Return on Invested Capital Employed (ROIC) is a financial metric that measures the profitability and efficiency of a company in terms of how it uses its capital. It’s a crucial indicator for investors and analysts to understand the company’s ability to generate returns from its invested capital. High ROICE indicates that a company is effectively using its capital to generate profits.

There are several key levers that drive high ROIC:

1. **Efficient Capital Allocation**: Companies that allocate their capital efficiently tend to have higher ROIC. This involves investing in projects or assets that yield high returns and divesting from those that are not profitable.

2. **Profit Margin**: A high profit margin indicates that a company is able to convert sales into profits efficiently, which contributes to a high ROIC.

3. **Asset Turnover Ratio**: This measures how effectively a company uses its assets to generate sales. A high asset turnover ratio indicates efficient use of assets, contributing to a high ROIC.

4. **Capital Structure**: Companies with an optimal mix of debt and equity tend to have higher ROIC as they can leverage borrowed funds to generate higher returns.

5. **Operational Efficiency**: Companies that operate efficiently tend to have lower costs, which can lead to higher profit margins and thus, higher ROIC.

Now, let’s look at some case studies:

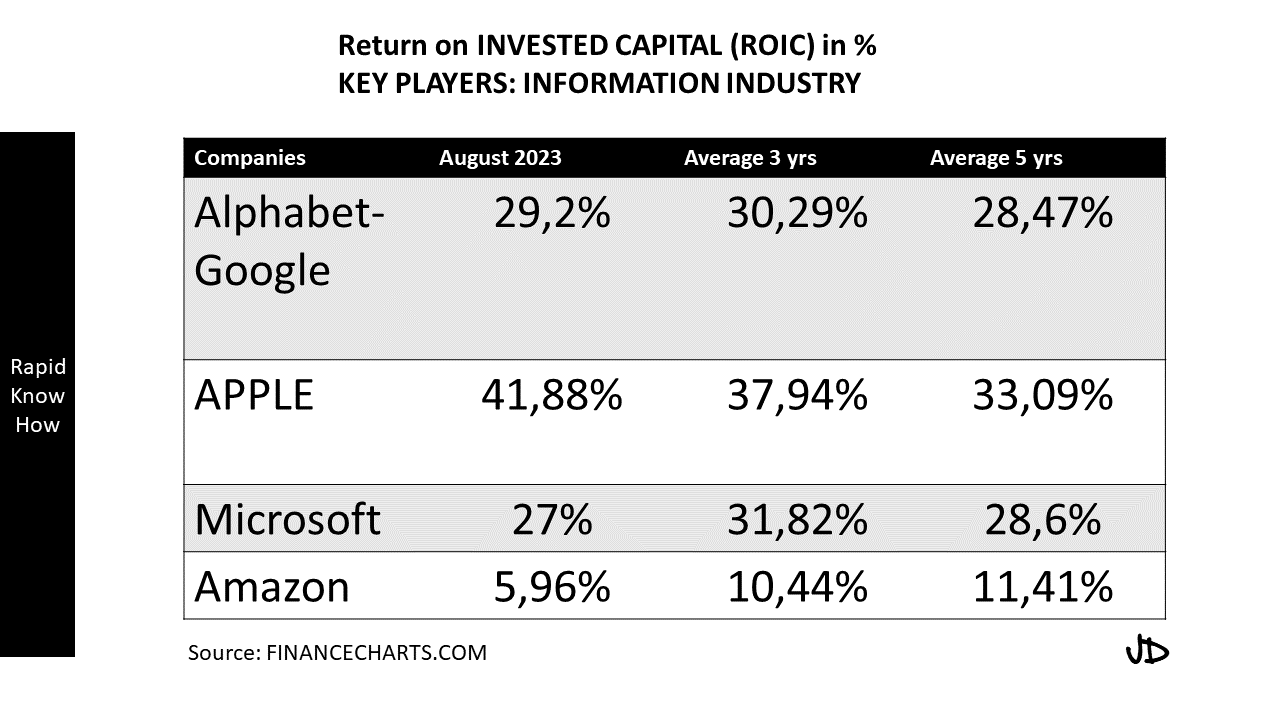

**Alphabet (Google)**: Alphabet has consistently maintained a high ROIC due to its efficient capital allocation and high profit margins. The company’s core business, Google Search, requires minimal capital investment but generates substantial profits, contributing to its high ROICE.

