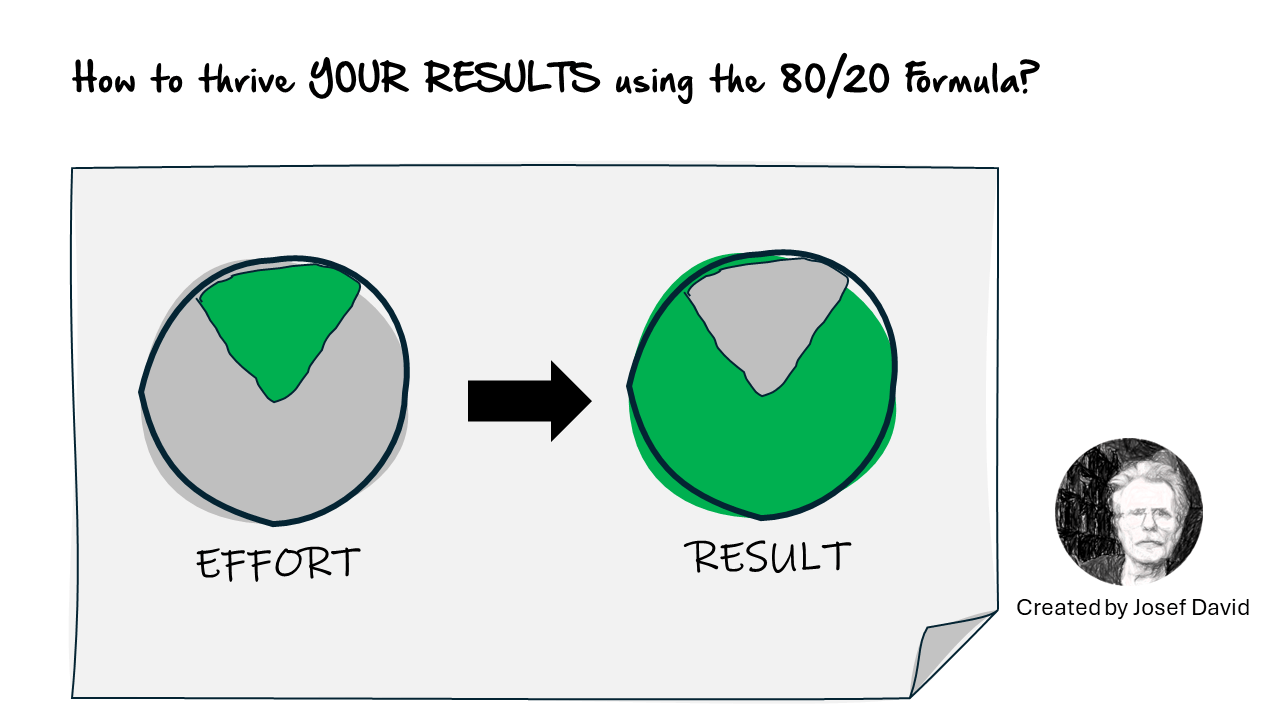

The 80/20 Rule, also known as the Pareto Principle, is a concept that suggests that 80% of outcomes (or outputs) result from 20% of all causes (or inputs) for any given event. In business, a goal is to identify inputs that are potentially the most productive and make them the priority. For instance, once managers identify factors that are critical to their company’s success, they should focus their resources on those areas.

Now, let’s apply this principle to personal cash-flow management.

80/20 Strategy to Increase Your Personal Cash-Flow

The 80/20 rule can be a powerful tool in managing your personal finances. It can help you focus on what really matters when it comes to increasing your cash flow. Here’s how you can apply the 80/20 rule:

1.Identify Your 20%: The first step is to identify which 20% of your actions contribute to 80% of your income. This could be a specific job, a side hustle, or an investment. Once you’ve identified these key income sources, you can focus more of your time and energy on them.

2.Maximize Your Income: Now that you know where most of your money comes from, think about how you can increase these earnings. Can you take on more responsibilities at work? Can you expand your side business? Can you invest more money or diversify your investments?

3.Minimize Your Expenses: Just as 20% of your actions lead to 80% of your income, it’s likely that 20% of your expenses account for 80% of your total spending. Identify these major expenses and think about how you can reduce them.

80/20 Actions to Increase Your Personal Cash-Flow

Here are some practical steps you can take:

1. Track Your Income and Expenses: You can’t manage what you don’t measure. Start by tracking your income and expenses. There are many apps and tools that can help with this.

2. Analyze Your Spending: Once you’ve tracked your income and expenses for a few months, analyze your spending. Identify the 20% of expenses that account for 80% of your total spending. These are likely to be big-ticket items like rent or mortgage, car payments, and food.

3. Cut Back on Major Expenses: Once you’ve identified your major expenses, think about how you can reduce them. Can you downsize your home or car? Can you cook at home more often instead of eating out? Can you use your home as office?

4. Focus on Your Most Profitable Activities: Similarly, identify the 20% of activities that contribute to 80% of your income. Focus more of your time and energy on these activities. Project work, customer relationship,mamagement, retain value customer management

Conclusion and Getting Started

The 80/20 rule is a powerful principle that can help you increase your personal cash flow. By focusing on the most profitable activities and cutting back on major expenses, you can significantly improve your financial situation.

Start by tracking your income and expenses, then analyze your spending to identify where most of your money is going and coming from. Once you’ve identified these key areas, focus on increasing your income from the most profitable activities and reducing your major expenses.

Remember, the goal isn’t to completely eliminate all other activities or expenses but to prioritize those that have the biggest impact on your cash flow. This way, you can make the most of your time and money.

The 80/20 rule isn’t a magic formula, but it’s a useful guideline that can help you focus on what really matters when it comes to managing your personal finances. So why not give it a try? You might be surprised at how much it can help improve your cash flow.