You want to get quick insight into the top drivers of the carbon dioxide market for the budget 2018.

You want to get quick insight into the top drivers of the carbon dioxide market for the budget 2018.

Here is a fact post that will help you to get a quick overview of the top 3 facts about the global carbon dioxide market.

[emaillocker id=”9547″]

QUICK SUMMARY

The Industrial carbon dioxide market depends on low production and distribution cost for high specification products and a technical knowledge of applications

FACT 1 – TOP 5 CRITICAL SUCCESS FACTORS

1) The Source of Carbon Dioxide – High carbon dioxide content, low impurities

The essential basis for a sound business is a source of carbon dioxide of suitable quality at a competitive cost. A good source of carbon dioxide is one which has feed gas stream of good purity, at least 90% carbon dioxide, by volume, and free from unacceptable impurities. The source should be available at high pressure, and with consistent available volumes. The price paid for the source must be economically better than the price and cost of treatment of a source of poorer quality.

2) Location of Plant – proximity to end-users

High quality carbon dioxide sources are seldom located near the centre of the market for carbon dioxide. However, a high quality source somewhat further from end-user locations may more than justify the additional distribution costs.

3) Production Capacity –size matters

Carbon dioxide plants are sized to meet peak demands which usually occur during the summer. World-scale carbon dioxide plants are generally in the range 200-300 mt/d but some much larger plants exist in developed regions like North America.

4) Quality – purity is the key

More than 65% of merchant carbon dioxide is used in the food industry for food preparation and in the production of beverages. Rigorous national standards and tight quality control procedures are now common in nearly all regions to avoid product contamination.

5) Price of Carbon Dioxide – Ever Lower

The use of carbon dioxide in carbonation of drinks has competition from the larger producers own production but has only market competition for smaller users. The use of carbon dioxide as a refrigerant is more price sensitive because there are many other competing technologies such as liquid nitrogen, which gives a better product, and mechanical refrigeration which has lower operating expenses. Since the major volumes are to large users this keeps prices in check.

FACT 2 – TOP 5 WAYS OF SUPPLY

1) Source of Carbon Dioxide

- The most commonly developed source for carbon dioxide used to be from Ammonia plants, due to the easy availability of high purity crude carbon dioxide. There have been many closures of Ammonia plants in North America and Europe and other more reliable sources have gained market share. It will be interesting to see what impact frack-gas has on the ammonia market.

- Industrial gas companies have developed high purity sources of carbon dioxide such as natural wells, chemical production by-products and off-gas from bioethanol. Steam reformer plants for hydrogen are a growing source since these are often owned by the industrial gas companies.

- In remote or developing regions, carbon dioxide is often made from the combustion products of natural gas or other hydrocarbons, usually in small quantities.

- Carbon dioxide used for EOR (Enhanced Oil Recovery) is mainly from wells or as part of inert gas, but liquid carbon dioxide is used for some remote, high value fields and gaseous carbon dioxide is pipelined from some gasification projects to fields up to 250 miles away

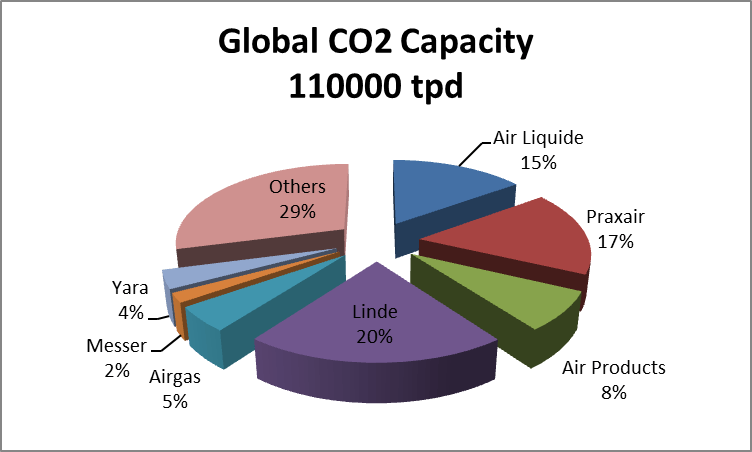

2) Carbon dioxide Suppliers to the Market

The carbon dioxide market was originally developed by companies outside of the usual industrial gas business, but gradually synergies with other gases have led to all of them entering the market in the last 35 years. Some, like Air Products have been in and out of the market but are now firmly in. Others, like Praxair, have started vertically integrating the business by buying hospitality suppliers.

Figure below shows the market split by production volume.

FACT 3 – TOP 2 MARKET FIGURES

The worldwide demand for merchant carbon dioxide at the end of 2013 totalled 52000 mt/d, (19.1MM mt/y) and is growing at 3%-5% per year. This includes liquid carbon dioxide, compressed cylinders and Dry Ice). On-site supply schemes are very few (<1%) and Liquid carbon dioxide for EOR is also very small.

1) By Volume

The North American market is the largest market for merchant carbon dioxide and reached 27550 mt/d in 2013, which is 53% of the global market.

- In addition the North America used more than 100000 mt/d for EOR mainly directly from carbon dioxide wells by pipeline to the oilfields

- The overall growth rate in north America is more than 5% per year if EOR is included and 2.5% per year for merchant carbon dioxide

The European market, the next largest is significantly lower and totalled 10850 mt/d in 2013 which is 21% of the global total

- The market in the developing regions of Eastern Europe are still growing fast and this builds on the lower underlying growth in the more mature economies. We would expect to see growth of 2%-3% in the near future. EOR using carbon dioxide is not a major factor in the market, except possibly in Russia where information is scant.

The Market for carbon dioxide in the Rest of the World was 13600 mt/d (26% of the market)

- This region has the smallest plants and also the poorest data so may be understated. Little information exists on on-purpose carbon dioxide generation for EOR and recent projects have tended to favour nitrogen injection.

Food and beverage end uses account for more than 70% of the world merchant carbon dioxide market by volume

2) By Value

The world market for carbon dioxide is valued at about $2.9 billion (2013)

- the US is $1280 million

- Europe is $735 million

- The ROW is $895 million

[/emaillocker]