Return on Invested Capital (ROIC) is a crucial financial metric that is often used to measure a company’s profitability and the efficiency with which its capital is employed. In the Household and Personal Products industry, companies like Procter & Gamble, Colgate-Palmolive, and L’Oreal are key players that have consistently demonstrated strong ROIC performance.

Procter & Gamble, for instance, has been a leader in the industry for many years. The company’s ROIC is impressive due to its strong brand portfolio, which includes household names like Tide, Pampers, and Gillette. These brands have a strong consumer base and generate significant cash flows, contributing to the company’s high ROIC.

Colgate-Palmolive is another company with a high ROIC in this industry. The company’s success can be attributed to its focus on core brands like Colgate and Palmolive, which are recognized globally. By concentrating on these brands, the company has been able to maintain high profit margins and generate substantial returns on its invested capital.

L’Oreal, the world’s largest cosmetics company, also boasts a high ROIC. The company’s success can be attributed to its diverse product portfolio that caters to various consumer needs across different price points. This strategy has allowed L’Oreal to tap into different market segments and generate high returns on its invested capital.

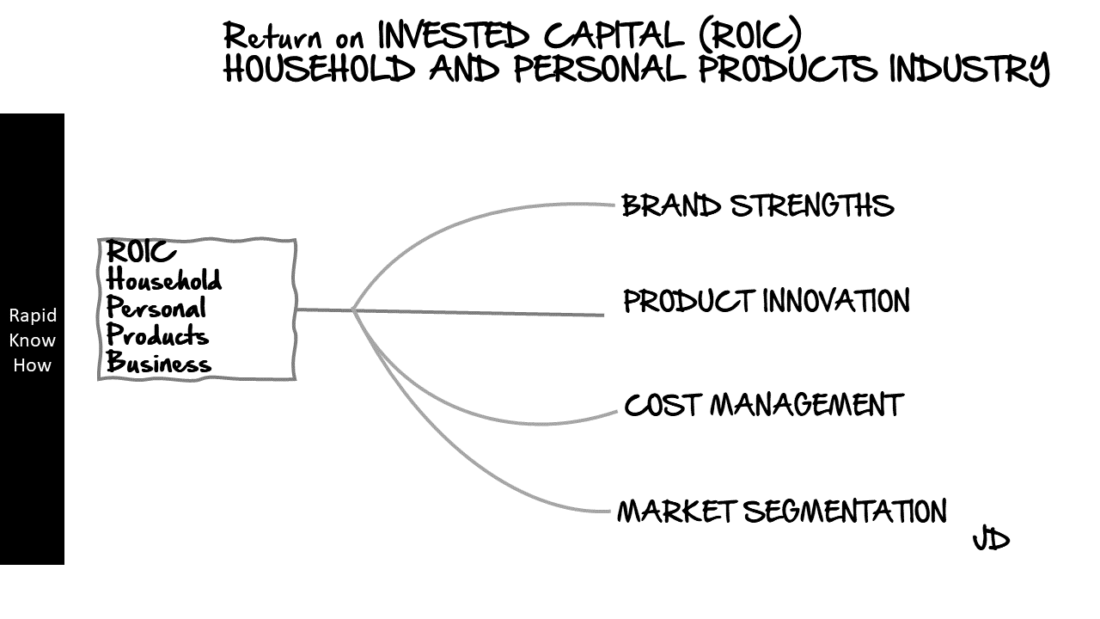

The Strategic Levers of the Household and Personal Products Industry

The strategic levers of the Household and Personal Products industry play a significant role in influencing these companies’ ROIC. These levers include brand strength, product innovation, cost management, and market segmentation.

Brand strength is crucial in this industry as strong brands command customer loyalty and can charge premium prices. Companies like Procter & Gamble and Colgate-Palmolive have leveraged their brand strength to generate high returns on their invested capital.

Product innovation is another strategic lever in this industry. Companies need to continually innovate their products to meet changing consumer needs and preferences. L’Oreal has been particularly successful in this regard with its continuous introduction of new products.

Cost management is also an important strategic lever. By managing costs effectively, companies can improve their profit margins and increase their ROIC. Procter & Gamble has been successful in managing its costs through efficient supply chain management.

Finally, market segmentation allows companies to cater to different consumer needs across various price points. This strategy has been particularly effective for L’Oreal, enabling it to tap into different market segments and generate high returns on its invested capital.

ROIC of the Major Players of the Houshold and Personal Products Industry

The ROIC of a company is calculated by dividing its net operating profit after taxes (NOPAT) by its invested capital. It is expressed as a percentage. A higher ROIC indicates that a company is more efficient at turning capital into profits.

Let’s take a look at the ROIC of Procter & Gamble, Colgate-Palmolive, and L’Oreal:

1. Procter & Gamble: As one of the largest consumer goods companies globally, P&G has consistently demonstrated strong ROIC. As per the latest financial reports, P&G’s ROIC stands at around 13%. This suggests that for every dollar invested in capital, P&G generates 13 cents in profit.

