Deal Overview

- What’s happening? Air Liquide has signed a binding agreement to acquire South Korea’s DIG Airgas from Macquarie Asia‑Pacific Infrastructure Fund 2 for €2.85 billion (around US $3.3 billion) airliquide.com+12Reuters+12Wall Street Journal+12.

- Timeline: The transaction is expected to close in the first half of 2026, pending regulatory approval from South Korea Reuters+1.

Strategic Rationale & Value Drivers

- Market expansion in Asia: South Korea ranks as the world’s fourth-largest industrial gases market and hosts a dynamic manufacturing sector—particularly in semiconductors, clean energy, batteries, and biopharma Reuters+4Reuters+4webdisclosure.com+4.

- Complementary operations: Air Liquide, with over 30 years of presence in South Korea, will gain from DIG Airgas’s diversified footprint—60 plants, 220 km of pipelines, ~550 employees, and a strong presence in electronics and high-growth sectors Wall Street Journal+12Reuters+12Chemical Engineering+12.

- Growth pipeline: DIG Airgas benefits from a backlog of nearly 20 secured projects, adding visibility to future cash flows kedglobal.com+11webdisclosure.com+11Seeking Alpha+11.

- Earnings accretion: Air Liquide expects this acquisition to contribute to net profit growth within one year of integration Seeking Alpha+11Reuters+11webdisclosure.com+11.

Financial Considerations

- Valuation multiples: Deal values imply an estimated 2024 EBITDA multiple in the 18–20× range Wall Street Journal+4Reuters+4Chemical Engineering+4. Air Liquide cites a base EBITDA multiple of 20.2×, which drops to 14.8× when considering backlog and cost synergies—and could fall further with additional growth synergies webdisclosure.com+1.

- Financing structure: Initially backed by a structured bridge loan, the acquisition will be later refinanced via bond issuance Wall Street Journal+3Chemical Engineering+3FinanceAsia+3.

Risks & Potential Caveats

- Regulatory approval risk: The deal still requires South Korean regulatory clearance. Delays, conditions, or rejection could impact timing or valuation webdisclosure.com+2Chemical Engineering+2.

- High multiple scrutiny: Even with synergies, a near-20× EBITDA multiple could be seen as aggressive, raising concerns about overpayment or execution risk.

- Integration complexity: Merging organizations and cultures, especially across borders, poses operational challenges. Speed of realizing synergies will be key.

- Macro & sector uncertainty: DIG’s exposure to semiconductors and batteries—cyclical and innovation-dependent sectors—could make revenue projections volatile.

Strategic Outlook

Despite some risks, the acquisition offers strong strategic upside:

- Deepens footprint in Asia: Secure access to Korea’s high-growth industrial gases market.

- Access to high-potential sectors: Semiconductor and battery industries offer premium growth opportunities.

- Synergy potential: Backlog and infrastructure synergies support faster ROI.

- Profitability gains: Air Liquide expects earnings accretion within a year—suggesting confidence in quick realization of benefits.

Recommended Critical Investor Watchpoints

| Focus Area | Key Questions to Track |

|---|---|

| Regulatory Due Diligence | Will regulators set conditions? Preferable timeframe? |

| Integration Execution | How quickly will synergies translate into cost savings and higher revenues? |

| Debt & Financing Impacts | What are the bond terms? Impact on leverage ratios and credit metrics? |

| Market Volatility Exposure | Sensitivity to downturns in semiconductor or battery industries? |

| Post-deal Performance Tracking | Is net profit growth as accelerated as projected, within 12 months post-close? |

Final Take (Critical Investor Perspective)

Air Liquide’s acquisition of DIG Airgas is a bold strategic move to solidify and expand its regional leadership in a highly dynamic and innovation-driven market. The compelling mix of robust infrastructure, sectoral growth, and project backlog supports the case—especially if synergies are delivered rapidly.

Yet, as a critical investor, it’s essential to monitor regulatory developments, integration discipline, financing pressure, and macro shifts in DIG’s end markets. If Air Liquide manages execution well, this deal could well be value-accretive; missteps, however, could turn the aggressive valuation into a risk.

Here’s the full pack of peer deal comps, a quick financial model, and regulatory-delay scenarios (all numbers in EUR unless noted).