**Apple**: Apple’s high ROIC can be attributed to its exceptional profit margins and efficient use of assets. The company’s innovative products command premium prices, leading to high profit margins. Additionally, Apple’s efficient supply chain management allows it to turn over its inventory quickly, contributing to its high asset turnover ratio.

**Amazon**: Amazon’s ROIC has improved over the years due to its efficient capital allocation and operational efficiency. The company has invested heavily in technology and logistics infrastructure, which has enabled it to reduce costs and improve operational efficiency. This has led to an increase in its profit margin and consequently, its ROIC.

**Microsoft**: Microsoft’s high ROIC can be attributed to its efficient capital allocation and high profit margins. The company’s shift towards cloud-based services has required less capital investment but generated higher returns, contributing to its high ROIC.

In conclusion, companies can drive their ROIC by focusing on efficient capital allocation, improving their profit margins, increasing their asset turnover ratio, optimizing their capital structure, and enhancing operational efficiency. These strategies have been successfully employed by companies like Alphabet, Apple, Amazon, and Microsoft.

How their Business Models work?

Generating sustained growing Return on Invested Capital (ROIC) in the Information Age is a complex task that requires a deep understanding of the digital landscape, strategic planning, and innovative thinking. The Information Age, characterized by the rapid shift from traditional industry to an economy based on information technology, has transformed the way businesses operate and generate profits.

To understand how to generate sustained growing ROIC in this era, it’s beneficial to examine the business models of some of the most successful companies in the Information Age: Alphabet (Google), Apple, Microsoft, and Amazon.

1. Alphabet (Google): Google’s business model is primarily based on advertising revenues generated through its search engine. The company has been able to sustain growing ROIC by continuously innovating and diversifying its product portfolio. Google’s strategy involves creating a vast ecosystem of products and services that not only generate direct revenue but also feed into its advertising business by increasing user engagement and data collection. This data is then used to improve ad targeting, thereby increasing ad revenues.

2. Apple: Apple’s business model is centered around creating high-quality, premium products and services that command high profit margins. The company has been able to sustain growing ROIC through continuous innovation, strong brand loyalty, and a tightly integrated ecosystem of products and services. This ecosystem creates a ‘lock-in’ effect where customers who own one Apple product are more likely to purchase other Apple products or services.

3. Microsoft: Microsoft’s business model has evolved over time from selling software licenses to a more service-oriented model with recurring revenues. The company’s shift towards cloud computing with services like Azure and Office 365 has been a key driver of its sustained growing ROIC. These services provide steady revenue streams and have high scalability, allowing Microsoft to serve an increasing number of customers at minimal incremental cost.

4. Amazon: Amazon’s business model is based on scale and efficiency. The company operates on thin margins but makes up for it with high volume sales. Amazon has been able to sustain growing ROIC through continuous expansion into new markets (like cloud computing with AWS), economies of scale, and operational efficiency improvements.

In conclusion, generating sustained growing ROIC in the Information Age involves leveraging technology to create scalable business models with recurring revenue streams, continuously innovating to stay ahead of competition, diversifying product portfolios to mitigate risks, and using data effectively to improve operational efficiency and customer targeting.

However, it’s important to note that what works for these tech giants may not work for every company. Each organization needs to understand its unique strengths, market dynamics, customer needs, and technological capabilities before deciding on the best strategy for generating sustained growing ROIC in the Information Age.