What are MCDs?

MCDs, or Multiple Cause Diagrams, are a tool used in business to identify and illustrate the various factors that contribute to a particular outcome. They are essentially visual maps that allow us to see the complex web of causes and effects that lead to a certain result. MCDs are particularly useful in situations where there are many interrelated factors at play, such as in the case of a cash-flow decline.

What are MCDs for Business and How they work?

In the context of business, MCDs can be used to analyse a wide range of issues, from operational problems to strategic challenges. They work by helping us break down complex problems into their constituent parts, making it easier to understand how different factors interact with each other.

To create an MCD, you start with the outcome you’re interested in – in this case, a decline in cash flow. You then identify all the potential causes of this outcome and map them out visually. This might involve drawing arrows between different causes to show how they’re related, or grouping similar causes together.

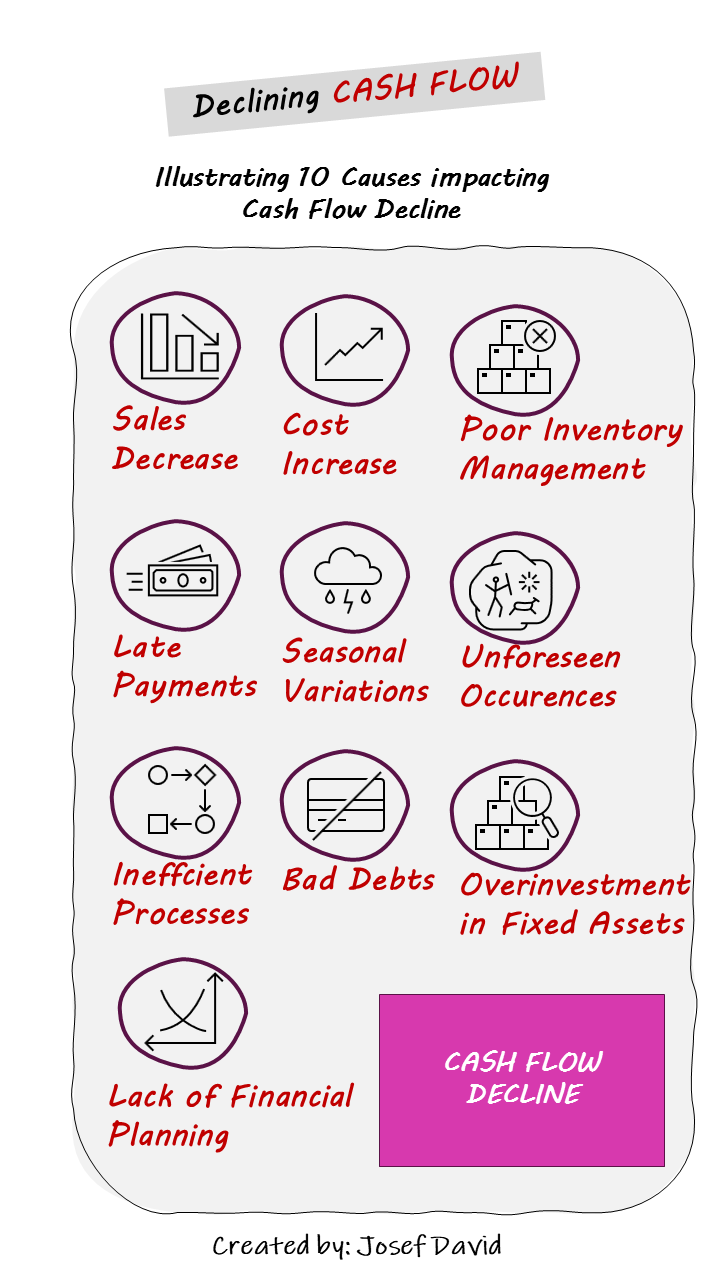

Illustrating 10 Multiple Causes for Cash-Flow Decline

1. Decreased Sales: This is perhaps the most obvious cause of cash-flow decline. If your business is selling less, it’s bringing in less money.

2. Increased Expenses: On the other side of the equation, if your costs go up – whether due to inflation, increased rent or higher supplier prices – your cash flow can take a hit.

3. Poor Inventory Management: If you’re holding too much stock, your money is tied up in inventory rather than being available for other uses.

4. Late Payments: If your customers aren’t paying their invoices on time, this can cause a serious cash-flow problem.

5. Seasonal Variations: Many businesses experience fluctuations in sales and cash flow throughout the year due to seasonal trends.

6. Unforeseen Circumstances: Events like natural disasters, pandemics or economic recessions can have a major impact on your cash flow.

7. Inefficient Processes: If your business processes are inefficient, this can lead to wasted time and money, affecting your cash flow.

8. Bad Debts: If customers fail to pay their invoices at all, this can result in a significant loss of income.

9. Overinvestment in Fixed Assets: If too much capital is tied up in property, equipment or other fixed assets, this can restrict your cash flow.

10. Lack of Financial Planning: Without a solid financial plan, it’s easy for spending to get out of control, leading to a decline in cash flow.

Conclusion and Next Steps

Understanding the multiple causes of cash-flow decline is the first step towards addressing the problem. Once you’ve identified the potential causes using an MCD, you can start to develop strategies to mitigate these issues.

This might involve improving your inventory management, tightening up your credit control processes or investing in more efficient business systems. It could also mean revisiting your pricing strategy or looking for ways to diversify your income streams.

In conclusion, MCDs are a powerful tool for understanding complex business problems. By helping us visualise the many interrelated factors that contribute to a particular outcome, they enable us to tackle these issues in a more systematic and effective way.