1. Increase sales: Focus on increasing revenue by implementing effective marketing strategies, improving product offerings, and expanding into new markets.

2. Reduce expenses: Analyze your expenses and look for areas where you can cut costs without sacrificing quality. This could include renegotiating contracts with suppliers, finding more cost-effective solutions, or streamlining operations.

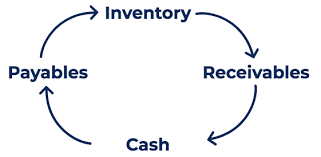

3. Improve cash collection: Implement a strong accounts receivable process to ensure timely payment from customers. This could include offering incentives for early payment, sending regular reminders, and following up on overdue invoices.

4. Negotiate better terms with suppliers: Work with your suppliers to negotiate better payment terms, such as extended payment terms or discounts for early payment. This can help improve your cash flow by giving you more time to pay your bills.

5. Manage inventory effectively: Avoid overstocking inventory by closely monitoring sales trends and adjusting your inventory levels accordingly. This can help free up cash that would otherwise be tied up in excess inventory.

6. Offer prepayment discounts: Encourage customers to pay upfront by offering discounts for prepayment. This can help improve your cash flow by bringing in cash before the product or service is delivered.

7. Lease instead of buying: Consider leasing equipment or property instead of purchasing it outright. Leasing can help preserve cash flow by spreading out the cost over time and avoiding large upfront expenses.

8. Implement a strong budgeting process: Develop a detailed budget that includes projected revenues and expenses for each month or quarter. Regularly review and update the budget to ensure you are staying on track and making necessary adjustments.

9. Explore financing options: If you need additional cash flow to fund growth or cover expenses, consider exploring financing options such as business loans, lines of credit, or invoice factoring.

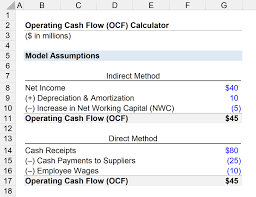

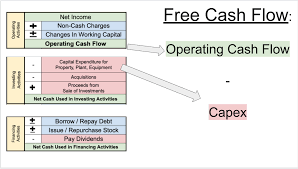

10. Monitor and analyze cash flow regularly: Keep a close eye on your cash flow by regularly reviewing financial statements and analyzing key metrics such as cash conversion cycle, operating cash flow, and free cash flow. This will help you identify any potential issues early on and make necessary adjustments to improve cash flow.