Problem:

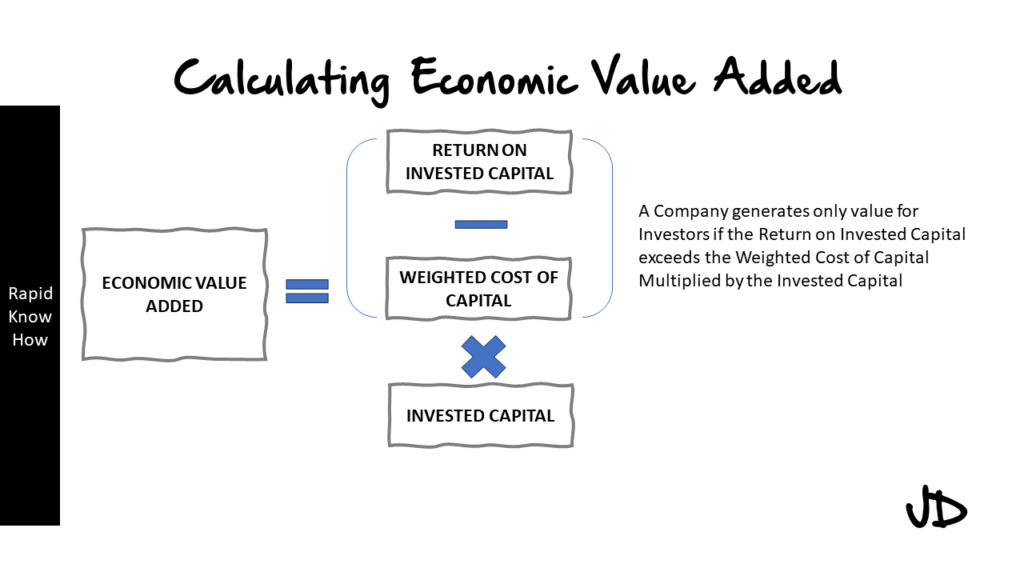

In the world of business and finance, understanding the Economic Value Added (EVA) is crucial. It’s a measure that reflects the real economic profit of a company, and it’s often used by investors to assess the true value of a business. However, cracking the EVA code can be a daunting task for many. The complexity of the concept, coupled with the intricate calculations involved, can make it seem like an insurmountable challenge. This is particularly true when trying to understand how a company generates value for its investors. It’s widely accepted that a company only generates value if its Return on Invested Capital (ROIC) exceeds its underlying Invested Capital Costs (ICC). But how does this work in practice? And how can you apply this knowledge to make informed investment decisions?

Impact

The lack of understanding about EVA and its components can lead to poor investment decisions. Without a clear grasp of these concepts, you may end up investing in companies that appear profitable on the surface but are actually destroying shareholder value. This could result in significant financial losses and missed opportunities for growth. Moreover, without understanding how ROIC and ICC interact to create value, you may struggle to identify companies that are truly generating wealth for their investors.

Solution:

To help you navigate this complex landscape, we’ve developed an in-depth guide on cracking the EVA code. Our guide breaks down these concepts into manageable chunks, making them easier to understand and apply. We delve into the relationship between ROIC and ICC, explaining how they work together to generate value for investors. We also provide practical examples from the manufacturing industry to illustrate these concepts in action.

Case Studies:

Our guide includes several case studies from the manufacturing industry. These real-world examples demonstrate how different companies have successfully generated value for their investors by ensuring their ROIC exceeds their ICC. By studying these cases, you’ll gain valuable insights into how successful companies operate and what strategies they use to maximize their EVA.

Call-to-Action:

Don’t let the complexity of EVA deter you from making informed investment decisions. With our comprehensive guide, you’ll have all the tools you need to crack the EVA code and identify companies that are truly generating value for their investors. So why wait? Start your journey towards becoming a more informed investor today by contacting us.

Remember: Knowledge is power – especially when it comes to investing. Equip yourself with the right information and start making smarter investment decisions today!

Calculate Your Economic Value Added

Powered by Calculator Tools