Return on Invested Capital (ROIC) is a crucial financial metric that is often used to measure a company’s efficiency at allocating its capital to profitable investments. It provides a benchmark for comparing the profitability of companies in the same industry, such as the industrial gases sector. One of the key players in this industry is Air Products, a company that has consistently demonstrated strong ROIC performance over the years.

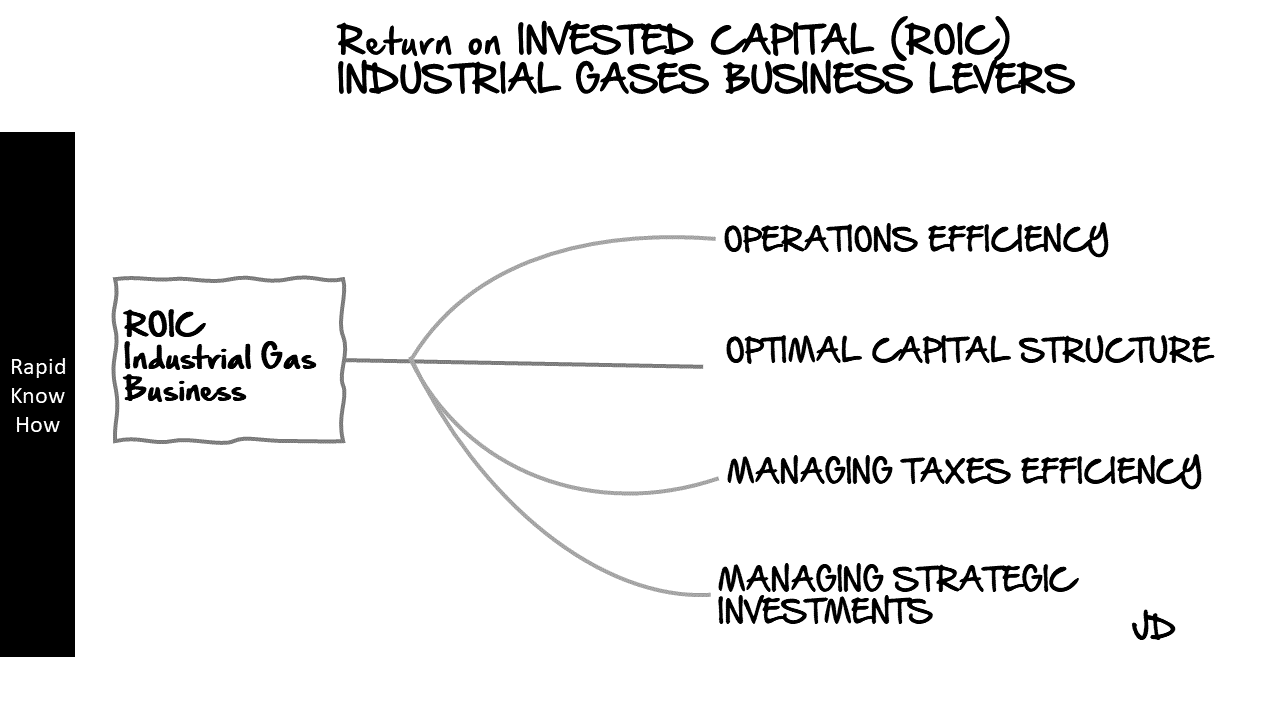

To understand what drives Air Products’ ROIC, it’s essential to analyze the various levers that influence it. These levers can be broadly categorized into operational efficiency, asset utilization, and capital structure.

1. Operational Efficiency: This refers to how well a company uses its resources to generate profits. For Air Products, operational efficiency can be seen in its ability to maintain high margins while keeping costs low. The company’s focus on customer- and employee satisfaction, innovation and technology has allowed it to develop efficient processes and systems that reduce waste and improve productivity. This has resulted in higher operating margins, which directly contribute to a higher ROIC.

2. Asset Utilization: This lever measures how effectively a company uses its assets to generate revenue. Air Products has been able to achieve high asset turnover due to its strategic investments in growth markets and its ability to maximize the use of its existing assets. For instance, the company’s decision to invest in hydrogen and helium production facilities has allowed it to tap into growing demand for these gases, thereby increasing its revenue and asset turnover.

3. Capital Structure: The way a company finances its operations also impacts its ROIC. Air Products has maintained a balanced capital structure with a mix of debt and equity financing. This not only reduces the cost of capital but also provides financial flexibility, allowing the company to invest in profitable opportunities as they arise.

In addition to these levers, other factors such as market conditions, regulatory environment, and competitive landscape also influence Air Products’ ROIC. For instance, favorable market conditions such as rising demand for industrial gases can boost the company’s revenue and ROIC.

In conclusion, analyzing the levers that drive Air Products’ ROIC provides valuable insights into how the company creates value for its stakeholders. It demonstrates that the company’s strong ROIC performance is not just a result of favorable market conditions but also a reflection of its people orientation, operational efficiency, effective asset utilization, and prudent capital management.