Introduction: Exploring the Success of Air Products

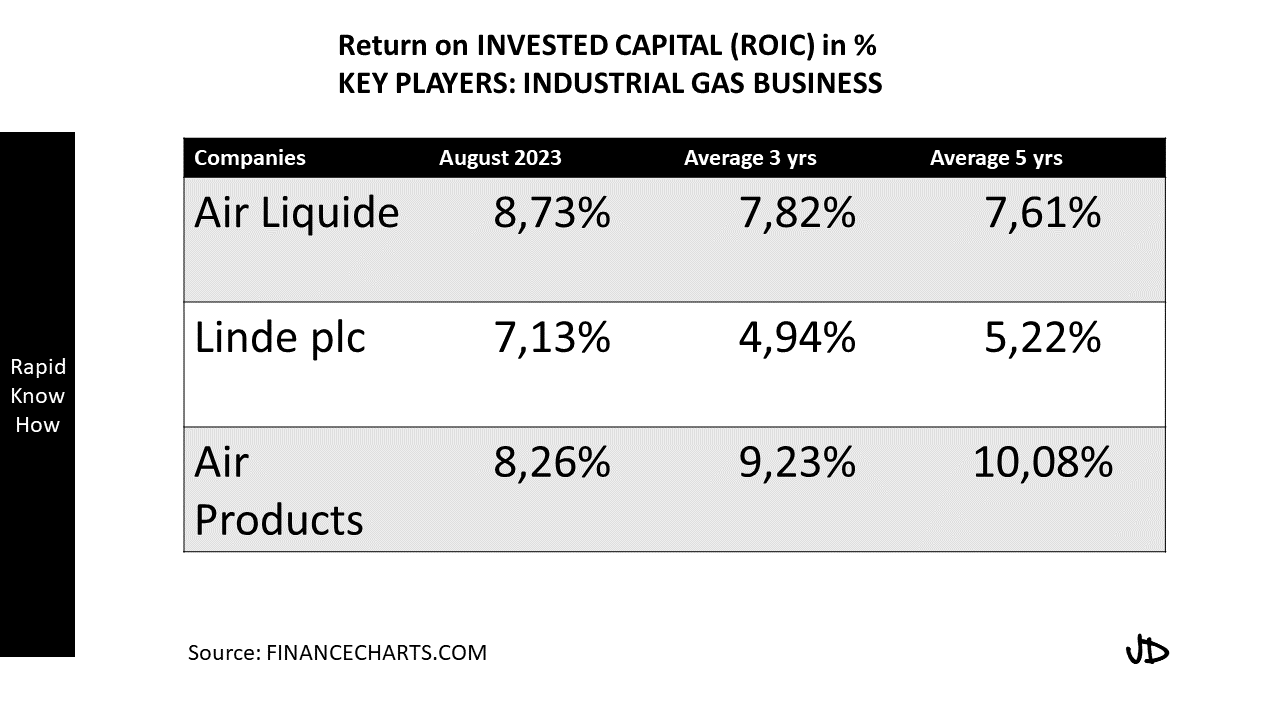

Air Products is a global leader in industrial gases and chemicals, providing a wide range of products and services to customers in various industries. With a history dating back to 1940, the company has established itself as a key player in the industry, known for its innovation, operational excellence, and commitment to sustainability. Over the years, Air Products has consistently delivered strong financial performance, achieving high returns on invested capital (ROIC) and driving shareholder value.

ROIC is a metric used to measure the profitability and efficiency of a company by evaluating how effectively it generates returns from its invested capital. It is calculated by dividing a company’s net operating profit after taxes (NOPAT) by its invested capital. ROIC is an essential metric for evaluating a company’s performance because it takes into account both the profitability and efficiency of its operations. By focusing on ROIC, investors can gain insights into how well a company is utilizing its resources to generate profits.

ROIC: An Essential Metric for Measuring Success

ROIC is considered an essential metric for measuring success because it provides a comprehensive view of a company’s financial performance. Unlike other financial metrics such as return on equity (ROE) or return on assets (ROA), which only focus on profitability or asset utilization, ROIC takes into account both factors. This makes it a more holistic measure of a company’s overall performance.

