Excellent Territorial Fit but Management Issues

The potential merger of Praxair and Linde would create the largest industrial gas company in the world subject only to divestments for anti-trust issues with 32% of global business The major area of concern in the merger is the general focus and management style of the two companies. Previous acquisitions by Linde of Aga and BOC have not gone smoothly because of these issues.

The merged Air Liquide/Airgas business would be about 23% of global business.

The next company of any size would be Air Products with about 12%.

In the space of less than a year, the oligopoly of 5 large players shrinks to 3. This has severe implications for users making inquiries for new gas volumes.

Anti-Trust Issues

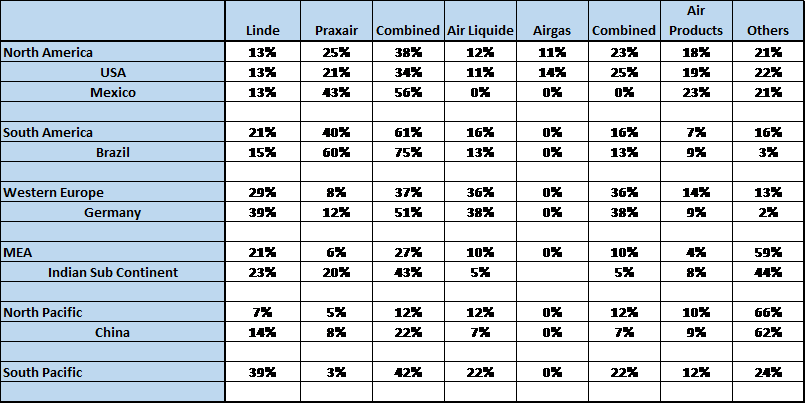

The global picture is less relevant than the regional or local issues see table below:

A quick examination of the above regions shows potential anti-trust issues in North and South America and South Pacific Rim.

However, when we look on a country basis the following countries could be problematic:

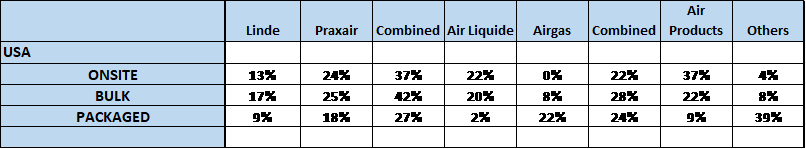

- USA – the combined 34% market share is very significant and would justify a regional and line of business analysis to avoid local or product monopolies.

- Mexico the combined 56% market share seems unacceptable but much of this is caused by large onsite plants for EOR and Praxair’s already dominant position in the cylinder gas market. Hard to resolve.

- Brazil – Praxair has a dominant position in all products with a 60% market share. Linde has a significant position in the Bulk liquid market 25%, a total of 85% which is unhealthy and should be at least partially divested

- China – businesses are highly regional and the Chinese government appears happy with the inward investment

- South Pacific – Although the combined Linde/Praxair total is 42% there appear to be no specific issues on a country basis and Praxair’s 3% is mainly in Thailand but is in a different product line to Linde’s and therefore unlikely to be a problem.

Strategic Focus and Operating Issues

The biggest area of concern in the merger is the general focus and management style of the two companies.

Previous acquisitions by Linde of Aga and BOC have not gone smoothly because of these issues.

- Praxair

- US management style – US centered but delegating

- Customer focused through Key Accounts with Key Account Managers

- Rigid and consistent financial analysis methods and no offer can be made that does not meet financial targets

- Management often bought in even at senior level

- Small engineering group for major equipment which rarely supplies anybody outside the Praxair Group

- May lack experience is some really large plants

- Linde

- German management style – Munich centered and controlling

- Technology focused in belief that customers will buy the best technology

- Inconsistent attitude to Key account managers

- Financial analysis methods unclear and appear inconsistent with US methods. Linde pricing is often viewed by customers as inconsistent.

- Management has mainly grown from internal sources and mainly engineers.

- Major engineering group producing up to 20% of revenues and “selling” plans internally to the gases group. Clear drag on corporate profits during economic downturns. Market leader in technology for Air Separation and own plants for hydrogen.

Whilst the benefits to Praxair of better technology are significant, the financial and management styles of the two organizations are very different and will make the merger difficult. It begs the question of whether the Linde Engineering group should be spun off as a separate company.

The devil is in the detail…

The overview of the proposed merger showed that on a headline basis the might be some issues in a number of countries based on total market share.

However, the authorities generally look deeper at the impact on the various product lines and, in the case of large companies, on a regional basis.

Whilst it is evidently true that some national governments pay lip service to the concept of monopoly practices, the USA treats the issue very seriously and anti-trust issues have, in the past scuppered acquisitions and merges.

The proposed acquisition of BOC by Air Liquide and Air products at the turn of the century was eventually abandoned because they could not dispose of significant assets in the USA, except as an unacceptable price to a competitor. This merger will face similar challenges.

On sites and Pipeline business

Because the contracts are often of 15 years duration and for significant revenues, a win can add a few percents to any company.

The real issue is that it is difficult for a potential customer to get enough bids, even from the existing 4 major bidders, even on a greenfield site.

Bids are also influenced by the ability of the supplier to add value from co-products such as liquid and argon, which share the production cost.

If there is an incumbent supplier the problem is even greater. The merger threatens the potential customer by reducing the number of potential bidders to three and other market factors, such as bulk dominance might reduce the number of bidders to one or two.

Bulk Gases – LOX, LIN, LAR and bulk Hydrogen

It is immediately obvious theta the 42% market share of the bulk business raises cause for concern at a national level.

Decisions on forced disposal will depend on a regional analysis. However, much of the packaged gas business is supplied by many small companies, which generally operate on a state or county level. These companies by the bulk liquid used to supply their filling systems mainly from the majors.

In some cases, they even buy wholesale cylinders from the majors for local distribution.

It is clear that with a market of only three major players there will be a temptation to increase the price of bulk liquid to “others” thus creating an anticompetitive rise in packaged gas prices.

This was one of the reasons that Airgas acquired or built is own liquid production facilities.

Packaged Gases

The market shares in packaged gases are below a monopoly level on a national basis and on a local basis there are many small companies.

The real threat is that by using local bulk leverage there could be acquisitions that create regional monopoly positions.

The regulator needs to look at both the effect on local packaged gas markets of the merger and the knock-on from the bulk business.

Authors: Dr.Keith Guy / Josef David – 2016