The pharmaceutical industry is a highly complex and dynamic sector, characterized by intense competition, high levels of innovation, and stringent regulatory oversight. One of the key financial metrics used to evaluate companies in this industry is Return on Invested Capital (ROIC). ROIC measures how effectively a company uses its capital to generate profits. It’s a particularly useful metric in the pharmaceutical industry, where companies often have to invest heavily in research and development (R&D) before they can generate any returns.

Let’s take a look at some of the major players in the industry: Pfizer, Johnson & Johnson, Merck, Novo Nordisk, and FMC.

Pfizer has consistently demonstrated strong ROIC figures over the years. This can be attributed to its robust product portfolio, which includes blockbuster drugs like Lipitor and Viagra. Pfizer’s ability to generate high returns on its invested capital is also a testament to its efficient use of resources and effective cost management strategies.

Johnson & Johnson is another pharmaceutical giant with impressive ROIC figures. The company’s diversified business model, which includes pharmaceuticals, medical devices, and consumer health products, allows it to spread its risks and capitalize on opportunities in different market segments. This diversification strategy has helped Johnson & Johnson maintain steady returns on its invested capital.

Merck’s ROIC has been somewhat volatile over the years due to various factors such as patent expirations and pricing pressures. However, the company has managed to maintain decent ROIC figures thanks to its strong pipeline of innovative drugs and strategic acquisitions.

Novo Nordisk has one of the highest ROICs in the pharmaceutical industry. The company specializes in diabetes care products, a market segment that has seen significant growth over the years. Novo Nordisk’s focus on this niche market has allowed it to generate high returns on its invested capital.

FMC Corporation is not traditionally classified as a pharmaceutical company but rather as a chemical company with a significant presence in agricultural solutions. However, it does have a health segment that contributes significantly to its overall revenue. FMC’s ROIC has been relatively stable over the years due to its diversified business model and strategic investments in high-growth markets.