Comparing ROIC with other financial metrics can provide valuable insights into a company’s strengths and weaknesses. For example, if a company has a high ROIC but a low ROE, it may indicate that the company is generating strong profits but not effectively utilizing its equity to generate returns for shareholders. On the other hand, if a company has a high ROE but a low ROIC, it may suggest that the company is generating strong returns for shareholders but not efficiently utilizing its assets to generate profits.

ROIC reflects the efficiency and profitability of a company by measuring how effectively it generates returns from its invested capital. A high ROIC indicates that a company is generating strong profits relative to the amount of capital invested in its operations. This can be a sign of operational excellence, as it suggests that the company is effectively utilizing its resources to generate profits. A high ROIC can also indicate that a company has a competitive advantage, as it suggests that the company is able to generate higher returns than its competitors.

Innovation and Technological Advancements: Fueling Air Products’ ROIC

Air Products has a strong commitment to innovation and technological advancements, which has played a significant role in driving its high ROIC. The company invests heavily in research and development to develop new products and technologies that meet the evolving needs of its customers. This focus on innovation has allowed Air Products to stay ahead of its competitors and maintain a strong market position.

One example of how innovation has contributed to higher ROIC for Air Products is the development of its proprietary cryogenic technology. This technology allows the company to produce and distribute industrial gases more efficiently, resulting in cost savings and improved profitability. By continuously investing in research and development, Air Products has been able to develop new technologies that improve its operational efficiency and drive higher returns on invested capital.

Continuous innovation is essential for maintaining a competitive advantage in the industrial gases industry. As customer needs and market dynamics change, companies must adapt and develop new solutions to stay ahead. By investing in innovation, Air Products ensures that it remains at the forefront of technological advancements, allowing it to deliver superior products and services to its customers and drive higher ROIC.

Market Expansion: How Air Products’ Global Presence Drives ROIC

Air Products has a strong global presence, with operations in over 50 countries around the world. This global footprint has been instrumental in driving the company’s high ROIC. By expanding into new markets, Air Products has been able to increase its revenue and generate higher returns on invested capital.

The company’s market expansion strategies have focused on entering emerging markets with high growth potential. By identifying and capitalizing on these opportunities, Air Products has been able to tap into new customer segments and diversify its revenue streams. This has helped the company mitigate risks associated with economic downturns in specific regions and maintain a consistent level of profitability.

Expanding into new markets presents both benefits and challenges for companies like Air Products. On one hand, it allows them to access new customers and revenue streams, driving higher ROIC. On the other hand, it requires significant investments in infrastructure, distribution networks, and local partnerships. Managing these challenges effectively is crucial for success in new markets and ensuring a positive impact on ROIC.

Strategic Partnerships: A Key Driver of Air Products’ Success

Air Products has established strategic partnerships with other companies as a key driver of its success and high ROIC. These partnerships allow the company to leverage the strengths and capabilities of its partners to drive innovation, expand its product offerings, and enter new markets.

One example of a strategic partnership for Air Products is its collaboration with Saudi Aramco, the world’s largest oil company. Through this partnership, Air Products has gained access to Saudi Aramco’s extensive infrastructure and resources, enabling it to expand its presence in the Middle East and tap into the region’s growing demand for industrial gases. This partnership has been instrumental in driving higher ROIC for Air Products by providing access to new customers and revenue streams.

Collaboration and synergy are essential for achieving success in today’s complex business environment. By partnering with other companies, Air Products is able to combine its expertise with the strengths of its partners, creating a win-win situation that drives higher ROIC for all parties involved. Strategic partnerships also allow companies to share risks and resources, enabling them to pursue opportunities that would be difficult to achieve on their own.

Operational Efficiency: Optimizing Processes for Higher ROIC

Air Products has a strong focus on operational efficiency and process optimization, which has contributed to its high ROIC. The company continuously looks for ways to streamline its operations, reduce costs, and improve productivity. By optimizing its processes, Air Products is able to generate higher returns on invested capital.

One example of how Air Products has achieved operational efficiency is through the implementation of lean manufacturing principles. The company has adopted a continuous improvement mindset, constantly seeking ways to eliminate waste and improve the efficiency of its production processes. This focus on operational excellence has resulted in cost savings and improved profitability, driving higher ROIC.

