Introduction

Value investing is a time-tested investment strategy that has proven to be a reliable pathway to wealth accumulation. It involves buying securities that appear underpriced by some form of fundamental analysis. This strategy, popularized by the legendary investor Warren Buffet, is based on the principle of buying stocks at less than their intrinsic value. The idea is to identify and invest in companies that are undervalued by the market but have strong potential for growth.

Understanding Value Investing

Value investing is not just about picking cheap stocks; it’s about buying quality businesses at a reasonable price. It’s about finding diamonds in the rough, companies whose true value is not accurately reflected in their current price. The goal is to find companies that are undervalued but have strong fundamentals, such as solid earnings, robust cash flow, low debt levels, and a competitive advantage in their industry.

The Value Investing Mindset

Successful value investing requires patience, discipline, and a long-term perspective. Unlike speculative trading, which seeks quick profits from short-term price fluctuations, value investing involves holding onto investments for several years to allow their intrinsic value to be realized. This approach requires an investor to have the conviction to stick with their investment decisions even when they go against prevailing market sentiments.

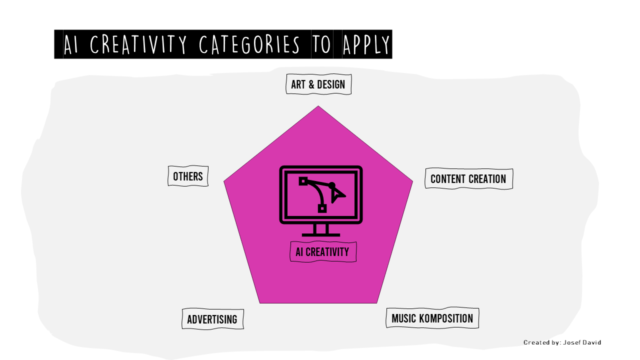

Seven Strategies for Successful Value Investing

1. Understand the Business: Before investing in any company, it’s crucial to understand its business model and industry. This includes understanding how the company makes money, its competitive position within its industry, and its growth prospects.

2. Look for Margin of Safety: The concept of margin of safety involves buying stocks at a price significantly below their calculated intrinsic value. This provides a cushion against potential losses if the company doesn’t perform as expected.

3. Focus on Long-Term Growth: Value investors should focus on companies with sustainable long-term growth prospects rather than those with high short-term earnings.

4. Diversify Your Portfolio: Diversification helps reduce risk by spreading investments across different sectors and industries.

5. Regularly Review Your Portfolio: Regular reviews help identify non-performing assets and make necessary adjustments.

6. Be Patient: Patience is key in value investing as it often takes time for a company’s true value to be recognized by the market.

7. Avoid Herd Mentality: Don’t follow the crowd; do your own research and make independent investment decisions based on your analysis.

Conclusion

Value investing is an intelligent strategy for wealth creation over the long term. It requires thorough research, patience, discipline, and conviction. By understanding a company’s business model and financial health, looking for a margin of safety in investment decisions, focusing on long-term growth prospects, diversifying your portfolio, regularly reviewing your investments, and avoiding herd mentality, you can increase your chances of becoming a successful value investor.

Remember that every investment comes with some level of risk and it’s important to invest only what you can afford to lose without affecting your lifestyle or financial goals. Always seek professional advice if you’re unsure about any investment decision.