Understanding how to present business information, particularly cash flow, is a crucial skill for any business professional. It’s not just about having the data; it’s about presenting it in a way that is clear, concise, and actionable. This is especially true when it comes to cash flow, which is a critical indicator of a company’s financial health.

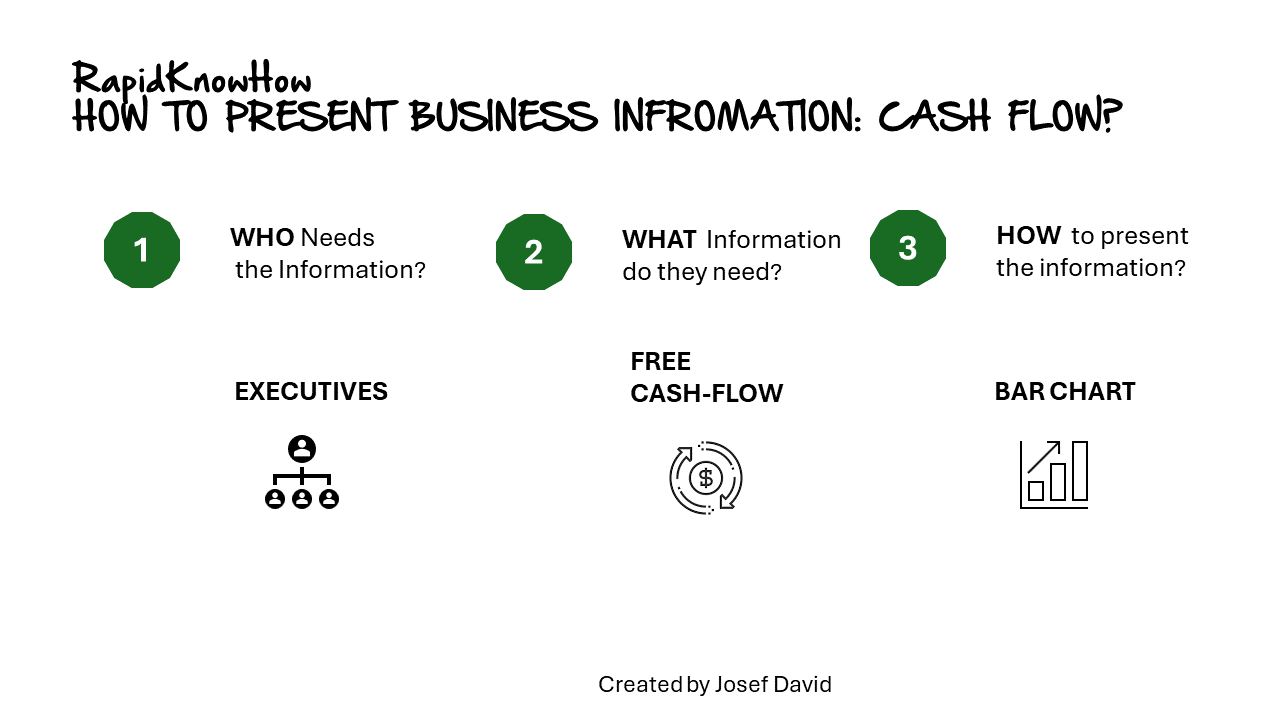

So, WHO needs this information?

The answer is quite broad. Business owners, managers, investors, lenders, and even employees can benefit from understanding a company’s cash flow. Each of these stakeholders has a vested interest in the financial health of the business and can use this information to make informed decisions.

WHAT does they need?

The information they need will vary depending on their role. A business owner or manager might need detailed cash flow data to make operational decisions, such as whether to invest in new equipment or hire more staff. An investor or lender, on the other hand, might be more interested in overall trends and projections to assess the company’s financial stability and growth potential.

HOW to fulfill their needs?

Presenting this information effectively requires a few key steps:

1. Understand Your Audience Tailor your presentation to the needs and knowledge level of your audience. A financial expert might appreciate detailed spreadsheets and complex analysis, while an executive might prefer simple graphs and straightforward explanations.

2. Be Clear and Concise: Avoid jargon and unnecessary complexity. Your goal should be to make the information as easy to understand as possible.

3. Use Visuals* Graphs, charts, and diagrams can often convey information more effectively than text alone. They can help your audience visualize trends and relationships between different data points.

4. Highlight Key Points: Don’t bury the lead. Make sure the most important information is easy to find and understand.

5. Provide Context: Help your audience understand what the numbers mean by providing context. For example, if cash flow has increased significantly over the past year, explain what factors contributed to this growth.

6. Be Honest and Transparent: Don’t try to hide or downplay negative information. Trust is crucial in business, and your audience will appreciate your honesty.

In conclusion, presenting business information, especially cash flow, is an art that requires a deep understanding of both the data and the audience.

By using the RAPID PROBLEM SOLVING FORMULA, you can deliver tangible results on-demand. This involves Recognizing the problem, Analyzing the situation, Pinpointing the root cause, Identifying potential solutions, and Deciding on and implementing the best solution.

Remember to maintain a neutral tone throughout your presentation and use clear, concise English language. With these strategies in mind, you can effectively present cash flow information that meets your audience’s needs and drives informed decision-making.