Introduction: Understanding the importance of ROIC in analyzing Air’Liquide’s success

Air’Liquide is a global leader in the industrial gas industry, providing a wide range of gases and services to various industries such as healthcare, energy, and manufacturing. The company has achieved remarkable success in the market, consistently outperforming its competitors and delivering strong financial performance. One crucial metric that investors and analysts use to evaluate Air’Liquide’s success is Return on Invested Capital (ROIC).

ROIC is a key financial metric that measures a company’s ability to generate returns on the capital invested in its operations. It is calculated by dividing a company’s operating income by its invested capital. ROIC provides insights into how efficiently a company utilizes its capital to generate profits and create value for shareholders.

What is ROIC and why is it a crucial metric for evaluating a company’s performance?

ROIC is a crucial metric for evaluating a company’s performance because it takes into account both the profitability and efficiency of a company’s operations. Unlike other traditional financial ratios such as Return on Assets (ROA) or Return on Equity (ROE), which only focus on profitability, ROIC considers the capital invested in a company’s operations.

By incorporating the capital invested, ROIC provides a more accurate measure of how effectively a company utilizes its resources to generate profits. It helps investors and analysts assess whether a company is generating sufficient returns to justify the capital invested in its operations.

Air’Liquide’s ROIC: Examining the company’s track record

Air’Liquide has consistently achieved high ROIC over the years, demonstrating its ability to generate strong returns on the capital invested in its operations.

This track record can be attributed to several factors. Firstly, Air’Liquide has experienced consistent revenue growth, driven by its strong market position and diversified customer base. The company’s ability to generate revenue growth has contributed to its high ROIC by increasing its operating income.

Secondly, Air’Liquide has maintained a high level of profitability, with strong operating margins and efficient cost management. The company’s focus on operational excellence and continuous improvement has helped it achieve higher profitability, resulting in a higher ROIC.

Lastly, Air’Liquide has demonstrated efficient capital allocation, investing in projects and acquisitions that have generated positive returns. The company’s disciplined approach to capital allocation has allowed it to maximize the returns on the capital invested, contributing to its high ROIC.

The key factors driving Air’Liquide’s ROIC: A deep dive into the winning formula

Several key factors contribute to Air’Liquide’s high ROIC. Firstly, the company’s revenue growth is driven by its strong market position and diversified customer base. Air’Liquide operates in a global market and serves a wide range of industries, allowing it to capture opportunities for growth in different sectors. This diversification helps mitigate risks and ensures a steady stream of revenue, contributing to the company’s high ROIC.

Secondly, Air’Liquide’s focus on profitability and cost management plays a crucial role in driving its high ROIC. The company continuously seeks opportunities to improve operational efficiency and reduce costs. By optimizing its supply chain, improving productivity, and implementing cost-saving initiatives, Air’Liquide is able to maintain strong operating margins and generate higher profits, resulting in a higher ROIC.

Lastly, Air’Liquide’s business model and strategy support its high ROIC. The company operates in a capital-intensive industry, requiring significant investments in infrastructure and technology. However, Air’Liquide’s business model allows it to generate stable cash flows and achieve economies of scale. This enables the company to generate higher returns on the capital invested, contributing to its high ROIC.

Industry dynamics: How Air’Liquide’s competitive advantage contributes to its ROIC

Air’Liquide enjoys a competitive advantage in the industrial gas industry, which contributes to its ability to maintain a high ROIC. The industry is characterized by high barriers to entry, including significant capital requirements and complex distribution networks. Air’Liquide’s strong market position and extensive infrastructure give it a competitive edge over new entrants, allowing the company to capture market share and maintain pricing power.

Furthermore, the industrial gas industry is characterized by long-term contracts and customer relationships. Air’Liquide has established strong relationships with its customers, many of whom rely on the company for critical gases and services. This customer loyalty and long-term contracts provide a stable revenue stream for Air’Liquide, contributing to its high ROIC.

Additionally, the industrial gas industry is subject to strict safety and environmental regulations. Air’Liquide’s commitment to safety and sustainability gives it a competitive advantage, as it ensures compliance with regulations and builds trust with customers. This reputation for safety and sustainability further strengthens Air’Liquide’s position in the market and contributes to its high ROIC.

Operational efficiency: Uncovering Air’Liquide’s strategies to maximize returns on invested capital

Air’Liquide has implemented several strategies to maximize returns on invested capital through operational efficiency. The company focuses on cost management and supply chain optimization to reduce expenses and improve profitability.

Air’Liquide continuously seeks opportunities to streamline its operations and eliminate inefficiencies. The company invests in technology and automation to improve productivity and reduce costs. By leveraging digital solutions and data analytics, Air’Liquide can optimize its production processes, minimize waste, and improve resource allocation. These initiatives contribute to higher profitability and a higher ROIC.

Supply chain optimization is another key strategy employed by Air’Liquide to maximize returns on invested capital. The company works closely with suppliers and customers to ensure efficient logistics and minimize transportation costs. By optimizing its supply chain, Air’Liquide can reduce lead times, improve delivery reliability, and enhance customer satisfaction. These efforts contribute to higher profitability and a higher ROIC.

Innovation and R&D: How Air’Liquide maintains a high ROIC

Air’Liquide places a strong emphasis on innovation and research and development (R&D) to maintain a high ROIC. The company invests significant resources in developing new technologies, products, and services to meet the evolving needs of its customers.

Air’Liquide’s innovation efforts focus on areas such as energy transition, healthcare, and digitalization. The company collaborates with customers, universities, and research institutions to develop innovative solutions that address industry challenges and create value for its stakeholders.

By staying ahead of the curve in terms of technology and innovation, Air’Liquide is able to differentiate itself from competitors and maintain a competitive advantage. This allows the company to command premium pricing for its products and services, contributing to its high ROIC.

