Understanding and presenting risk levels in business is a crucial aspect of strategic planning and decision-making. It involves identifying potential threats that could negatively impact an organisation’s ability to conduct its operations and achieve its objectives.

What are Risk Levels in Business?

Risk levels in business refer to the potential for loss due to some unforeseen event or action. These risks can be financial, operational, strategic, or related to compliance, among others. The level of risk is typically categorised as low, medium, or high based on the likelihood of occurrence and the potential impact on the business.

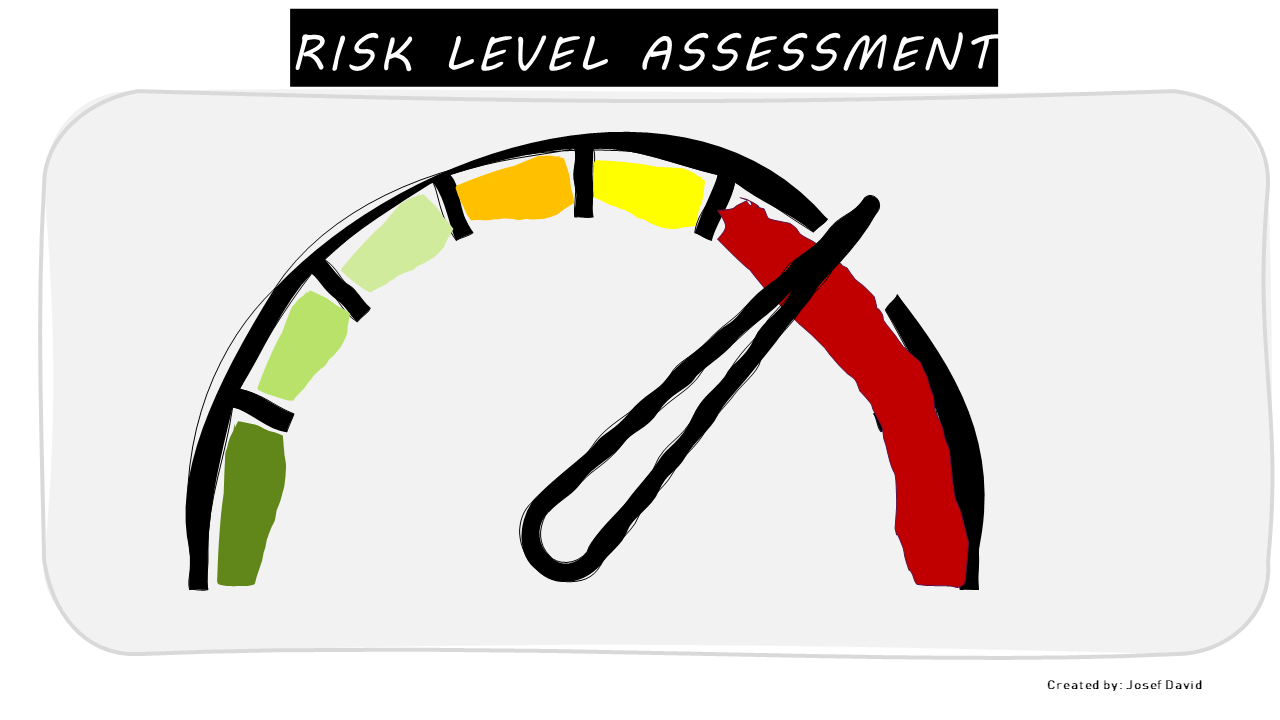

Low-risk scenarios are those with a low probability of occurrence and minimal impact on the business. Medium-risk scenarios have a moderate likelihood of occurrence and could potentially have a significant impact on the business. High-risk scenarios are those with a high probability of occurrence and could have severe consequences for the business.

Why Analyse Risk Levels in Business?

Analysing risk levels in business is essential for several reasons:

1. Informed Decision Making: Understanding the potential risks allows businesses to make informed decisions about their strategies and operations.

2. Risk Mitigation: By identifying potential risks, businesses can develop strategies to mitigate these risks before they occur.

3. Resource Allocation: Understanding the level of risk associated with different activities can help businesses allocate resources more effectively.

4. Compliance: In many industries, businesses are required by law or regulation to conduct risk assessments and maintain certain levels of risk management.

How to Analyse Risk Levels in Business?

Risk analysis involves several steps:

1. Identify Risks: The first step is to identify potential risks that could affect your business. This could involve conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), examining industry trends, or consulting with experts.

2. Assess Risks: Once you’ve identified potential risks, you need to assess their likelihood and potential impact. This could involve quantitative methods (like financial modelling) or qualitative methods (like expert judgement).

3. Prioritise Risks Based on your assessment, you can prioritise risks based on their level (low, medium, high). This will help you focus your risk management efforts on the most significant threats.

4. Develop Mitigation Strategies: For each risk, develop a strategy to mitigate its impact. This could involve reducing the likelihood of occurrence, reducing the potential impact, or transferring the risk to another party (like an insurer).

Analysing Risk Levels in Business: Entering a New Market

When entering a new market, businesses face several potential risks. These could include competition, regulatory challenges, cultural differences, or economic instability.

To analyse these risks:

1.Conduct Market Research: Understand the market dynamics, including competitors, customers, and regulatory environment.

2.Assess Financial Risks: Consider the financial implications of entering the new market, including potential costs and revenues.

3. Consider Operational Risks: Evaluate how entering the new market could affect your operations.

4. Develop a Risk Mitigation Strategy: Based on your analysis, develop a strategy to mitigate these risks.

Conclusion and Recommendation

Understanding and managing risk levels in business is crucial for success. By identifying potential risks, assessing their likelihood and impact, prioritising them based on their level of risk, and developing mitigation strategies, businesses can better navigate uncertainty and achieve their objectives.

It’s recommended that businesses regularly review and update their risk assessments to reflect changes in their environment or operations. Additionally, businesses should consider seeking expert advice when conducting risk assessments to ensure they are comprehensive and accurate.