Peer transaction benchmarks (industrial gases)

| Deal | Size / EV | EBITDA ref. | Implied EV/EBITDA | Notes |

|---|---|---|---|---|

| Air Liquide → DIG Airgas (KR) (binding) | €2.85bn | 2024 EBITDA $170–180m (≈ €147–155m) | 18.3–19.4× headline | AIRP expects profit uplift w/in 1 yr of integration; closing targeted H1’26, subject to KFTC. Reuters+1 |

| Adjusted view (same deal) | €2.85bn | management “backlog + cost synergies” basis | 14.8× | Multiple falls to 14.8× when including signed backlog and cost synergies. airliquide.comfuelcellsworks.com |

| Air Liquide → Airgas (US, 2016) | $13.4bn EV | 2016e EBITDA | 12.8× pre-synergy; 9.8× post-synergy | Also quoted ~13.5× vs 2015 LTM. Useful long-term benchmark. airliquide.comReuters |

| AirFirst (KR) → BlackRock 30% (2023) | ₩1.028tn for 30% | Co. 2023 EBITDA | ~25× (implied) | Minority stake in Korea’s #2 player; shows local scarcity premium. kimchang.comkedglobal.com+1 |

Takeaway: DIG Airgas prices at a premium to classic Western gas deals but broadly in line with recent Korea prints (higher multiples for scarce, infra-like gas assets serving semis/batteries).

Quick valuation math (what the €2.85bn buys)

- Headline multiple: EV / EBITDA(€) with EBITDA converted at $1 = €0.8633 ⇒ €147–155m → 18.3–19.4×.

- “Adjusted” lens: EV / €193m (backlog+synergies per mgmt) → 14.8×.

- Sensitivity (illustrative, € EBITDA): 150 → 19.0×; 170 → 16.8×; 190 → 15.0×; 200 → 14.3×. Reuters+1airliquide.com

Financial model (back-of-the-envelope)

Funding cost anchor: Air Liquide’s average cost of net debt ~3.3% (H1’25); recent 10-yr green bond 3.57%. I assume 3.3–3.5%. MarketScreenerairliquide.com

AIRP baseline: 2024 revenue €27.06bn, net profit €3.306bn; net debt €9.79bn at 30-Jun-2025; group EBITDA margin guided ~27–29% (S&P view). Reutersairliquide.com+2airliquide.com+2

EPS impact (FY basis, simplified)

Assumptions: target EBITDA base €151m midpoint; D&A 25% of EBITDA; tax 25%; new debt €2.85bn.

- At 3.3% funding cost: ~0.44% to 1.14% EPS accretive in Year 1 (base vs. “adjusted” EBITDA case).

- Rate sensitivity: Every +50 bps on funding cuts accretion by ~0.3 pp.

- Delay carry (per quarter, after tax): €17.6–€24.0m (3.3–4.5% range).

(Management’s “net profit up within a year” statement is consistent with low single-digit EPS accretion under these assumptions.) Reuters

Leverage (net debt / EBITDA)

Using net debt €9.79bn (Jun-25) and 2024 EBITDA implied from 27–29% margin on €27.06bn revenue:

- Pre-deal: ~1.25–1.34×

- Post-deal (+€2.85bn debt): ~1.61–1.73×

→ +0.3–0.4× step-up, still comfortably investment-grade by agency frameworks. airliquide.com+1Reuters

Regulatory-delay scenarios (KFTC)

KFTC timing norms: Initial 30 days (or 15 for simplified), extendable +90 days, with “stop-the-clock” possible; complex cases can run longer. LexologyLex Mundiglobalcompetitionreview.com

- Base case – clearance H1’26 (no remedies).

- Accretion shows in FY’27 run-rate, partial in H2’26.

- Financing cost until close: minimal if bridge drawn just before completion; interest carry limited. Reuters

- Moderate delay / behavioral remedies (add 6–9 months).

- Cash cost: ~€18–24m per quarter after tax in interest carry if debt drawn earlier (or opportunity cost if hedged).

- Start-up of contracts backlogs slips; “adjusted” multiple benefit deferred by ~2–3 quarters.

- Structural remedies (e.g., local divest).

- If remedy trims target EBITDA by 5–10%, headline multiple drifts to ~19.9–21.0× on base EBITDA (and accretion compresses).

