You want to learn from the industrial gas leaders how to build a sustainable industrial gas business.

That’s why I’ve written this blog to help you achieve your goal.

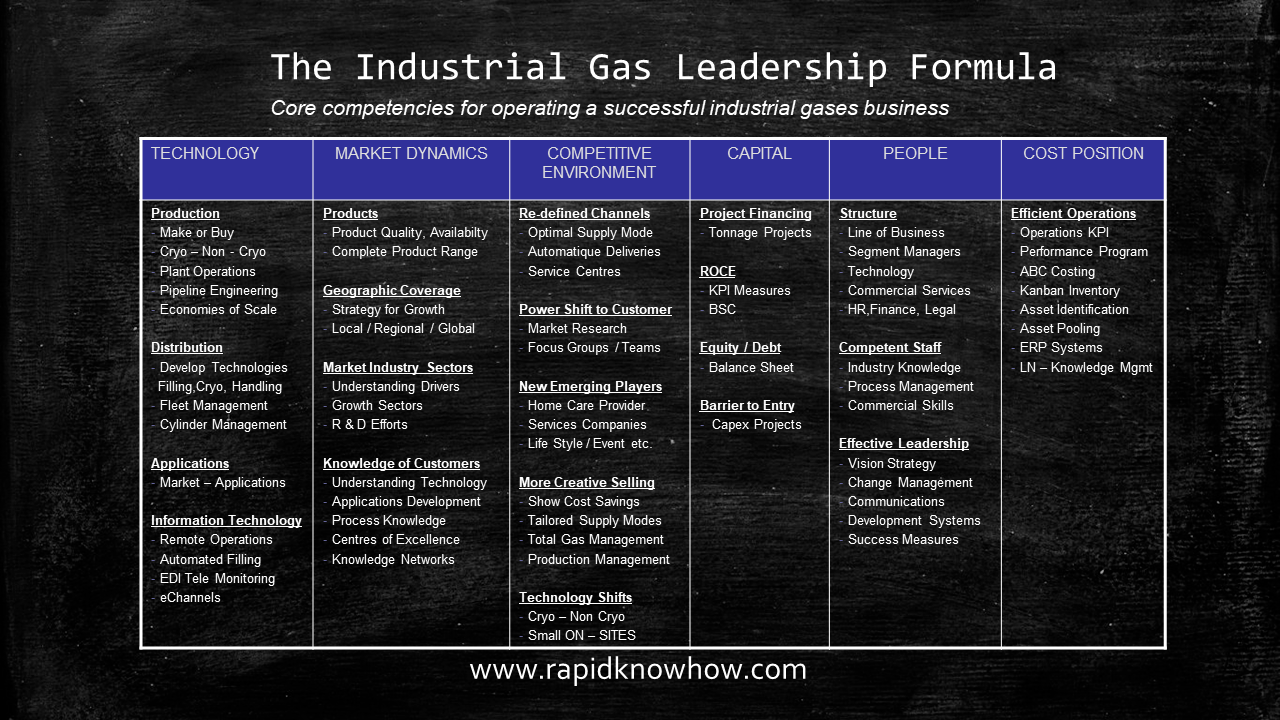

1. The Industrial Gas Leadership Success Formula

First, I’ve summarized the core compentencies you need for operating a successful industrial gas business.

[emaillocker id=”9547″]

You may discuss the leadership formula with your colleagues and make notes where you are now and where you want to be end of 2018.

2. Industrial Gas Competitive Success Formula

The competition will be on the most effective and efficient Business Channels and Networks

Companies succeed being best in:

Strategic Marketing

- Market Research : Understanding Customer Needs

- Market Segmentation: Segmenting Key Markets / Customers

- Portfolio Management: Developing targeted Strategies for Growth

- Innovative Channels and Partners/ Alliances Development and Management

- Operational Excellence

Covering Integrated Operations Planning, Operations Technology, Asset Management , Customer Services and Performance Benchmarking vs Best Practice.

