Return on Invested Capital (ROIC) is a crucial financial metric that investors and business owners use to measure the efficiency of a company’s capital allocation. It is calculated by dividing net operating profit after taxes (NOPAT) by the total invested capital. The higher the ROIC, the more efficiently a company is using its capital to generate profits.

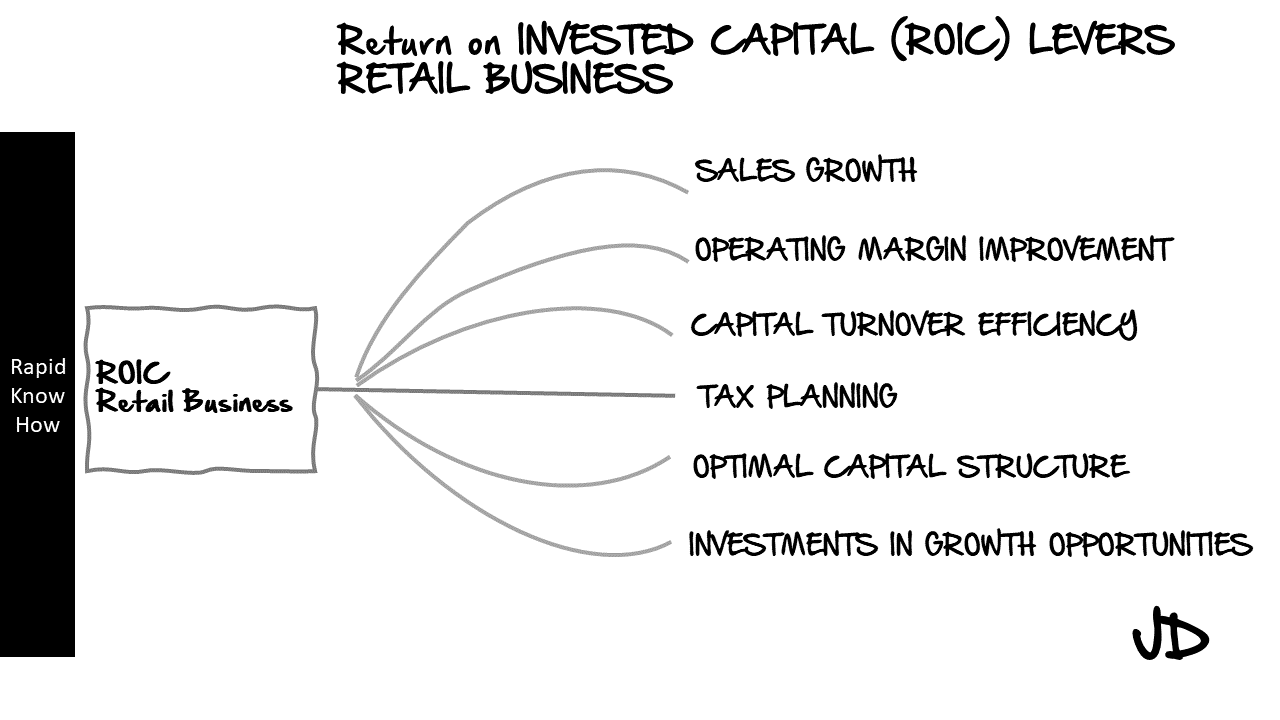

There are several levers that can impact ROIC, and these can be particularly relevant in the context of a retail business.

1. **Sales Growth:** Sales growth is a primary driver of ROIC. In retail, this could be achieved through opening new stores, expanding online sales channels, or increasing same-store sales through improved merchandising or customer service. However, it’s important to note that sales growth must be profitable to positively impact ROIC; unprofitable growth can actually decrease ROIC.

2. **Operating Margin:** This is another key lever for ROIC. It measures how much profit a company makes on each dollar of sales after deducting all direct costs associated with producing and delivering the goods or services sold but before deducting interest and taxes. Retail businesses can improve their operating margin by increasing prices, reducing cost of goods sold through better purchasing practices or more efficient production, or controlling operating expenses.

3. **Capital Turnover:** This measures how effectively a company uses its capital to generate sales. In retail, this could involve managing inventory more effectively to reduce the amount of capital tied up in unsold goods, improving store layout or merchandising to increase sales per square foot, or leveraging technology to reduce the need for physical assets.

4. **Tax Efficiency:** Companies can also improve their ROIC by minimizing their tax liability through legal tax planning strategies. For retail businesses, this might involve locating stores or distribution centers in areas with lower tax rates or taking advantage of tax credits for certain activities.

5. **Capital Structure:** The mix of debt and equity a company uses to finance its operations can also impact ROIC. Using more debt can increase ROIC because interest payments are tax-deductible, reducing the company’s tax liability. However, too much debt can increase financial risk and potentially lead to bankruptcy if the company cannot meet its debt obligations.

6. **Investment in Growth Opportunities:** Companies that invest wisely in growth opportunities can increase their future earnings potential and thus their ROIC. For retailers, this might involve investing in e-commerce capabilities, new store formats, or international expansion.

