Introduction: Understanding Linde’s ROIC Success

Linde is a global industrial gases and engineering company that operates in over 100 countries. With a history dating back over 140 years, the company has established itself as a leader in its industry, providing a wide range of products and services to customers in various sectors such as healthcare, manufacturing, and energy.

Return on Invested Capital (ROIC) is a key metric used by investors and analysts to evaluate a company’s financial performance. It measures the profitability of a company’s investments and indicates how effectively it is utilizing its capital to generate returns. A high ROIC indicates that a company is generating strong returns on the capital it has invested, while a low ROIC suggests that the company is not efficiently utilizing its resources.

Linde’s ROIC Explained: What is ROIC and Why is it Important?

ROIC is calculated by dividing a company’s operating income (earnings before interest and taxes) by its invested capital. Invested capital includes both equity and debt, representing the total amount of capital that has been invested in the company.

ROIC is an important metric for investors and shareholders because it provides insight into how well a company is generating returns on the capital it has invested. It helps investors assess the efficiency and profitability of a company’s operations, as well as its ability to generate cash flows.

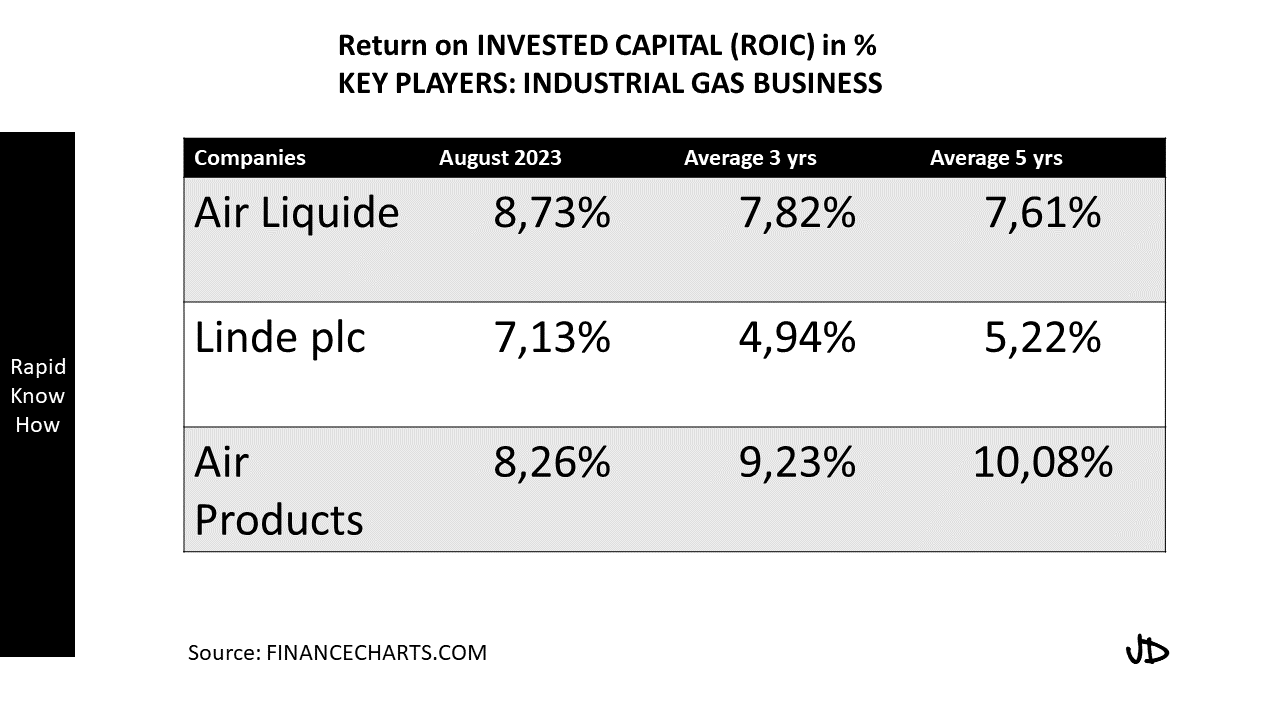

When comparing Linde’s ROIC to industry peers, it becomes evident that the company has consistently outperformed its competitors. This indicates that Linde has been able to generate higher returns on its invested capital compared to its peers, which is a positive sign for investors.