2. Colgate-Palmolive: Known for its oral care products, Colgate-Palmolive has also shown impressive ROIC figures. The company’s latest reported ROIC is approximately 34%, indicating a highly efficient use of capital.

3. L’Oreal: As the world’s largest cosmetics company, L’Oreal’s ROIC is an important indicator of its financial health. The company’s most recent ROIC is around 16%, suggesting that it generates 16 cents in profit for every dollar invested in capital.

In conclusion, ROIC is a critical financial metric in the Household and Personal Products industry. Companies like Procter & Gamble, Colgate-Palmolive, and L’Oreal have demonstrated strong ROIC performance due to their effective use of strategic levers such as brand strength, product innovation, cost management, and market segmentation.

ROIC boosted from Virtual Assets

ROIC, or Return on Invested Capital, is a profitability ratio that measures the return that an investment generates for those who have provided capital, i.e., bondholders and stockholders. Virtual assets, in this context, refer to digital resources with value such as cryptocurrencies, digital tokens, or even non-fungible tokens (NFTs). The impact of ROIC from virtual assets on the critical levers of the Household and Personal Products Industry can be profound and multifaceted.

Firstly, let’s discuss brand strengths. A strong brand is a valuable asset in the Household and Personal Products Industry. It helps to attract and retain customers, command premium prices, and differentiate from competitors. Virtual assets can enhance brand strength by providing a new avenue for customer engagement. For instance, a company could issue its own branded cryptocurrency as part of a customer loyalty program. This would not only incentivize repeat purchases but also create a sense of community among customers. The increased customer engagement and loyalty could then lead to higher ROIC.

Next is product innovation. The Household and Personal Products Industry is characterized by constant innovation as companies strive to meet changing consumer needs and preferences. Virtual assets can facilitate product innovation by providing a secure and transparent platform for tracking the lifecycle of products. For example, blockchain technology could be used to verify the authenticity of organic or eco-friendly products, thereby enhancing their appeal to environmentally conscious consumers. This could result in higher sales and ROIC.

Lastly, cost management is another critical lever in the Household and Personal Products Industry. Companies need to manage costs effectively to maintain profitability in the face of intense competition and fluctuating raw material prices. Virtual assets can contribute to cost management by streamlining transactions and reducing the need for intermediaries. For instance, using cryptocurrencies for international transactions could lower transaction costs and speed up payment processes. Moreover, smart contracts on blockchain platforms could automate routine tasks such as inventory management or invoice processing, thereby reducing operational costs. These cost savings could then boost ROIC.

In conclusion, ROIC from virtual assets can significantly impact the critical levers of the Household and Personal Products Industry by enhancing brand strengths, facilitating product innovation, and improving cost management. However, it’s important to note that implementing virtual assets also involves challenges such as regulatory uncertainties, technological complexities, and security risks. Therefore, companies should carefully assess these factors before deciding to invest in virtual assets.

Artificial Intelligence (AI) for each Household and Personal Products Lever

Artificial Intelligence (AI) has been making waves in various sectors, and the household and personal products industry is no exception. LeverLever, a leading brand in this sector, has been leveraging AI to enhance its brand strength, drive product innovation, manage costs, and segment the market effectively.

Brand Strength:

AI has been instrumental in strengthening Lever’s brand. By using AI-powered analytics tools, the company can gain insights into customer behavior and preferences. This data helps them tailor their marketing strategies to meet customer needs more effectively, thereby enhancing their brand image. For instance, AI can analyze social media trends to understand what customers are saying about the brand. This feedback can be used to improve products or services and address any negative perceptions, thereby strengthening the brand.

Product Innovation:

AI is also driving product innovation at LeverLever. The company uses AI to analyze vast amounts of data on consumer preferences and market trends. This information is then used to develop new products that meet emerging consumer needs. For example, AI can identify a growing preference for organic or eco-friendly products among consumers. LeverLever can then use this insight to innovate and launch new products that cater to this demand.

Cost Management:

In terms of cost management, AI helps Lever streamline its operations and reduce costs. For instance, AI-powered automation tools can handle repetitive tasks more efficiently than humans, freeing up staff to focus on more strategic tasks. This not only improves productivity but also reduces operational costs. Additionally, predictive analytics powered by AI can forecast demand more accurately, helping the company manage its inventory better and reduce wastage.

Market Segmentation:

Finally, AI plays a crucial role in market segmentation at Lever. By analyzing customer data, AI can identify different customer segments based on factors like buying behavior, preferences, and demographics. This enables Lever to target each segment with personalized marketing messages and offers, thereby increasing conversion rates.

In conclusion, AI applications are transforming how Lever operates in the household and personal products industry. From strengthening the brand to driving product innovation, managing costs, and segmenting the market effectively – AI is proving to be a game-changer for each Lever.