Best Commercial Services Practices

To meet the challenges , the best commercial practices must be adopted:

- Cylinder Management, Rental Systems

- Integrated Supply Chain Management

- Make or Buy Evaluation of Captive vs On-Site Production

- Outsourcing of customers non value activities etc.

3. Industrial Gas Market Drivers

You’ll get insight into the key industrial gas market drivers that help you to get ahead of your compeition in 2018+

- Real or “Underlying” Growth for industrial gases will run at between 6% and 7% per annum

Excluding currency impact, pass-through variation and inflation - An additional 1-2% per annum achievable through:

Utility services, gas management, leisure industry, homecare services, hydrogen economy - Continued consolidation but on a regional basis

- Increased conversion of captive plants to on-site supply schemes

- Expanding the offering

- High oil price boosts demand for industrial gases and will also drive new GTL and GTP projects.

It will significantly increase demand for gas and equipment and possibly O &M (Observations and Management) services

Major Business Drivers

- Continuous Strong Gas Demand

Chemical, Petroleum, Electronics continue to represent the bulk of gas demand - Nitrogen, Oxygen are the largest volume gases

However Hydrogen, Special Rare Gases will be the highest growth gases - Gas Supply Situation

No problem after extensive Investments except fairly tight Helium supplies - Industrial Gas Companies providing added value to their most valuable customers

You’ll define the most attractive Market Segments and Key Customers providing tailored Gas Supply Channels through e-business solutions

Tailored Gas Supply Modes considering environmental costs and impacts On-Site Supply vs Bulk vs Mini Bulk vs Bundles / Pallets - Growing On-Site Generation

Legislation , Increasing Energy and Fuel Costs driving the Trend towards On-Site generation of Industrial Gases. Customers benefit is that they do not have to contend with logistics, distribution and inventory costs - Growing Need on Commercial Gas Services

Offering a point-of-use supply mode ensuring consistent gas purity

Offering Product Tracking Services, Order History Services, Process Cost Allocation to Customers receiving Cost Centres etc. - Supply Chain Integration with Key Account Customers, Key Suppliers, Specialised Dealers etc.

- Partnerships, Alliances, Joint Ventures and M& A

After extensive M& A activities , Business Alliances provide a strategic opportunity to create, implement , develop new business models leveraging strategic partners skills.

Major Competitive Offerings

- Integrated Supply Chain Management

All main Industrial Gas Companies are taking bold steps towards this trend.

To build integrated distribution networks adding new products / commercial services and new e-commerce channels to their traditional branch-based offerings.

This offer through multiple integrated channels , allows customers to reduce their suppliers ( Primary, Alternative) while Industrial Gas Companies benefit from building Strategic Barriers and Strategic Partnership Networks. - Cylinder Management and Logistics Systems

Customers Outsourcing Facility Management to those Service Providers overseeing multiuser operations on the spot.

The Range of services include:

In-plant delivery to the point of use

Bundled Pricing ensuring all users are billed for their share of charges for gases and cylinder rent - From Gas Applications Adviser to Manufacturing Value Added Partner

Best Practice Industrial Gas Supplier providing tailored commercial and technical consultancy to Key Account Customers on:

Increasing the Productivity of Key Customers Operations

Decreasing Rework and Emissions of Manufacturing Processes

Increasing Energy efficiency and safety at work

For Strategic Customers Industrial Gas Companies are striving for taking over full responsiblity of the Manufacturing and In-House Industrial Gas Logistics Processes of Strategic Customers - Compliance Management

Industrial Gas Services Companies providing turnkey training and assessment packages covering regulatory and compliance issues ( eco efficiency,product-cycle analysis) aiming at making SUSTAINABILITY ( economical-, ecological-, and social) awareness a permament part of customers cultures thereby creating long term close partnerships

[/emaillocker]