- Could still clear given Korea’s concentrated gas market and precedent transactions, but worth modeling a 10–15% EBITDA haircut case. kedglobal.com

What to watch (investor checklist)

- Reg path: Pre-filing consultations with KFTC; scope of any information RFIs; whether semis pipeline contracts raise competition questions. globalcompetitionreview.com

- Financing terms: Bridge covenants, timing to swap into bonds, and any change to average cost of net debt vs. 3.3% guide. MarketScreener

- Synergy & backlog conversion: The 14.8× “adjusted” claim hinges on timely project start-ups and cost capture. Track slippage. airliquide.com

- Macro exposure: Korea semis/battery capex cycles; if wafer/fab timing slips, merchant/onsite volumes could lag mgmt’s plan. Reuters

Comparing AI OPTIMIZED FREE CASHFLOW Strategy on ROICE and Market Value

Here’s a structured comparison of a traditional free cash flow (FCF) strategy vs. an AI-optimized free cash flow strategy, using RapidKnowHows own lens of ROICE (Return on Innovation, Convenience & Efficiency) and Market Value.

1. Traditional FCF Strategy

Focus:

- Maximize FCF via cost control, capex discipline, and working capital efficiency.

- Decisions made on historical data, human judgment, and slow reporting cycles.

ROICE Impact:

- Innovation: Limited — capital allocated mainly to proven projects.

- Convenience: Low — decision-making reactive, reports lag reality.

- Efficiency: Moderate — lean programs exist but static.

Market Value Outcome:

- Stable dividends and predictable payout → moderate valuation premium.

- Valuation multiples constrained by slower growth and “legacy” perception.

2. AI-Optimized FCF Strategy

Focus:

- Apply AI to optimize cash inflows/outflows daily (dynamic pricing, predictive collections, smart payables, capex simulation).

- AI integrates operational + financial data in real time.

ROICE Impact:

- Innovation: High — AI reallocates FCF into new growth bets faster.

- Convenience: Very high — real-time dashboards give management and investors clear visibility.

- Efficiency: High — predictive models shorten cash cycles, reduce idle capital.

Market Value Outcome:

- Market perceives higher growth optionality + superior resilience.

- Re-rating of multiples (P/FCF, EV/EBITDA) as investors value agility.

- Potential 20–40% ROICE uplift → valuation premium vs. peers.

3. Strategic Comparison Matrix

| Dimension | Traditional FCF Mgmt | AI-Optimized FCF |

|---|---|---|

| Decision Speed | Monthly/quarterly | Real-time |

| Cash Conversion | 60–90 days cycle | 30–45 days cycle |

| ROICE | +5–10% | +20–40% |

| Market Perception | “Steady cash generator” | “AI-driven cashflow engine” |

| Valuation Effect | Market value tied to payout ratio | Market value boosted by growth + efficiency premium |

4. Investor Takeaways

- ROICE as differentiator: Traditional FCF is defensive, while AI-optimized FCF is offensive — building strategic valuation premiums.

- Valuation triggers: Investors will reward firms that prove AI systems increase predictability + redeployment speed of FCF.

- Risk factor: Over-automation without governance can expose firms to liquidity shocks.

👉 In practice, AI-optimized FCF strategy doesn’t just improve free cash flow margins — it turns FCF into a dynamic, innovation-funding engine. That’s why its effect on ROICE is exponential and on market value is re-rating rather than incremental.

Acquisition Highlights (Baseline)

- Deal size: €2.85 billion (≈ US $3.3 billion), expected to close in H1 2026, pending South Korean regulatory approval. Semiconductor Engineering+12Reuters+12Reuters+12

- Strategic rationale: Strengthens Air Liquide’s presence in South Korea—the 4th-largest industrial gas market globally—and gains footholds in semiconductors, secondary batteries, and green hydrogen sectors. Reuters+2MarketScreener+2

- Assets: DIG Airgas generated €510 million revenue in 2024, operates ~60 facilities and 220 km of pipelines, and employs ~550 staff. Reuters+14Reuters+14MarketScreener+14

AI-ROICE Evaluation

1. Innovation (I)

Traditional Strategic Expansion: Acquiring DIG brings established contracts with semiconductor majors (Samsung, SK Hynix) and positions Air Liquide to support sub-3 nm chip manufacturing next-gen purity demands. AInvest

AI-ROICE Lens:

- Incremental vs. Transformational: The acquisition solidifies infrastructure—but innovation remains incremental. To elevate ROICE, Air Liquide must layer AI-driven applications: predictive supply analytics, purity monitoring, and demand forecasting.

- Opportunity: Embedding AI to optimize gas purity control and supply chain responsiveness would shift the innovation dial higher.

2. Convenience (C)

Baseline: DIG’s local infrastructure—pipelines and multiple plants—ensures proximity to high-growth semiconductor and hydrogen clients. Reuters

AI-ROICE Lens:

- Digital convenience gains if Air Liquide integrates AI for real-time asset visibility and customer self-service (e.g., predictive deliveries, just-in-time demand matching).

