ROIC, or Return on Invested Capital, is a profitability ratio that measures the return that an investment generates for those who have provided capital, i.e., bondholders and stockholders. It’s a crucial metric in the petroleum industry, which is capital-intensive and requires significant upfront investment.

Let’s take a look at three major players in the petroleum industry: ExxonMobil, Lukoil, and Gazprom, and how they utilize ROIC.

ExxonMobil, an American multinational oil and gas corporation, has consistently demonstrated a strong ROIC. The company’s ability to generate high returns on its invested capital can be attributed to its strategic focus on high-margin projects, operational efficiency, and disciplined capital allocation. ExxonMobil’s integrated business model allows it to leverage synergies across its various business segments, thereby enhancing its overall profitability.

Lukoil, one of Russia’s largest oil companies, also exhibits a robust ROIC. The company’s strategy revolves around optimizing its asset portfolio by focusing on profitable projects and divesting non-core assets. Lukoil also emphasizes cost control and operational efficiency to maximize returns on invested capital.

Gazprom, another Russian energy giant, has a slightly different approach. While it also focuses on operational efficiency and cost control like Lukoil, Gazprom places a significant emphasis on strategic investments in pipeline infrastructure and gas exploration projects to ensure long-term growth and profitability.

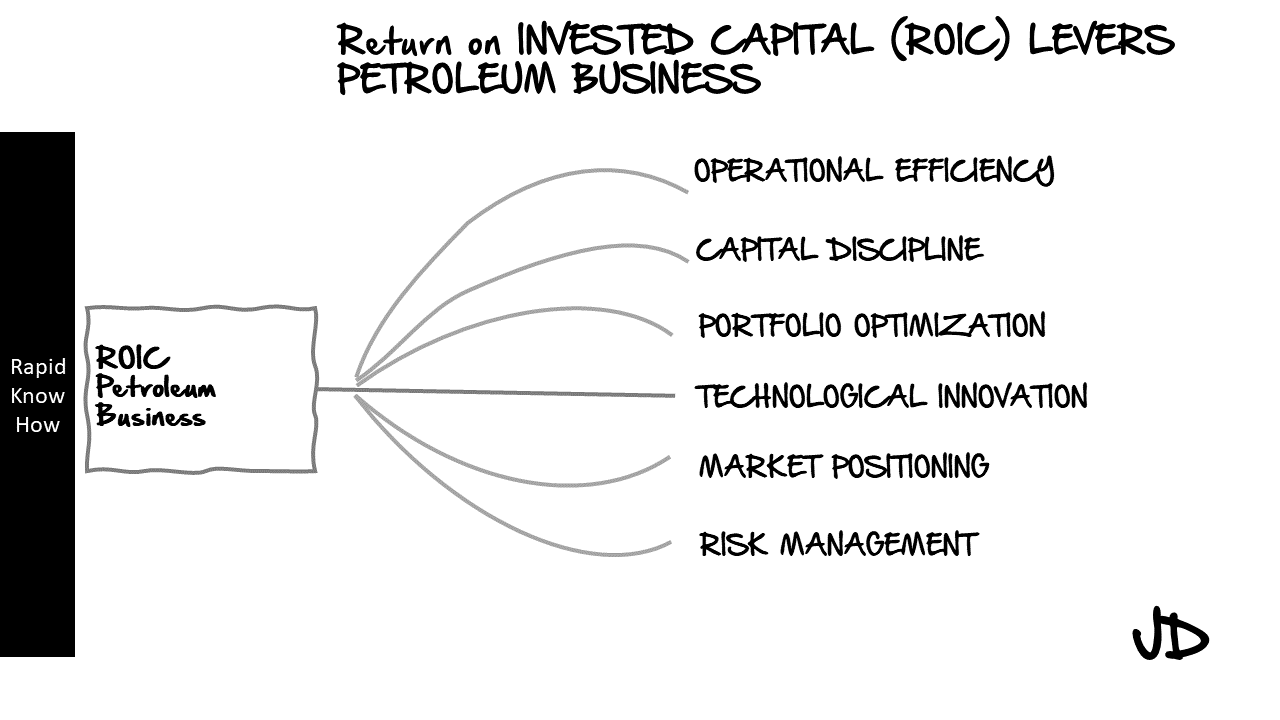

The Strategic Levers of the Petroleum Industry

Now let’s delve into the strategic levers of the petroleum industry:

1. **Operational Efficiency**: This involves optimizing processes to reduce costs and improve productivity. Companies can achieve this through technological advancements, process improvements, or better resource management.

