs (the 20%) can lead to a large proportion of outputs (the 80%).

Applying the Pareto Rule for Investing in Stocks

Applying the Pareto Principle in stock investing involves identifying and focusing on the stocks that provide the highest returns. Here’s how you can do it:

1. Portfolio Analysis: Start by analyzing your current portfolio. Identify which stocks are performing well and which ones aren’t. You’ll likely find that a small number of stocks are driving most of your portfolio’s performance.

2. Focus on High-Performing Stocks: Once you’ve identified these high-performing stocks, focus your investment efforts on them. This doesn’t necessarily mean you should sell all other stocks; diversification is still important for managing risk. However, it does mean you should allocate more resources towards these high-performers.

3. Regular Review: The stock market is dynamic and constantly changing, so it’s important to regularly review your portfolio and adjust your strategy as needed. What works today might not work tomorrow, so stay flexible and be ready to pivot when necessary.

4. Patience and Discipline: The Pareto Principle is not a get-rich-quick scheme. It requires patience and discipline. Remember, investing is a long-term game, and it’s the consistent, high-performing stocks that will drive your portfolio’s performance over time.

Conclusion and Actions

In conclusion, the Pareto Principle can be a powerful tool for stock investing. By focusing on the stocks that generate the highest returns, you can optimize your portfolio and potentially achieve better results.

However, it’s important to remember that this principle is just one tool in an investor’s toolbox. It should be used in conjunction with other strategies and principles, such as diversification and risk management. Also, always keep in mind that past performance is not indicative of future results.

Remember, investing is not about finding a magic formula; it’s about making informed decisions based on sound principles and strategies. The Pareto Principle can help guide these decisions, but it’s ultimately up to you to make the choices that are best for your financial goals and risk tolerance.