- Potential: Platformizing customer interaction and operations with AI dashboards would markedly improve convenience and stakeholder experience.

3. Efficiency (E)

Existing Efficiency: DIG boasts a lean operational profile and steady EBITDA; the deal trades at 18–20× core EBITDA—justified via long-term contracts and high-margin infrastructure. ReutersAInvest+1

AI-ROICE Lens:

- Efficiency uplift: Embedding AI can improve working capital cycles, capacity utilization, maintenance scheduling, and operational mix.

- Synergy capture: Reaching the “adjusted” EBITDA multiple (e.g., 14.8×) depends on timely synergy realization—from backlog, cost synergies, and now AI-driven operational gains.

4. Market Value Impact

Core Value: The acquisition is expected to be net profit accretive within 1 year of integration, suggesting positive EPS trajectory. Reuters Analysts see it as a modest strategic positive, although multiples are high. MarketScreener

AI-ROICE Lens:

- Re-rating Catalysts: By framing it as a digital-native expansion—where AI optimizes cash flows, precision service, and project delivery—Air Liquide could unlock premium valuations beyond infrastructure multiples.

- Premium Justification: Investors may reward a reimagined asset: not just pipelines, but AI-enhanced revenue engines—supporting durability (semiconductor demand, hydrogen programs) and growth optionality.

Summary: Traditional vs. AI-ROICE Growth Outcomes

| Dimension | Traditional View (Infrastructure) | AI-ROICE Growth Lens |

|---|---|---|

| Innovation | Enhanced market reach; infrastructure footprint | AI-powered service delivery; predictive purity & demand |

| Convenience | Local assets reduce latency | Real-time access; client portals; digital customer interface |

| Efficiency | Lean operations, synergy targets | Optimization via AI: uptime, working capital, maintenance |

| Market Value | Contribution to net profit; strategic presence | Re-rating on growth optionality plus digital premium |

Final Take

Air Liquide’s acquisition of DIG Airgas is solid infrastructure expansion—but viewed through the AI-ROICE lens, it becomes a platform for digital transformation.

- To shift from static to dynamic value creation, Air Liquide could layer AI across operations: predictive demand, real-time analytics, customer self-service, and maintenance optimization.

- This pivot upgrades ROICE beyond capital expenditure synergy into an engine of innovation, convenience, and efficiency, positioning the company for a valuation uplift aligned with high-tech service leaders—not just industrial gas peers.