Operational efficiency plays a crucial role in driving profitability for companies like Air Products. By optimizing processes and reducing costs, companies can improve their profit margins and generate higher returns on invested capital. This allows them to reinvest in their business, fund future growth initiatives, and drive long-term shareholder value.

Sustainable Practices: Environmental Responsibility and ROIC

Air Products is committed to sustainable practices and environmental responsibility, which has positively impacted its ROIC. The company recognizes that sustainability is not only important from an ethical standpoint but also from a business perspective. By integrating sustainability into its operations, Air Products has been able to reduce costs, improve efficiency, and drive higher returns on invested capital.

One example of how Air Products has embraced sustainability is through the use of renewable energy sources in its operations. The company has invested in renewable energy projects such as wind farms and solar installations to power its facilities. By reducing its reliance on fossil fuels, Air Products has been able to lower its energy costs and improve its environmental footprint, resulting in cost savings and improved profitability.

Sustainability is becoming increasingly important in today’s business landscape. Customers, investors, and other stakeholders are placing greater emphasis on companies’ environmental and social impact. By adopting sustainable practices, companies like Air Products can enhance their brand reputation, attract environmentally conscious customers, and drive higher ROIC.

Talent Acquisition and Development: Investing in People for ROIC

Air Products recognizes the importance of investing in its people as a key driver of its success and high ROIC. The company has a strong focus on talent acquisition and development, ensuring that it has a skilled and motivated workforce to drive innovation, operational excellence, and customer satisfaction.

Air Products has implemented various initiatives to attract and retain top talent. The company offers competitive compensation packages, career development opportunities, and a supportive work environment. By investing in its employees, Air Products is able to attract and retain the best talent in the industry, driving higher ROIC through their contributions.

A skilled and motivated workforce is essential for driving success in today’s competitive business environment. Employees are the backbone of any organization, and their knowledge, skills, and dedication are critical for achieving high performance and driving profitability. By investing in talent acquisition and development, Air Products ensures that it has the right people in place to deliver superior results and generate higher returns on invested capital.

Customer-Centric Approach: Enhancing ROIC through Customer Satisfaction

Air Products has adopted a customer-centric approach and prioritizes customer satisfaction as a key driver of its success and high ROIC. The company understands that satisfied customers are more likely to be loyal, repeat customers who generate consistent revenue and contribute to long-term profitability.

Air Products focuses on understanding its customers’ needs and delivering solutions that meet or exceed their expectations. The company invests in market research, customer feedback programs, and relationship management initiatives to ensure that it remains responsive to its customers’ evolving needs. By prioritizing customer satisfaction, Air Products is able to build strong relationships with its customers, drive loyalty, and generate higher returns on invested capital.

Prioritizing customer satisfaction is essential for driving profitability in today’s competitive business landscape. Customers have more choices than ever before, and their loyalty cannot be taken for granted. By delivering exceptional customer experiences, companies like Air Products can differentiate themselves from their competitors, attract new customers, and drive higher ROIC.

Future Outlook: Predicting Air Products’ Continued Success and ROIC Growth

Looking ahead, Air Products is well-positioned for continued success and ROIC growth. The company has a strong foundation built on its commitment to innovation, operational excellence, sustainability, and customer satisfaction. These core pillars will continue to drive its performance and generate higher returns on invested capital.

In terms of innovation, Air Products will continue to invest in research and development to develop new products and technologies that meet the evolving needs of its customers. The company will also focus on expanding its global presence and entering new markets with high growth potential. By leveraging its strategic partnerships and optimizing its operations, Air Products will be able to drive efficiency, reduce costs, and improve profitability.

The growing importance of sustainability in business success presents both challenges and opportunities for Air Products. The company will need to continue investing in renewable energy sources and implementing sustainable practices to reduce its environmental footprint and drive cost savings. At the same time, it can capitalize on the increasing demand for sustainable solutions by offering innovative products and services that help customers achieve their sustainability goals.

In conclusion, Air Products’ success can be attributed to its focus on key drivers such as innovation, market expansion, strategic partnerships, operational efficiency, sustainable practices, talent acquisition and development, and customer satisfaction. By continuing to prioritize these areas, Air Products is well-positioned for continued success and ROIC growth in the future.