Discover the industrial gas pricing rules that drive success in one hour

An understanding of the cost structure or cost drivers applicable to each type of industrial gas provides an understanding of the reasons for the various modes of supply and the price levels which result.

[emaillocker id=”9557″]

With the exception of special gases and (to a degree) argon, the industrial gases are not traded internationally, and pricing is therefore generally done on a national or even local basis to reflect local production costs and the immediate competitive environment.

Domestic/national production costs can differ markedly between countries depending on the available production or recovery methods, the scale of these local facilities, feed-stock and energy costs.

GENERIC COST FACTORS

GENERIC COST FACTORS

Before turning our attention to each gas it is useful to classify the primary cost drivers into:

• prime production/recovery costs:

- raw materials/feed-stock price

- energy o capital cost recovery

- production labour • distribution costs

- “repackaging” (for different supply modes)

- delivery of gases • administrative costs

- marketing

- applications & product development

- sales effort

- order processing

- accounting and general administration

These are not dissimilar to what other industries face or incur, but in the case of most industrial gases, the two primary costs are the power and the distribution costs.

PRIME COSTS

Most industrial gases are either raw material or energy intensive (but not both) and reasonably capital intensive to manufacture/recover. Labour costs are moderate at the prime cost level.

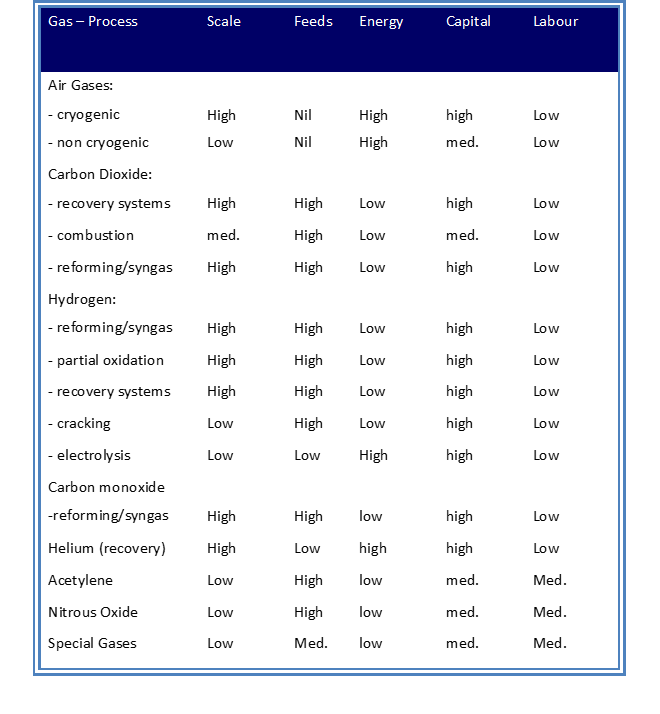

Table 1 presents a comparison of the importance of each prime cost factors (on a scale from nil to high) in determining prime production unit costs according to the gas and method.

It also indicates how well the process “scales up” (i.e. the advantages of scale):

TABLE 1

IMPACT OF COST FACTORS ON PRIME COSTS

Gases are produced in expensive process plant, which leads to capital intensity and advantages of scale (but low labour costs).

Exceptions are acetylene and nitrous oxide where the process plant is simple, raw material costs crucial and operating labour significant.

The main method of producing the air gases, oxygen, nitrogen, argon and the noble gases (excluding helium) remains the cryogenic distillation of air.

It has the advantage of being capable of producing high purity gases in large volumes.

However it is capital and energy intensive.

Typical power consumption levels for producing air gases by cryogenic means include:

Large GOX/GAN 0.55 kWh/Nm3

Large LOX/LIN 0.60- 0.75 kWh/Nm3

Small LOX/LIN 1.40 – 2.50 kWh/Nm3

In the case of non-cryogenic nitrogen and oxygen, capital costs are more moderate than with cryogenic processes providing the purities are not high, and the plant can be operated round the clock. However, the processes do not scale up well since the amount of sieve or membrane material (the major component of plant cost) is directly proportional to the output capacity and electricity costs are still high. It is impractical to liquefy the products.

A typical power consumption level for an O2 VPSA (1000 nm3/h) would be 0.55-0.60 Kwh/nm3 of gas

Syngas production for H2, CO and CO2 and recovery systems for these gases entail capital intensive plants where economies of scale are highly significant.

However, feed-stock costs are a crucial determinant of final product cost and usually decide the method to be used.

On the other hand, hydrogen production from ammonia cracking or electrolysis is in small-scale processes which do not scale up well. The cost of ammonia is crucial to the first and the cost of electricity to the second. Dedicated combustion plants for CO2 are a moderate expense, but fuel cost is all important.

Helium recovery is capital and energy intensive since liquefaction of helium requires a great deal of energy.

DISTRIBUTION COSTS

For the sake of convenience, we include in this category the costs associated with changing the state or packaging of the product to effect one or more supply modes (pipeline or on-site, bulk or compressed), as well as the physical costs of distribution to the customer.

Distribution costs are minimised where gases can be delivered directly to the customer’s process by pipeline. In this case, they are limited to the operating costs of the pipeline – pipeline capital costs, maintenance and pipeline compression.

This is the basis for tonnage/on-site supply schemes to major customers with steady 24-hour demand patterns.

For liquid supplies – required by customers with variable demand, (this includes back-up to pipeline supplies), those that have insufficient volume to warrant a pipeline or those requiring to use the cryogenic properties of a gas – there is often an additional cost to that of the production on cost for liquid for delivery by road or rail to the customer.

