Return on Invested Capital (ROIC) is a financial metric that is widely used to measure the probability of gaining a return from an investment. It is a ratio that indicates the efficiency and profitability of a company’s capital investments. ROIC is particularly useful when comparing the profitability of companies within the same industry, such as the industrial gases sector.

In this context, let’s examine and compare the ROIC of three major players in the industrial gases industry: Air Liquide, Linde, and Air Products.

Air Liquide, based in France, is one of the world’s largest suppliers of industrial gases by revenues and has operations in over 80 countries. It provides gases for various industries including medical, chemical and electronic manufacturers.

Linde PLC, headquartered in Ireland, is a leading global provider of industrial, process and specialty gases and is one of the largest oil and gas service companies worldwide.

Air Products & Chemicals Inc., based in the USA, is a world-leading Industrial Gases company serving both industrial, energy and technology markets worldwide for over 75 years with innovative solutions that help customers improve productivity and reduce environmental impact.

To compare these companies’ ROICs, we need to look at their net operating profits after taxes (NOPAT) and their invested capital. NOPAT can be calculated by subtracting all operating expenses (including taxes) from revenues. Invested capital is calculated by adding equity to debt (both short-term and long-term), then subtracting cash and cash equivalents.

Comparing the ROIC Ratio of the Industrial Gas KEY PLAYERS

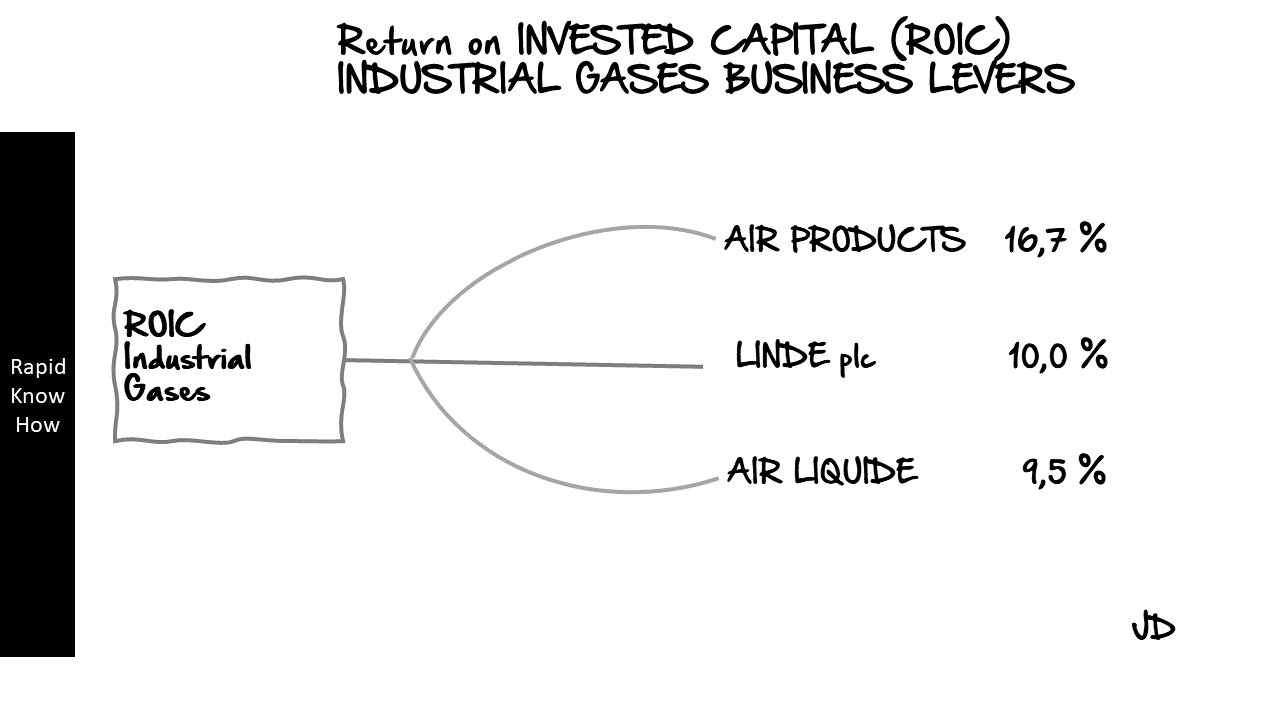

As per recent financial reports:

– Air Liquide had a NOPAT of €3.37 billion with an invested capital of €35.6 billion. This gives us an ROIC of approximately 9.46%.

– Linde had a NOPAT of $4.4 billion with an invested capital of $44 billion. This gives us an ROIC of approximately 10%.

– Air Products had a NOPAT of $2.5 billion with an invested capital of $15 billion. This gives us an ROIC of approximately 16.67%.

From these calculations, it appears that Air Products has the highest ROIC among these three companies.

However, it’s important to note that while ROIC can provide valuable insights into how effectively a company uses its capital to generate profits, it should not be used in isolation when making investment decisions or comparing companies’ performances.

Other factors such as market share, growth rate, profit margins, debt levels and management effectiveness should also be considered alongside ROIC to get a more comprehensive view of a company’s overall performance and potential for future growth.

Moreover, different industries have different average ROICs due to variations in business models and industry structures. Therefore, while comparing ROICs within the same industry can be useful for identifying relative performance levels, comparing ROICs across different industries may not yield meaningful insights.

In conclusion, while Air Products currently has a higher ROIC compared to Air Liquide and Linde based on recent financial data, this does not necessarily mean it is a better investment opportunity without considering other financial metrics and aspects related to each company’s operations and market conditions.