Leading the Return on Invested Capital Way: A Deep Dive into Sectors and Companies Generating High ROIC and the Strategic Levers They Apply

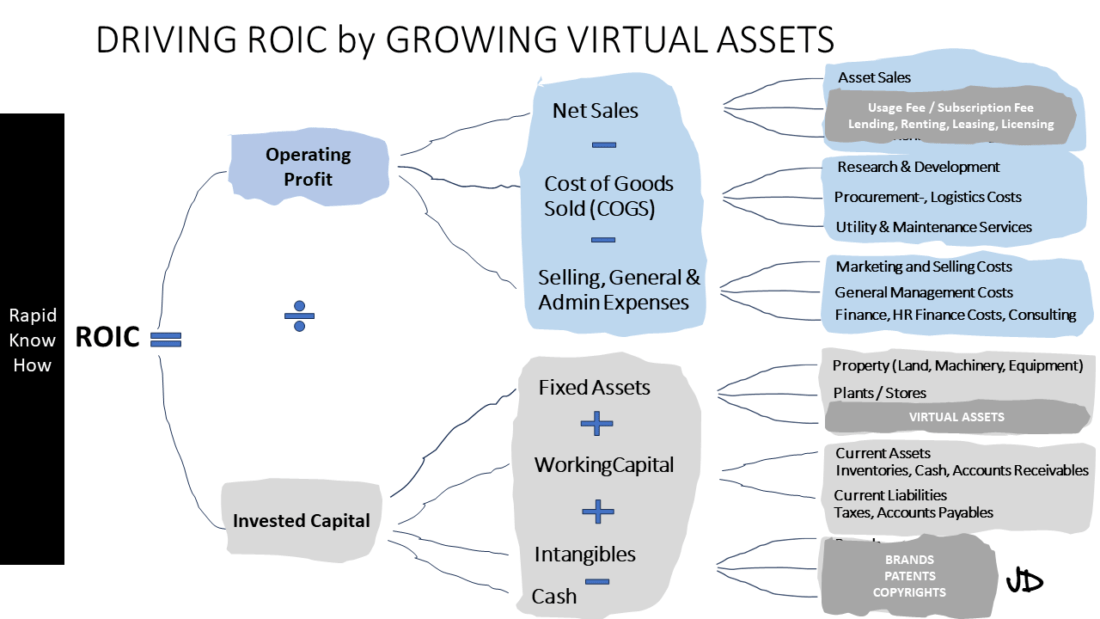

In the dynamic world of business, financial metrics serve as a compass, guiding companies towards sustainable growth and profitability. One such critical metric is Return on Invested Capital (ROIC), a performance indicator that measures how effectively a company uses its capital to generate profits. In essence, it’s a litmus test for assessing the efficiency of a company in turning capital into profits.

In this blog post, we will explore the concept of ‘Leading the ROIC Way’, delving into various sectors and companies that have successfully harnessed the power of high ROIC. We will also shed light on the strategic levers they apply to achieve this feat.

From technology giants to manufacturing behemoths, numerous companies across diverse sectors have managed to generate impressive ROIC figures. These companies have not only mastered the art of capital allocation but also strategically leveraged various tools and tactics to maximise their returns.

Whether it’s through innovative product development, strategic acquisitions, cost optimisation, or efficient supply chain management, these companies have demonstrated that there are multiple paths to achieving high ROIC. Each path requires careful planning, strategic foresight, and meticulous execution.

As we delve deeper into this topic, we will uncover how these leading companies navigate their unique paths and what lessons other businesses can learn from their success stories. We will also explore how these strategic levers can be adapted and applied across different sectors and business models.

So, whether you’re a seasoned investor seeking insights into high-performing companies or a business leader looking for strategies to enhance your company’s financial performance, this blog post promises to offer valuable insights and practical guidance.

Join us as we embark on this enlightening journey of ‘Leading the ROIC Way’, exploring the intersection of sector-specific strategies, company performance, and ROIC generation. Let’s delve into the world of high ROIC companies and the strategic levers they employ to stay ahead of the curve. See the simple , but comprehensive ROIC Table below:

| Sector | Leading Companies | ROIC 5Yrs (Source: FinanceCharts) | Strategic Levers |

| Industrial Gases | Air Liquide Air Products Linde plc | 7,61% 10,08% 5,12% | Operational Efficiency Capital Structure Tax Efficiency Strategic Investments |

| Houshold and Personal Products | Procter & Gamble Colgate Palmolive L’Oreal | 15,18% 26,00% 14,71% | Brand Strength Product Innovation Cost Management |

| Petroleum | Exxon Mobile Saudi Aramco Shell | 6,12% 23,07% 6,07% | Operational Efficiency Capital Discipline Portfolio Optimization Technological Innovation |

| Pharmacuetical | Novo Nordisk Pfizer Johnson & Johnson Zoets (ZTS) | 35,78% 10,78% 17,18% 21,87% | Product & Process Innovation Mergers & Acquisitions Cost Management Diversification |

| Information | Apple Microsoft Alphabet / Google | 33,09% 28,68% 28,47% | Lock-in – Brand Strength Technology Innovation Data into Knowledge Conversion |