In the dynamic world of industrial gases, Linde plc has emerged as a global market leader, thanks to a series of strategic moves that have reshaped the company’s trajectory. This narrative will delve into the major strategic decisions that have propelled Linde plc to its current position, the reasons behind these moves, and the reactions from its major competitors – AGA, Air Liquide, Air Products, BOC, and Praxair. We will also explore the state of affairs in 2023.

Linde plc’s journey to global leadership began with a series of mergers and acquisitions (M&A). The first significant move was the merger with AGA in 2000. The merger aimed at strengthen Linde’s position in Scandinavia and South America. Next, the merger with BOC Group in 2006. This merger was a strategic decision aimed at expanding Linde’s global footprint and enhancing its product portfolio. The move was met with mixed reactions from competitors. While some viewed it as a threat to their market share, others saw it as an opportunity to capitalize on potential market disruptions.

The second major strategic move was the acquisition of Lincare Holdings Inc. in 2012. This acquisition was aimed at diversifying Linde’s business by venturing into the home healthcare sector. The move was seen as a bold step by competitors, signaling Linde’s intent to explore new growth avenues beyond industrial gases.

However, the most significant strategic move that cemented Linde’s position as a global leader was its merger with Praxair in 2018. This merger created an industrial gas giant with unparalleled reach and resources. The move was driven by the need for consolidation in an increasingly competitive market. Competitors reacted with concern as they anticipated increased competition from the newly formed entity.

In response to these moves, competitors like Air Liquide, and Air Products have also made strategic decisions to strengthen their positions. Air Liquide has pursued a strategy of innovation and digital transformation to differentiate itself from competitors. Meanwhile, Air Products has invested heavily in technology development and strategic partnerships to enhance its competitive edge.

Fast forward to 2023; Linde plc continues to dominate the global industrial gases market thanks to its extensive network and diverse product portfolio. The company has successfully integrated its operations post-merger with Praxair and is reaping the benefits of synergies.

Competitors have adapted to this new reality by focusing on niche markets and investing in innovation. Air Liquide is recognized for its innovative solutions in healthcare and electronics sectors. Air Products continues to leverage technology for competitive advantage.

In conclusion, Linde plc’s geobusiness strategic moves have been instrumental in its rise as a global leader in industrial gases. These moves were driven by a desire for expansion, diversification, and consolidation amidst increasing competition. While competitors initially reacted with concern, they have since adapted their strategies to compete effectively in this new landscape.

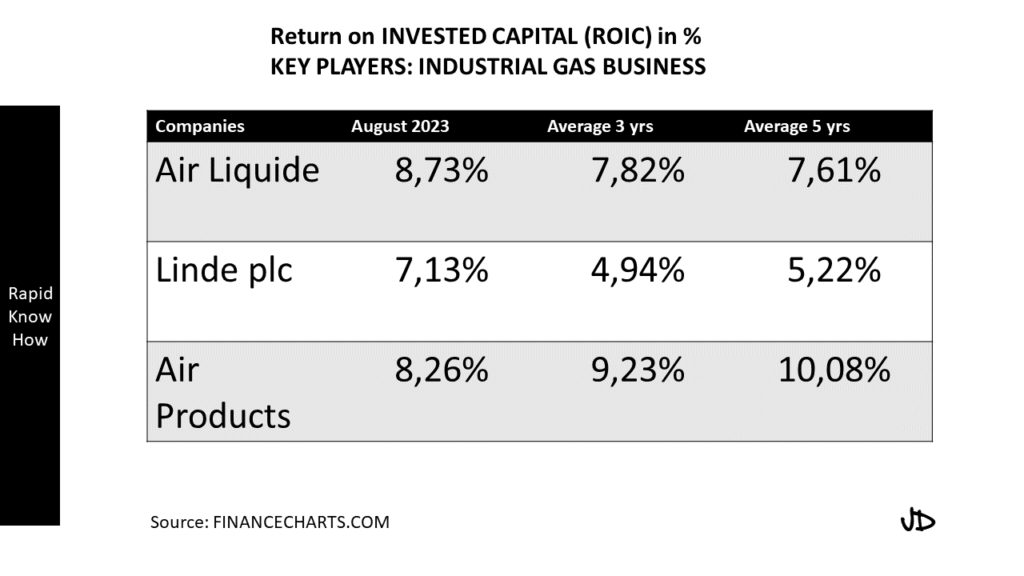

Linde’s plc ROICE is the lowest of all major Competitors

As we predicted: The Devil is in the “detail”.