Organic Growth vs. M&A: What Strategy Generates a Higher ROIC? Case: Industrial Gases

When it comes to business expansion, two primary strategies are often considered: organic growth and mergers & acquisitions (M&A). Both have their unique advantages and disadvantages, and the choice between the two often depends on the specific circumstances of a company. In this discussion, we will delve into these strategies, focusing on their impact on Return on Invested Capital (ROIC) over a 10-year period. We will use the industrial gases sector as our case study.

[emaillocker id=”62166″]Organic Growth:

Organic growth refers to the process of business expansion through increasing output and enhancing sales internally. This can be achieved by opening new branches, investing in customer acquisition, or introducing new products or services.

Advantages:

1. Control: Organic growth allows a company to maintain full control over its operations. There are no external parties involved, which means that the company can make decisions that align with its long-term goals.

2. Brand Consistency: With organic growth, there’s less risk of diluting or confusing the brand because all growth is under the same brand umbrella.

3. Lower Risk: Organic growth is generally less risky than M&A because it involves fewer unknowns.

Disadvantages:

1. Time-Consuming: Organic growth is often slower than M&A. It takes time to build market share and customer loyalty.

2. High Initial Costs: Organic growth can require significant upfront investment in marketing, infrastructure, and personnel.

3. Limited Resources: Companies may not have access to enough resources for significant organic growth.

In terms of ROIC over a 10-year period, organic growth can be beneficial if the company has a strong brand and a loyal customer base that allows for steady revenue increases over time. However, the high initial costs can lead to lower ROIC in the early years.

Mergers & Acquisitions (M&A):

M&A involves one company merging with or acquiring another to expand its operations.

Advantages:

1. Rapid Expansion: M&A allows for rapid expansion into new markets or sectors.

2. Economies of Scale: M&As can lead to economies of scale, reducing costs per unit due to increased output.

3. Access to New Technologies or Expertise: Acquiring another company can provide access to their proprietary technology or industry expertise.

Disadvantages:

1. Integration Challenges: Merging two companies can lead to integration challenges related to culture, systems, and processes.

2. High Costs: M&As are typically expensive and can lead to high levels of debt.

3. Regulatory Hurdles: M&As often face regulatory scrutiny which can delay or prevent deals.

In terms of ROIC over a 10-year period, M&A could potentially offer higher returns due to rapid expansion and economies of scale. However, high initial costs and potential integration issues could negatively impact ROIC in the short term.

Case Studies:

In the industrial gases sector, both strategies have been employed with varying degrees of success.

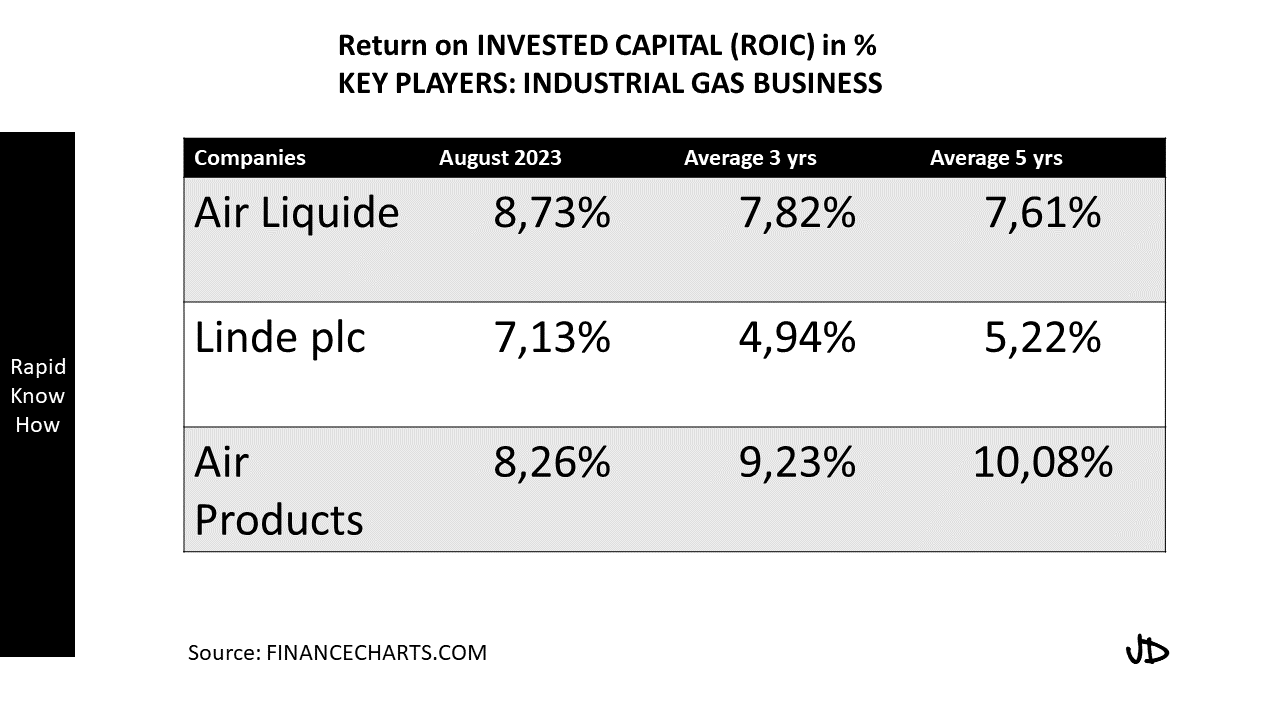

Air Products & Chemicals Inc., for example, has focused on organic growth by investing heavily in its core businesses and expanding its global footprint gradually. Over a 10-year period, they’ve seen steady increases in their ROIC due largely to their controlled expansion strategy.

On the other hand, Praxair’s merger with Linde AG is an example of an M&A strategy in this sector. The merger created a leading industrial gas company with increased market share and significant cost synergies. However, integration challenges have impacted their short-term ROIC.

[/emaillocker]In conclusion, both organic growth and M&A have potential advantages and disadvantages when it comes to generating higher ROIC over a 10-year period in the industrial gases sector. The choice between these strategies should be based on careful consideration of a company’s specific circumstances including its financial health, market position, competitive landscape, and long-term goals.