In conclusion, there are many levers that companies can pull to improve their Return on Invested Capital (ROIC). In retail businesses specifically, these levers often involve strategies around sales growth, operating margin improvement, capital turnover efficiency, tax planning, optimal capital structure decisions and smart investment in growth opportunities.

ROIC boosted from Virtual Assets

ROIC, or Return on Invested Capital, is a profitability ratio that measures the return that an investment generates for those who have provided capital, i.e., bondholders and stockholders. It is a comprehensive measure of a company’s profitability, as it takes into account the cost of capital. In the context of virtual assets, ROIC can be a critical metric to assess the efficiency and profitability of investments made in these digital resources.

Virtual assets can significantly impact the critical levers of retail business, including sales growth, operating margin improvement, capital turnover efficiency, tax planning, optimal capital structure, and investments in growth opportunities.

1. Sales Growth: Virtual assets like digital marketing tools, e-commerce platforms, and customer relationship management software can significantly boost sales growth. They can help retailers reach a broader audience, streamline sales processes, and enhance customer service. The return on these virtual assets can be measured using ROIC by comparing the increase in sales to the capital invested in these digital tools.

2. Operating Margin Improvement: Virtual assets can also help improve operating margins by reducing costs and increasing operational efficiency. For example, automation tools can reduce labor costs, while data analytics tools can provide insights to optimize pricing strategies and inventory management. The ROIC from these virtual assets would be the increase in operating margin divided by the capital invested.

3. Capital Turnover Efficiency: This refers to how effectively a company uses its capital to generate revenue. Virtual assets like supply chain management software can improve capital turnover efficiency by reducing inventory levels and shortening cash conversion cycles. The ROIC from these virtual assets would be the increase in revenue divided by the decrease in invested capital.

4. Tax Planning: Virtual assets like tax software can help retailers optimize their tax planning strategies. These tools can identify tax-saving opportunities and ensure compliance with tax laws, thereby reducing tax liabilities and increasing after-tax profits. The ROIC from these virtual assets would be the decrease in tax expense divided by the capital invested.

5. Optimal Capital Structure: Virtual assets like financial modeling software can help retailers determine their optimal capital structure – the mix of debt and equity that minimizes their cost of capital. This can enhance shareholder value and increase ROIC.

6. Investments in Growth Opportunities: Finally, virtual assets like market research tools and business intelligence software can help retailers identify and capitalize on growth opportunities. These tools provide valuable insights into market trends, customer behavior, and competitive dynamics that can inform strategic decisions about product development, market expansion, mergers and acquisitions, etc.

In conclusion, virtual assets have the potential to significantly impact various critical levers of retail business performance. By measuring ROIC from these digital resources, retailers can assess their effectiveness and make informed decisions about where to allocate their capital for maximum return.

Artifical Intelligence (AI) for each Retail Lever

Artificial Intelligence (AI) has been a game-changer in the retail industry, revolutionizing various aspects of retail operations and strategy. Let’s delve into how AI applications can impact each retail lever, including sales growth, operating margin improvement, capital turnover efficiency, tax planning, optimal capital structure, and investments in growth opportunities.

1. Sales Growth: AI can significantly boost sales growth in retail. Machine learning algorithms can analyze customer behavior and preferences to predict future buying patterns. This predictive analysis can help retailers tailor their offerings to meet customer needs better, leading to increased sales. Additionally, AI-powered chatbots can provide personalized shopping experiences, further driving sales growth.

2. Operating Margin Improvement: AI can help improve operating margins by optimizing inventory management and reducing operational costs. AI algorithms can predict demand for different products at different times, helping retailers maintain optimal inventory levels and reduce storage costs. Furthermore, AI can automate various operational processes such as billing, customer service, etc., reducing labor costs and improving efficiency.

3. Capital Turnover Efficiency: Capital turnover efficiency refers to how effectively a company uses its capital to generate revenue. AI can enhance this efficiency by optimizing supply chain management. For instance, AI can predict demand trends and help retailers manage their supply chain more effectively, reducing capital tied up in inventory and improving capital turnover.

4. Tax Planning: While AI’s role in tax planning is still emerging, it holds significant potential. AI can analyze vast amounts of financial data to identify tax-saving opportunities that might be missed by human analysts. It can also automate the tax filing process, reducing errors and ensuring compliance with tax laws.

5. Optimal Capital Structure: AI can assist in achieving an optimal capital structure by providing insights into market trends and predicting future financial scenarios. These insights can help retailers make informed decisions about debt and equity financing to minimize cost of capital and maximize shareholder value.

6. Investments in Growth Opportunities: Lastly, AI can help retailers identify growth opportunities by analyzing market trends and customer behavior. For instance, machine learning algorithms can identify products or services that are likely to be popular in the future based on current trends. This information can guide investment decisions and help retailers capitalize on growth opportunities.

In conclusion, the applications of AI in retail are vast and varied. From boosting sales growth to improving operating margins to enhancing capital turnover efficiency to aiding in tax planning and investment decisions – AI has the potential to transform every aspect of retail operations and strategy. As such, it is imperative for retailers to embrace this technology and leverage its capabilities to stay competitive in the rapidly evolving retail landscape.