Capital allocation: Analyzing Air’Liquide’s prudent investment decisions and their impact on ROIC

Air’Liquide’s capital allocation strategy plays a crucial role in driving its high ROIC. The company takes a disciplined approach to investment decisions, carefully evaluating potential projects and acquisitions to ensure they generate positive returns.

Air’Liquide focuses on investments that align with its strategic priorities and have the potential to create long-term value. The company considers factors such as market dynamics, growth potential, and risk profile when evaluating investment opportunities.

By making prudent investment decisions, Air’Liquide is able to allocate capital efficiently and generate higher returns on the capital invested. This contributes to the company’s high ROIC and creates value for shareholders.

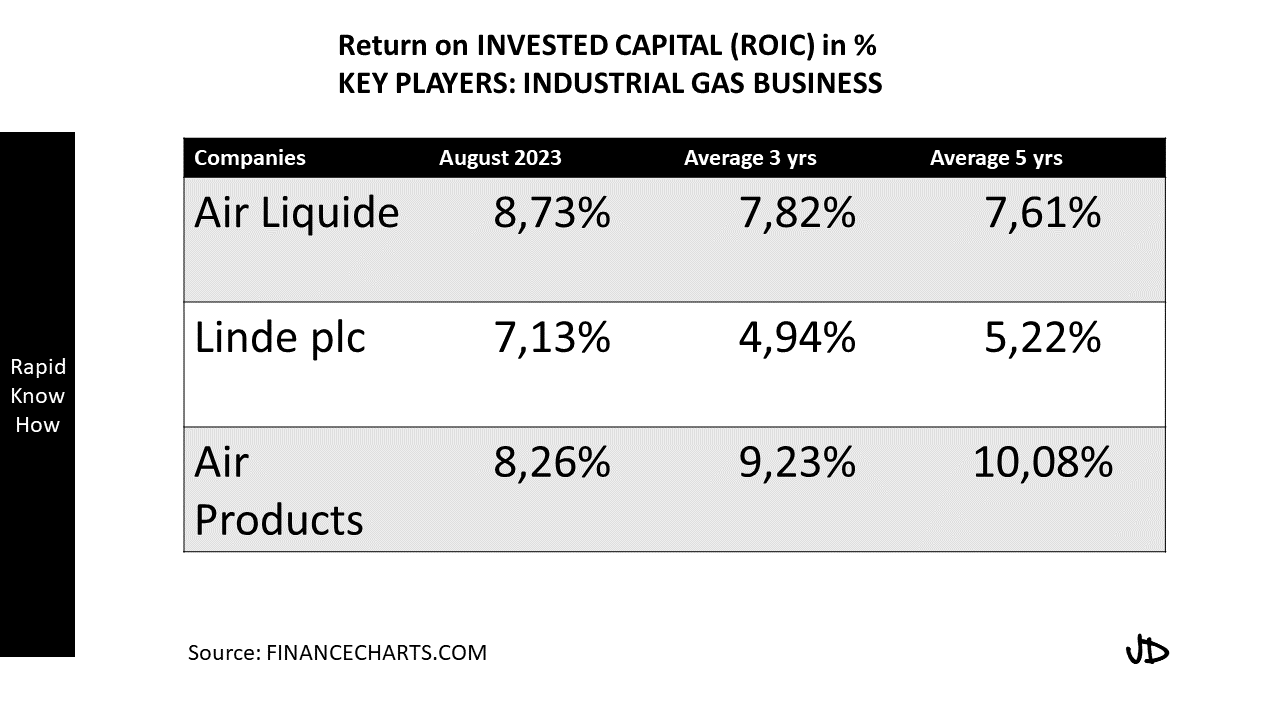

Comparing Air’Liquide’s ROIC to industry peers: Assessing the company’s position in the market

When comparing Air’Liquide’s ROIC to industry peers and competitors, it becomes evident that the company consistently outperforms in some levers its rivals. Air’Liquide’s high ROIC indicates that the company is efficient in generating returns on the capital invested .

This performance can be attributed to several factors, including Air’Liquide’s strong market position, diversified customer base, and focus on operational excellence. The company’s ability to consistently achieve high ROIC demonstrates its competitive advantage and superior performance in the industry.

Furthermore, when comparing Air’Liquide’s ROIC to industry averages, it becomes clear that the company is a leader in terms of capital efficiency. Air’Liquide’s ability to generate higher returns on invested capital compared to industry averages indicates its superior performance and ability to create value for shareholders.

Conclusion: Lessons learned from Air’Liquide’s ROIC success and its implications for investors

Air’Liquide’s exceptional track record of high ROIC provides valuable lessons for investors. Firstly, it highlights the importance of evaluating a company’s ability to generate returns on invested capital when assessing its performance. ROIC provides a comprehensive measure of a company’s profitability and efficiency, allowing investors to make informed investment decisions.

Secondly, Air’Liquide’s success demonstrates the importance of factors such as revenue growth, profitability, efficient capital allocation, and operational efficiency in driving a high ROIC. Investors should consider these factors when evaluating companies and assessing their potential for generating strong returns.

Lastly, Air’Liquide’s competitive advantage in the industrial gas industry and its focus on innovation and R&D highlight the importance of sustainable competitive advantages and continuous improvement. Companies that can differentiate themselves from competitors and stay ahead of industry trends are more likely to achieve a high ROIC and deliver long-term value for shareholders.

In conclusion, Air’Liquide’s high ROIC is a testament to its exceptional performance and ability to generate strong returns on invested capital. By understanding the key factors driving Air’Liquide’s success and applying the lessons learned, investors can make informed investment decisions and identify companies with the potential for high ROIC and long-term value creation.