Furthermore, when analyzing Linde’s historical performance, it is clear that the company has been able to maintain a high ROIC over time. This demonstrates the company’s ability to consistently generate strong returns on its investments, which is an important factor for long-term investors.

Strong Operational Efficiency: Linde’s Commitment to Cost Management

Linde has a strong focus on operational efficiency and cost management, which has played a significant role in its ROIC success. The company has implemented various initiatives and strategies to improve operational efficiency and control costs.

One example of Linde’s commitment to operational efficiency is its continuous improvement program, which aims to identify and implement cost-saving measures across the organization. This program involves regular reviews of processes and operations to identify areas for improvement and implement changes that can lead to cost savings.

Linde also invests in technology and automation to improve operational efficiency. By leveraging cutting-edge solutions, the company is able to streamline its operations, reduce manual labor, and increase productivity. This not only improves the company’s profitability but also contributes to its ability to generate higher returns on its invested capital.

The impact of strong operational efficiency on Linde’s ROIC can be seen in the company’s financial performance. By effectively managing costs and improving operational efficiency, Linde has been able to generate higher profits and cash flows, which in turn has contributed to its high ROIC.

Strategic Investments: Linde’s Focus on High-ROI Projects

Linde’s approach to capital allocation and investment decisions is another key factor contributing to its ROIC success. The company focuses on identifying and investing in high-ROI projects that have the potential to generate strong returns.

Linde evaluates potential investment opportunities based on their expected return on investment, taking into account factors such as market demand, competitive landscape, and potential risks. The company conducts thorough due diligence before making investment decisions, ensuring that it invests in projects that have a high probability of success.

One example of a successful strategic investment made by Linde is its acquisition of Praxair in 2018. This merger created the world’s largest industrial gases company, with increased scale and geographic reach. The acquisition was expected to generate significant cost synergies and operational efficiencies, which would contribute to Linde’s ROIC.

By focusing on high-ROI projects, Linde is able to allocate its capital effectively and generate strong returns on its investments. This has been a key driver of the company’s ROIC success.

Innovation and Technology: Linde’s Embrace of Cutting-Edge Solutions

Linde is committed to innovation and technological advancements, which has played a crucial role in its operational efficiency and ROIC success. The company leverages innovation and technology to improve its processes, products, and services, resulting in increased efficiency and profitability.

Linde invests in research and development to develop new technologies and solutions that can enhance its operations. For example, the company has developed advanced gas separation technologies that enable the efficient production of industrial gases. These technologies not only improve the quality and purity of the gases produced but also reduce energy consumption and emissions.

In addition to internal research and development, Linde also collaborates with technology companies and academic institutions to leverage external expertise and stay at the forefront of technological advancements. By partnering with leading technology companies, Linde is able to access cutting-edge solutions that can further enhance its operational efficiency and drive its ROIC.

The impact of innovation and technology on Linde’s ROIC can be seen in its financial performance. By leveraging innovative solutions, the company has been able to improve its operational efficiency, reduce costs, and increase profitability. This has contributed to its ability to generate higher returns on its invested capital.

Global Expansion: Linde’s Ability to Capture New Markets

Linde’s global presence and expansion strategy have been instrumental in its ROIC success. The company has a strong track record of identifying and entering new markets, allowing it to capture new growth opportunities and generate higher returns.

Linde’s global expansion strategy involves entering new markets through organic growth or acquisitions. The company conducts thorough market research to identify markets with high growth potential and favorable market dynamics. It then develops a market entry strategy that aligns with its business objectives and leverages its core competencies.

One example of successful market expansion by Linde is its entry into the Chinese market. China is one of the fastest-growing markets for industrial gases, driven by the country’s rapid industrialization and urbanization. Linde recognized this growth opportunity and established a strong presence in China through strategic partnerships and investments.

By expanding into new markets, Linde is able to diversify its revenue streams and reduce its dependence on specific regions or industries. This not only improves the company’s financial stability but also contributes to its ability to generate higher returns on its invested capital.