These costs include the capital of the cryogenic tanker, labour and fuel costs.

Usually this is relatively high in Europe (€1.75-€2.25 per ton per km) compared with that in the US.

Compressed gases, unless produced directly at the prime production stage (nitrous oxide, acetylene) entail additional compression costs.

To reduce overall distribution costs, cylinders are often filled in regional centres (compressing stations) remote from the production centres from which they are shipped in bulk.

For compressed gas/cylinder supplies the labour element of filling cylinders, maintaining cylinders and cylinder fittings and delivering cylinders to customers are considerable. (The initial cost of a cylinder is also significant relative to the amount of gas held, although they have a long life, e.g. $150 per cylinder).

In developed economies especially, this makes cylinder gases much more expensive than bulk supplies, but small customers cannot justify the cost of liquid storage, and in all markets, there is a very large population of customers who use a few cylinders of gases per year.

It will be evident that distribution costs per unit increase as customer volume decreases and the prime reasons for the different supply modes result from a tradeoff between capital and other distribution costs.

Pipeline distribution costs are very low and depend more on market price levels than cost allocation. Many companies write their pipeline down over a long period, and capital charges are low. Operating costs are negligible for all except CO pipelines which are avoided.

ADMINISTRATIVE COSTS

The different methods of supply and the customer profiles that help to determine this have an impact on the sales and administrative costs of doing business.

For marketing to large-scale users, whether pipeline or bulk, it is necessary to have applications expertise within the gases company which can assist the customer in the efficient use of the gases to improve his costs and quality.

Indeed the gas companies are eager to demonstrate such expertise to expand their market and as far as possible differentiate themselves from competitors.

Even in the case of compressed gases (for example in welding) it is advantageous to be knowledgeable about customers’ processes and requirements, but pipeline and liquid customers require the most effort.

Regarding winning contracts, it takes effort and specialist engineering and commercial knowledge to be able to construct appropriate supply schemes for pipeline supplies. Liquid customers on average require more sales effort and order processing per ton sold, while compressed supplies require well-honed systems of order processing, customer account management and cylinder management.

The management accounting for production and sales is most straightforward for pipeline supplies and the most complex for cylinder supplies which involve further production and distribution costs and a myriad of customers.

COST-VOLUME RELATIONSHIPS

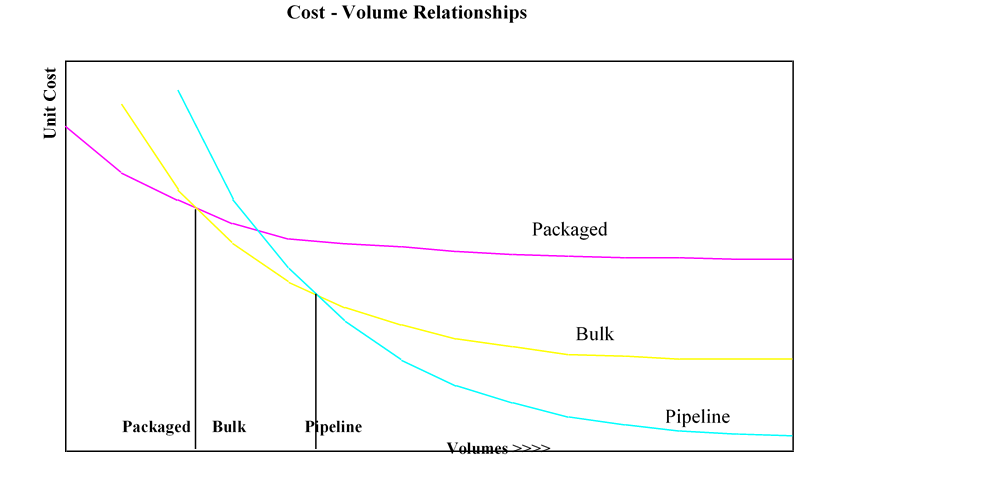

Although there are additional costs incurred as one moves from a pipeline to bulk to packaged supplies, the trade-off between capital and other costs is volume related, and this determines the most appropriate supply mode for a particular customer.

In general, it is possible to construct cost versus volume curves, which will indicate the correct choice, subject to special uses or demand patterns.

The cost scale will reflect local supply structures (economies of scale, power costs, feed-stock prices, labour costs, etc.) and the cross-over points on the volume axis will vary somewhat, but a typical set of curves for air gases will show a pattern similar to those presented in Figure 2.

FIGURE 2

COST-VOLUME RELATIONSHIP (Indicative only)

PRICING ISSUES

Prices naturally tend to follow the pattern of costs. The pattern of costs is heavily influenced by the available supply modes.

The absolute levels are also determined by the available sources of supply, the scale of production and the unit costs of the factors of supply – energy costs, fed-stock costs, labour rates, etc. and these can vary widely from one country to another.

In highly developed economies the cost variations between supply modes tend to be larger than in developing economies because: Labour costs are higher economies of scale are greater distribution costs are higher administrative costs are higher, and therefore the differential impact is greater.

In Europe, the unit prices of liquid oxygen are typically 4-5 times pipeline prices, and compressed oxygen can be 1530 times pipeline prices depending on annual volume.

The pricing mechanisms in use to recover costs and make adequate returns on investment are discussed in the commercial practices post. However the ability to apply premium pricing to low volume packaged gases can make this a very profitable business

[/emaillocker]