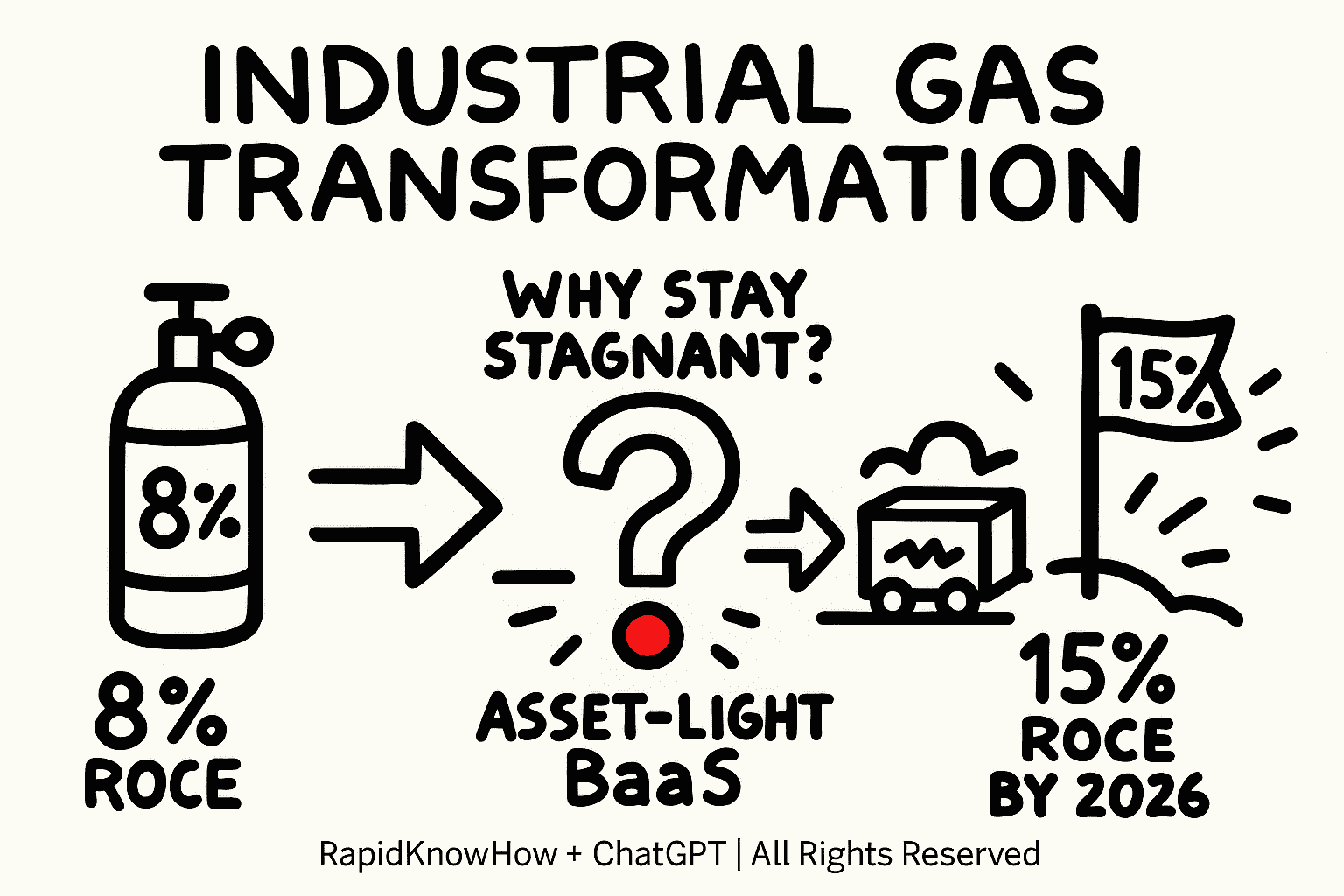

📊 Scenario Comparison: Air Liquide DIG Airgas Acquisition

Scenario 1 – Air Liquide “As Usual”

- Profile: Integration of DIG as a traditional industrial gas acquisition.

- Drivers: Infrastructure, long-term contracts, cost synergies only.

- ROCE Impact:

- 3 Years: +1–1.5 pp (ROCE uplift to ~9–10% vs. baseline 8%).

- 10 Years: +2 pp (~10–11%), plateau as infrastructure matures.

- Risk: Slow innovation adoption; multiple may compress after initial excitement.

Scenario 2 – Air Liquide AI-Optimized

- Profile: AI deployed to optimize free cash flow, predictive maintenance, dynamic pricing, and customer portals across DIG + global base.

- Drivers: AI-ROICE: Innovation (faster reallocation), Convenience (real-time UX), Efficiency (cash & capacity cycle optimization).

- ROCE Impact:

- 3 Years: +3–4 pp (ROCE ~12% by 2028).

- 10 Years: +6–8 pp (ROCE ~14–16% by 2035).

- Risk: Execution on AI scaling; requires cultural + digital transformation.

- Investor Signal: ROCE uplift + valuation multiple expansion → re-rating vs. peers.

Scenario 3 – Acquisition Synergy + AI

- Profile: Combines DIG Airgas asset base with AI optimization across Asia footprint.

- Drivers:

- Backlog of 20 secured projects.

- Synergy realization (lower multiple ~14.8×).

- AI acceleration layered on new infrastructure.

- ROCE Impact:

- 3 Years: +4–5 pp (ROCE ~13%).

- 10 Years: +8–10 pp (ROCE ~16–18%).

- Risk: Integration speed; regulatory environment in Korea; over-optimistic synergy timing.

- Investor Signal: “Best case” → durable growth optionality, higher ROCE than industrial peers, premium market value.

📈 Comparative View

| Time Horizon | Scenario 1: As Usual | Scenario 2: AI-Optimized | Scenario 3: Acquisition + AI |

|---|---|---|---|

| 3 Years (2028) | 9–10% ROCE | 12% ROCE | 13% ROCE |

| 10 Years (2035) | 10–11% ROCE | 14–16% ROCE | 16–18% ROCE |

🎯 Final Insight

- Without AI, Air Liquide remains a strong infrastructure player but with moderate ROCE uplift.

- With AI, free cash flow optimization transforms the acquisition into a growth engine, with double the ROCE gain in 10 years.

- Acquisition + AI is the winning formula: infrastructure expansion plus AI-ROICE digital transformation, unlocking sustainable 16–18% ROCE over the long term.