Customer Relationships: Linde’s Commitment to Long-Term Partnerships

Linde places a strong emphasis on building and maintaining long-term customer relationships, which has been a key driver of its ROIC success. The company understands the importance of customer loyalty and works closely with its customers to meet their needs and exceed their expectations.

Linde’s commitment to customer relationships is reflected in its customer-centric approach. The company invests in understanding its customers’ businesses and industries, allowing it to develop tailored solutions that address their specific needs. By providing value-added services and solutions, Linde is able to differentiate itself from competitors and build strong customer loyalty.

In addition to providing excellent customer service, Linde also focuses on customer retention strategies. The company works proactively to identify potential issues or challenges that may arise in its customer relationships and takes proactive measures to address them. This includes regular communication with customers, ongoing support, and continuous improvement initiatives.

Strong customer relationships contribute to Linde’s ROIC by driving customer loyalty and repeat business. By maintaining long-term partnerships with its customers, the company is able to generate stable revenue streams and improve its profitability. This has a positive impact on its ROIC, as it indicates that the company is effectively utilizing its capital to generate returns.

Sustainable Practices: Linde’s Environmental and Social Responsibility

Linde is committed to sustainability and corporate social responsibility, which has been a key factor contributing to its ROIC success. The company recognizes the importance of environmental and social responsibility and integrates sustainable practices into its operations.

Linde’s sustainability initiatives include reducing greenhouse gas emissions, conserving resources, and promoting the use of renewable energy sources. The company invests in technologies and processes that minimize its environmental impact and improve its energy efficiency. By reducing its carbon footprint, Linde not only contributes to a more sustainable future but also improves its operational efficiency and profitability.

In addition to environmental sustainability, Linde also focuses on social responsibility. The company invests in the well-being and development of its employees, ensuring a safe and inclusive work environment. It also engages with local communities and supports social initiatives that align with its values.

Sustainable practices contribute to Linde’s ROIC by improving its operational efficiency and reducing costs. By implementing energy-efficient technologies and processes, the company is able to reduce its energy consumption and lower its operating expenses. This improves its profitability and contributes to its ability to generate higher returns on its invested capital.

Strong Leadership: Linde’s Management Team and Corporate Culture

Linde’s management team and corporate culture have played a significant role in the company’s ROIC success. The company is led by a team of experienced executives who have a deep understanding of the industry and a strong track record of driving growth and profitability.

The management team at Linde adopts a proactive approach to leadership, focusing on strategic planning, execution, and performance management. They set clear goals and objectives for the company, communicate them effectively to employees, and provide the necessary resources and support to achieve them.

Linde’s corporate culture is characterized by a strong focus on teamwork, collaboration, and continuous improvement. The company encourages employees to share ideas, take ownership of their work, and strive for excellence. This fosters a culture of innovation and accountability, which contributes to the company’s ability to generate higher returns on its invested capital.

Strong leadership has been instrumental in Linde’s ROIC success by driving a culture of operational excellence and innovation. The management team’s strategic vision and effective execution have enabled the company to consistently generate strong returns on its investments.

Conclusion: The Future of Linde’s ROIC Success

In conclusion, Linde’s ROIC success can be attributed to several key factors. The company’s strong operational efficiency, strategic investments, focus on innovation and technology, global expansion strategy, commitment to customer relationships, sustainable practices, and strong leadership have all played a significant role in its ability to generate high returns on its invested capital.

Looking ahead, Linde is well-positioned for continued ROIC success. The company operates in a growing industry with favorable market dynamics, providing ample opportunities for growth. By continuing to focus on its core strengths and leveraging its competitive advantages, Linde can maintain and improve its ROIC in the future.

However, there are also challenges that Linde may face in maintaining and improving its ROIC. These include increasing competition, changing market dynamics, and regulatory pressures. To overcome these challenges, the company will need to continue to innovate, adapt to market changes, and invest in new growth opportunities.

Overall, Linde’s ROIC success is a testament to its strong business model, strategic focus, and commitment to excellence. By continuing to prioritize operational efficiency, strategic investments, innovation, customer relationships, sustainability, and strong leadership, Linde is well-positioned for continued success in generating high returns on its invested capital.