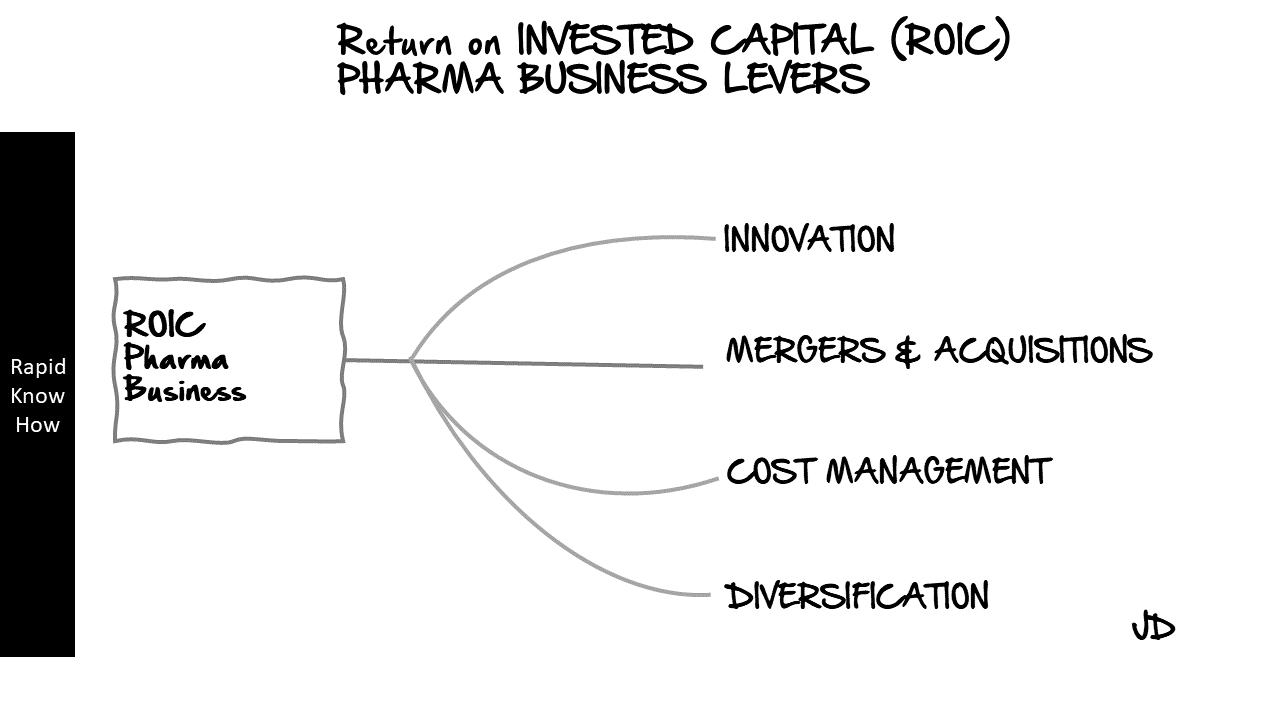

Strategic Levers of the Pharmaceutical Industry

Now let’s discuss some of the strategic levers that these companies use to drive their ROIC:

1. Innovation: Pharmaceutical companies invest heavily in R&D to develop new drugs and therapies. These innovations can command high prices in the market, driving up revenues and returns on invested capital.

2. Mergers & Acquisitions: Companies often acquire or merge with other firms to expand their product portfolios or gain access to new markets. This can lead to increased sales and higher ROIC.

3. Cost Management: By managing costs effectively, companies can improve their profit margins and increase their ROIC. This can involve everything from streamlining operations to negotiating better terms with suppliers.

4. Diversification: As seen with Johnson & Johnson and FMC Corporation, diversifying into different business segments can help spread risks and create multiple revenue streams.

5. Market Specialization: Companies like Novo Nordisk have found success by specializing in specific market segments where they have unique expertise or competitive advantages.

ROIC of the Major Players in the Pharmaceutical Industry

Let’s take a look at some of the major players in the pharmaceutical industry: Pfizer, Johnson & Johnson, Merck, Novo Nordisk, and FMC.

Pfizer, one of the world’s largest pharmaceutical companies, has consistently demonstrated strong ROIC. As of 2020, Pfizer’s ROIC was approximately 9.6%. This indicates that for every dollar invested in capital, Pfizer generated nearly 10 cents in profit.

Johnson & Johnson, another global leader in healthcare, has also shown impressive ROIC. In 2020, their ROIC was around 17%, demonstrating a strong ability to generate returns from their capital investments.

Merck & Co., known for its wide range of prescription medicines and vaccines, had an ROIC of about 12% in 2020. This suggests that Merck is effectively using its capital to generate profits.

Novo Nordisk, a global healthcare company with a strong focus on diabetes care, had an ROIC of approximately 80% in 2020. This extraordinarily high figure reflects Novo Nordisk’s efficient use of capital and successful business model.

FMC Corporation, a chemical manufacturing company with a significant presence in the pharmaceutical industry, had an ROIC of around 9% in 2020. While this is lower than some other companies on this list, it still indicates a reasonable level of profitability.

In conclusion, while ROIC is an important metric for evaluating pharmaceutical companies’ performance, it should not be viewed in isolation. Other factors such as revenue growth, profit margins, debt levels, and future prospects should also be considered when assessing these companies’ financial health and investment potential.

ROIC boosted from Virtual Assets

Return on Invested Capital (ROIC) from virtual assets is a critical metric that has been gaining significant attention in the pharmaceutical industry. It is a measure of how effectively a company uses its capital to generate profits. The impact of ROIC from virtual assets on the critical levers of the pharmaceutical industry, including innovation, mergers and acquisitions, cost management, diversification, and market specialization, is profound and multifaceted.

Innovation is the lifeblood of the pharmaceutical industry. The development of new drugs and therapies requires substantial investment in research and development (R&D). Virtual assets can significantly enhance the efficiency and effectiveness of these investments. For instance, digital technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics can expedite drug discovery and development processes, thereby improving the ROIC. These technologies can also facilitate personalized medicine by enabling more precise targeting of therapies, which can further enhance the ROIC by reducing wastage and improving outcomes.

Mergers and acquisitions (M&A) are another critical lever in the pharmaceutical industry. They provide an avenue for companies to acquire new capabilities, expand their product portfolios, or enter new markets. Virtual assets can play a pivotal role in M&A by providing more accurate and timely information for decision-making. For example, blockchain technology can ensure the integrity and transparency of financial transactions, thereby reducing risks and improving the ROIC from M&A.