2. **Capital Discipline**: Given the capital-intensive nature of the petroleum industry, companies must be disciplined in their capital allocation decisions. This means investing in high-return projects while avoiding unnecessary expenditure.

3. **Portfolio Optimization**: This involves strategically managing the company’s asset portfolio to maximize returns. Companies may choose to divest non-core or low-return assets while investing more in high-return projects.

4. **Technological Innovation**: Technology plays a crucial role in the petroleum industry. Innovations can lead to more efficient exploration and production processes, thereby reducing costs and improving returns.

5. **Market Positioning**: Companies need to strategically position themselves in the market to gain competitive advantages. This could involve focusing on specific geographic regions or market segments.

6. **Risk Management**: The petroleum industry is subject to various risks including price volatility, geopolitical issues, environmental concerns etc. Effective risk management strategies are essential to protect returns.

ROIC of the Major Players in the Petroleum Industry

Let’s take a look at some of the major players in the petroleum industry and their ROIC:

1. Exxon Mobil: Exxon Mobil is one of the world’s largest publicly traded international oil and gas companies. As of 2020, Exxon Mobil’s ROIC was approximately 0.01%. This low figure reflects the challenging conditions faced by the oil and gas industry due to falling prices and reduced demand caused by the COVID-19 pandemic.

2. Lukoil: Lukoil is Russia’s second-largest oil company and one of the biggest international oil companies in terms of proven reserves and production. In 2020, Lukoil’s ROIC was around 7.8%, demonstrating a relatively efficient use of capital compared to many of its peers.

3. Gazprom: Gazprom is a global energy company focused on geological exploration, production, transportation, storage, processing and sales of gas, gas condensate and oil. As per their annual report for 2020, Gazprom’s ROIC was approximately 4.5%.

4. Chevron: Chevron is one of the world’s leading integrated energy companies with operations across the globe. In 2020, Chevron’s ROIC was about -0.02%, reflecting the impact of lower oil prices on its profitability.

These figures demonstrate that even within the same industry, ROIC can vary significantly between companies due to differences in operational efficiency, cost management strategies, capital allocation decisions, and risk management practices.

In conclusion, ROIC is a critical measure of financial performance in the petroleum industry that reflects how effectively a company uses its capital to generate profits. By pulling strategic levers such as operational efficiency, cost management, capital allocation, and risk management, petroleum companies can enhance their ROIC and overall financial performance.

ROIC is an important measure of profitability for companies in the petroleum industry like ExxonMobil, Lukoil and Gazprom. By leveraging strategic levers such as operational efficiency, capital discipline, portfolio optimization, technological innovation, market positioning and risk management these companies aim to maximize their return on invested capital.

ROIC boosted from Virtual Assets

Return on Invested Capital (ROIC) from virtual assets is a critical metric that is increasingly impacting the petroleum industry. This impact is felt across several key levers, including operational efficiency, capital discipline, portfolio optimization, technological innovation, market positioning, and risk management.

Starting with operational efficiency, virtual assets can significantly enhance the petroleum industry’s ability to streamline operations and reduce costs. For instance, blockchain technology can be used to track and verify transactions in real-time, eliminating the need for intermediaries and reducing administrative costs. Similarly, digital twins – virtual replicas of physical assets – can be used to monitor equipment performance and predict maintenance needs, thereby minimizing downtime and improving overall operational efficiency.

Capital discipline is another area where ROIC from virtual assets can make a significant difference. By providing a more transparent and efficient way of tracking investments and returns, these digital tools can help companies maintain fiscal discipline and ensure that capital is allocated in the most productive way possible. This is particularly important in an industry like petroleum, where capital investments are often substantial and long-term.

