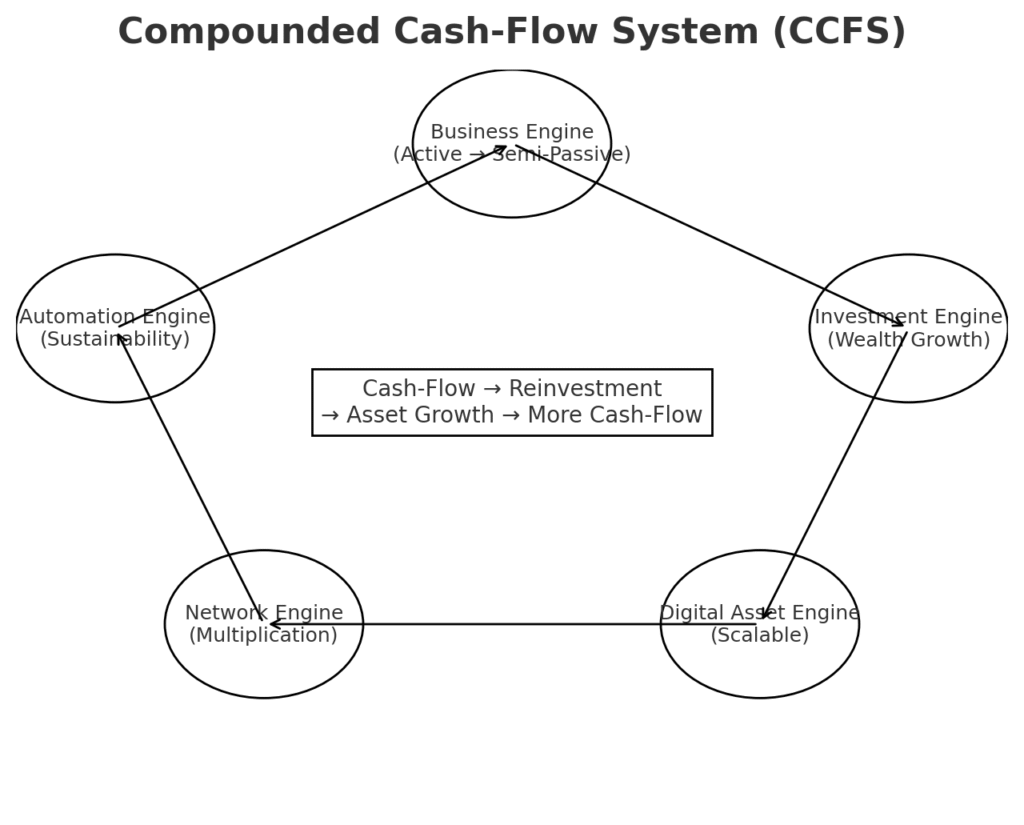

Let’s define the Compounded Cash-Flow System (CCFS) as your strategic wealth engine – simple enough to act on, powerful enough to scale.

⚡ Compounded Cash-Flow System (CCFS)

🎯 Objective

Create sustainable, growing streams of cash-flow by combining multiple engines (business, assets, partnerships, automation) into a reinforcing loop that compounds wealth year after year.

🔑 5 Core Cash-Flow Engines

- Business Engine (Active → Semi-Passive)

- RapidThrive Licenses

- Consulting-as-a-Service

- Subscription / Membership revenue

- Investment Engine (Wealth Growth)

- Dividend-paying stocks

- Bonds / ETFs

- Real estate rental income

- Digital Asset Engine (Scalable)

- PowerBooks & Online Courses

- AI Simulation Games

- WooCommerce Product Packs

- Network Engine (Multiplication)

- Licensing Partners (Regional / Sector)

- Affiliate Ecosystems

- Co-Branding with Strategic Allies

- Automation Engine (Sustainability)

- AI-driven customer acquisition

- CRM + Marketing Funnels

- Smart ROI dashboards

🔄 The Compounding Loop

Cash-Flow → Reinvestment → Asset Growth → More Cash-Flow

- Generate Cash-Flow from Engines

- Reinvest X% into Growth Assets

- Build Compounding Wealth Base

- Scale → repeat cycle quarterly

📊 Example: 5-Year Projection

- Start: €10,000 yearly cash-flow

- Reinvest: 60% into growth assets

- Compounding Rate (CR): 1.25 per year

- After 5 years → ~€30,500 yearly cash-flow (3x growth)

🧭 Strategic Compass

- Today: Identify your 2 strongest engines

- This Quarter: Launch one new semi-passive digital product

- This Year: Build the automation + licensing network

- Legacy: Cash-flow sustains wealth while you sleep

Next, let’s assess the 5 Core Cash-Flow Engines on two dimensions:

- Ease to Thrive (Low → High)

How easy is it to set up, manage, and sustain with minimal friction? - Cash-Flow Generated (Low → High)

The potential scale and speed of generating sustainable inflows.

⚡ Assessment Matrix – 5 Core Cash-Flow Engines

| Engine | Ease to Thrive | Cash-Flow Generated | Assessment |

|---|---|---|---|

| Business Engine (Active → Semi-Passive) | ⚫⚫⚫⚫⚪ (High – requires initial effort, then semi-passive) | ⚫⚫⚫⚫⚫ (Very High – recurring clients, service packs, licenses) | Strongest driver, especially with RapidThrive licenses |

| Investment Engine (Wealth Growth) | ⚫⚫⚫⚪⚪ (Medium – depends on capital, risk tolerance) | ⚫⚫⚫⚪⚪ (Medium – steady, but needs scale to matter) | Solid stability layer, not quick cash |

| Digital Asset Engine (Scalable) | ⚫⚫⚫⚫⚫ (Very High – once created, easy to scale globally) | ⚫⚫⚫⚪⚪ (Medium – needs audience growth to monetize fully) | Fastest to launch, strong compounding long-term |

| Network Engine (Multiplication) | ⚫⚫⚪⚪⚪ (Low – requires trust, time, partners) | ⚫⚫⚫⚫⚪ (High – exponential scaling if partnerships succeed) | Multiplication effect, slower to establish |

| Automation Engine (Sustainability) | ⚫⚫⚫⚪⚪ (Medium – initial tech setup effort) | ⚫⚫⚫⚪⚪ (Medium – ensures sustainability, lowers costs) | Long-term efficiency backbone, not immediate cash |

🧭 Strategic Insight

- Quick Wins → Digital Assets + Business Engine (fast to start, recurring potential)

- Stability Layer → Investment Engine (predictable, but slower growth)

- Scaling Multiplier → Network Engine (once trust is built, exponential growth)

- Sustainability Anchor → Automation Engine (protects margins, frees time)