Cost management is a perennial challenge in the pharmaceutical industry due to the high costs associated with drug discovery, development, manufacturing, and distribution. Virtual assets can help mitigate these costs through automation and optimization. For instance, AI and ML can automate routine tasks in R&D and manufacturing, thereby reducing labor costs. They can also optimize supply chains by predicting demand more accurately and managing inventory more efficiently, thereby reducing inventory holding costs.

Diversification is another important strategy in the pharmaceutical industry to spread risks across different therapeutic areas or markets. Virtual assets can facilitate diversification by providing insights into potential opportunities based on data analysis. For example, big data analytics can identify trends or patterns in disease prevalence or patient behavior that may indicate potential opportunities for diversification.

Market specialization is a strategy that some pharmaceutical companies adopt to focus on specific therapeutic areas or patient populations where they have unique capabilities or advantages. Virtual assets can support market specialization by providing detailed insights into specific markets or patient populations based on data analysis. For example, AI and ML can analyze patient data to identify unmet needs or treatment gaps that a company could address with its specialized capabilities.

In conclusion, ROIC from virtual assets has a significant impact on various critical levers of the pharmaceutical industry. By enhancing innovation, facilitating M&A, improving cost management, enabling diversification, and supporting market specialization, virtual assets can significantly improve the ROIC in this industry. However, it’s important to note that leveraging these assets requires careful planning and execution to ensure they align with a company’s strategic objectives and capabilities.

Artifical Intelligence (AI) Applications for each Pharma Lever

Artificial Intelligence (AI) has been a game-changer in various industries, and the pharmaceutical sector is no exception. AI applications have significantly impacted four key levers in the pharmaceutical industry: Innovation, Mergers & Acquisitions (M&A), Cost Management, and Diversification. Let’s delve into each of these areas to understand how AI is revolutionizing them.

1. Innovation:

Innovation is the lifeblood of the pharmaceutical industry. It’s all about developing new drugs, improving existing ones, and finding novel ways to treat diseases. AI plays a crucial role in this process by accelerating drug discovery and development. Machine learning algorithms can analyze vast amounts of data to predict how different compounds will behave and interact with the human body. This reduces the time it takes to identify potential drug candidates.

Moreover, AI can also help in clinical trials. It can predict patient outcomes based on their medical history and genetic profile, thereby enabling personalized medicine. AI can also monitor patients remotely during trials, ensuring their safety and improving data collection.

2. Mergers & Acquisitions:

M&A activities are common in the pharmaceutical industry as companies seek to expand their product portfolios or gain access to new markets. AI can streamline this process by providing valuable insights into potential acquisition targets.

AI-powered predictive analytics can analyze a company’s financials, product pipeline, market position, and more to determine its value and potential fit with the acquiring company. This helps decision-makers make informed choices about which companies to acquire.

Furthermore, after an acquisition is made, AI can assist in integrating the two companies’ operations. It can identify redundancies, streamline workflows, and help manage change effectively.

3. Cost Management:

Cost management is a significant challenge for pharmaceutical companies due to high R&D costs, regulatory compliance requirements, and price pressures from payers. AI can help address these issues by improving efficiency and reducing waste.

For instance, AI can optimize supply chain operations by predicting demand for different drugs and ensuring that production meets this demand without excess inventory or shortages. It can also automate routine tasks such as data entry or report generation, freeing up employees’ time for more value-added activities.

In terms of regulatory compliance, AI can keep track of changing regulations across different markets and ensure that the company’s practices remain compliant. This reduces the risk of costly fines or reputational damage.

4. Diversification:

Diversification involves expanding into new therapeutic areas or markets to spread risk and increase growth opportunities. Here too, AI has much to offer.

AI-powered market research tools can analyze trends in different therapeutic areas or geographies to identify promising opportunities for diversification. They can also assess the competitive landscape in these areas to inform strategy development.

Moreover, once a company decides to diversify into a new area, AI can assist in product development (as discussed under Innovation) and market entry strategies (e.g., identifying key opinion leaders or potential partners in the new market).

In conclusion, AI has wide-ranging applications across all key levers of the pharmaceutical industry – from driving innovation to facilitating M&A activities, managing costs effectively, and enabling diversification strategies. As such, it’s not just an optional tool but a critical enabler for success in today’s competitive pharmaceutical landscape.