In terms of portfolio optimization, virtual assets can provide valuable data that helps companies make informed decisions about their asset mix. For example, predictive analytics tools can forecast future market trends and demand patterns, enabling companies to adjust their portfolios accordingly. This not only maximizes returns but also helps mitigate risks associated with market volatility.

Technological innovation is another critical lever that is heavily influenced by ROIC from virtual assets. The petroleum industry has traditionally been slow to adopt new technologies; however, the advent of digital tools like AI and machine learning has created new opportunities for innovation. These technologies can improve drilling accuracy, optimize resource allocation, enhance safety measures, among other benefits – all of which contribute to a higher ROIC.

Market positioning is another area where virtual assets can have a significant impact. With the help of data analytics and AI-powered tools, petroleum companies can gain deeper insights into market trends and customer behavior. This information can be used to develop targeted marketing strategies that enhance brand visibility and improve market positioning.

Finally, risk management is a critical lever that benefits greatly from ROIC from virtual assets. Digital tools like predictive analytics and real-time monitoring systems can help identify potential risks early on – whether they’re related to market volatility, operational inefficiencies or regulatory changes – allowing companies to take proactive measures to mitigate these risks.

In conclusion, ROIC from virtual assets has far-reaching implications for the petroleum industry’s critical levers. By enhancing operational efficiency, promoting capital discipline, enabling portfolio optimization, driving technological innovation, improving market positioning and facilitating risk management – these digital tools are reshaping the industry landscape in profound ways.

Artifical Intelligence (AI) Applications for each Petroleum Lever

The petroleum industry is one of the most complex and technologically advanced sectors in the world. It involves a wide range of operations, from exploration and production to refining and marketing. In recent years, Artificial Intelligence (AI) has emerged as a powerful tool that can significantly enhance the efficiency and effectiveness of these operations. Here, we will discuss how AI can be applied to each lever in the petroleum industry, including operational efficiency, capital discipline, portfolio optimization, technological innovation, market positioning, and risk management.

1. Operational Efficiency: AI can greatly improve operational efficiency in the petroleum industry. For instance, machine learning algorithms can analyze vast amounts of data from drilling operations to predict equipment failures and optimize maintenance schedules. This not only reduces downtime but also extends the lifespan of expensive equipment. Moreover, AI-powered automation can streamline various processes such as data entry and report generation, freeing up human resources for more strategic tasks.

2. Capital Discipline: Capital discipline refers to the strategic allocation of financial resources to maximize returns. AI can support this by providing accurate forecasts of oil prices based on complex factors such as geopolitical events, economic indicators, and market trends. This allows companies to make informed decisions about where to invest their capital for maximum return on investment.

3. Portfolio Optimization: In the context of the petroleum industry, portfolio optimization involves selecting the right mix of assets (e.g., oil fields, refineries) to maximize profitability while minimizing risk. AI can assist in this process by analyzing historical data and market trends to predict future performance of different assets. This enables companies to make data-driven decisions about which assets to acquire or divest.

4. Technological Innovation: AI is at the forefront of technological innovation in the petroleum industry. For example, AI-powered robots are being used for dangerous tasks such as offshore drilling or pipeline inspections, improving safety and efficiency. Furthermore, AI algorithms are being used to analyze seismic data for oil exploration, significantly reducing the time and cost involved in finding new oil reserves.

5. Market Positioning: Market positioning involves establishing a unique position in the market that differentiates a company from its competitors. AI can support this by providing insights into customer behavior and market trends. For example, machine learning algorithms can analyze social media data to gauge public sentiment towards different brands or products. This information can be used to tailor marketing strategies and improve customer engagement.

6. Risk Management: The petroleum industry is fraught with risks ranging from volatile oil prices to environmental disasters. AI can help manage these risks by providing predictive analytics that forecast potential threats based on historical data and current trends. For instance, machine learning algorithms can predict the likelihood of an oil spill based on factors such as equipment age and maintenance history.

In conclusion, AI has immense potential to transform every aspect of the petroleum industry by enhancing operational efficiency, enforcing capital discipline, optimizing portfolios, driving technological innovation, improving market positioning, and managing risks effectively. As such, it is imperative for companies in this sector to embrace AI technologies and integrate them into their strategic planning processes.