Problem:

In the industrial gases sector, one of the most pressing issues that businesses face is the lack of sufficient free cash flow. This problem is often due to high operational costs, inefficient management of resources, and a lack of strategic financial planning. The inability to generate enough free cash flow can severely limit a company’s ability to invest in new technologies, expand operations, or even meet its day-to-day financial obligations.

Impact:

The impact of insufficient free cash flow on an industrial gases company can be quite severe. It can lead to a myriad of financial difficulties such as inability to pay suppliers, delayed salaries for employees, and even bankruptcy in extreme cases. Furthermore, it can hinder the company’s growth prospects as it limits the ability to invest in research and development or expansion into new markets. This could result in a loss of competitive advantage and market share. Additionally, it could also negatively affect the company’s credit rating, making it more difficult and expensive to borrow money in the future.

Solution:

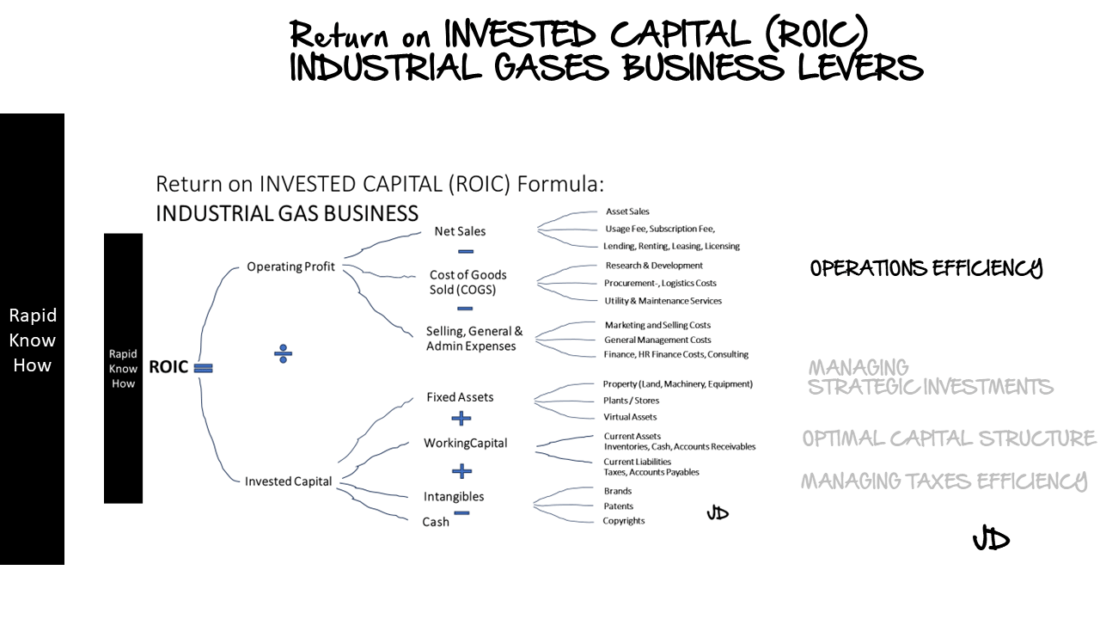

To increase free cash flow within an industrial gases company, several strategies can be implemented. Firstly, improving operational efficiency is key. This could involve streamlining processes to reduce waste and lower costs or investing in more efficient machinery and equipment. Secondly, effective financial management is crucial. This includes careful budgeting, prudent spending, and strategic investment decisions. Thirdly, companies could consider diversifying their product range or expanding into new markets to increase revenue streams.

Another potential solution is to renegotiate terms with suppliers for longer payment periods or discounts for early payments. This would help manage outgoing cash flows more effectively. Lastly, companies could also explore options for debt restructuring or refinancing to reduce interest payments.

Action:

To implement these solutions effectively, it is recommended that industrial gases companies undertake a thorough review of their current operations and financial management practices. They should identify areas where efficiencies can be improved and costs reduced. They should also engage with financial advisors to develop a robust financial plan that aligns with their strategic objectives.

Furthermore, companies should consider investing in training and development for their staff to ensure they have the necessary skills and knowledge to implement these changes effectively. They should also communicate these changes clearly to all stakeholders to ensure buy-in and support.

Conclusion:

In conclusion, while the issue of insufficient free cash flow is a significant challenge for industrial gases companies, it is not insurmountable. By implementing strategies to improve operational efficiency, manage finances effectively, and diversify revenue streams, companies can increase their free cash flow. This will not only help them meet their financial obligations but also provide them with the resources they need to invest in growth opportunities and secure their long-term success. It is crucial that these strategies are implemented in a thoughtful and strategic manner, with the necessary support and buy-in from all stakeholders.